Crypto VC Inflows Reach $3.48 Billion Weekly Record as Institutions Pile In

Venture capital inflows into crypto soared to a record $3.48 billion last week, led by Pantera and Hack VC. The shift toward CeFi and infrastructure highlights a maturing market focused on long-term, utility-driven growth.

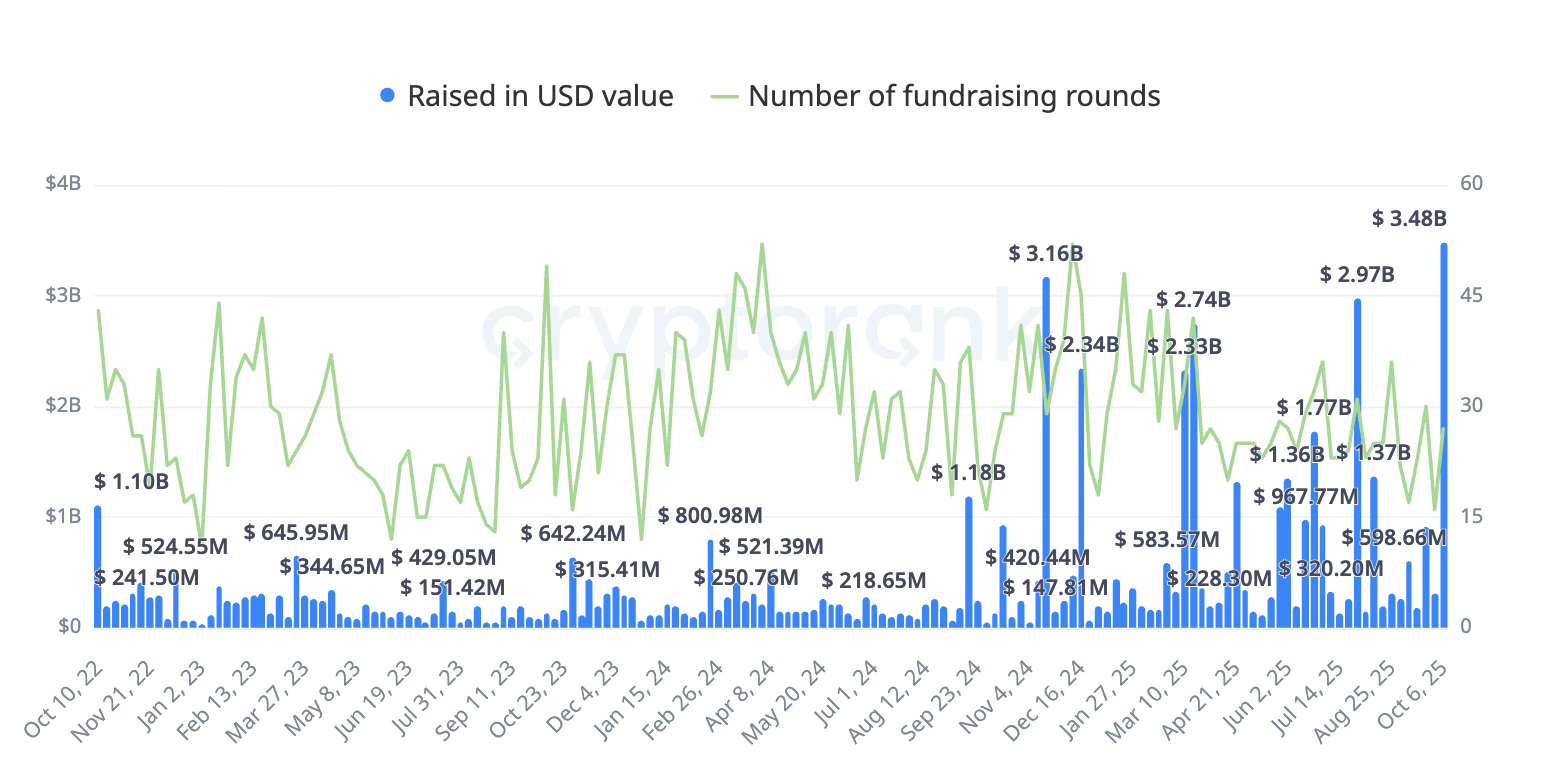

The cryptocurrency sector witnessed a surge in venture capital inflows last week, with fundraising totaling $3.48 billion, marking a new weekly record high.

This milestone highlights how major venture capital firms and institutional giants are increasing their investments in the blockchain space.

Venture Capital Flows Into Crypto at Record Pace

According to CryptoRank, between October 6 and 12, crypto venture fundraising hit $3.48 billion, surpassing the previous ATH of $3.16 billion set in November 2024. The record haul encompassed 27 funded projects and companies, reflecting broad participation across the ecosystem.

Crypto VC Fundraising in October. Source:

CryptoRank

Crypto VC Fundraising in October. Source:

CryptoRank

Pantera Capital emerged as the most active participant, closing four rounds, including two in which it took the lead. Hack VC followed closely, spearheading two investments.

Other prominent firms, each leading one round, included General Catalyst, Road Capital, Delphi Ventures, Sequoia Capital, Andreessen Horowitz (a16z), and Galaxy. The blockchain services category dominated activity, accounting for 12 rounds. Centralized finance (CeFi) followed with 6 rounds.

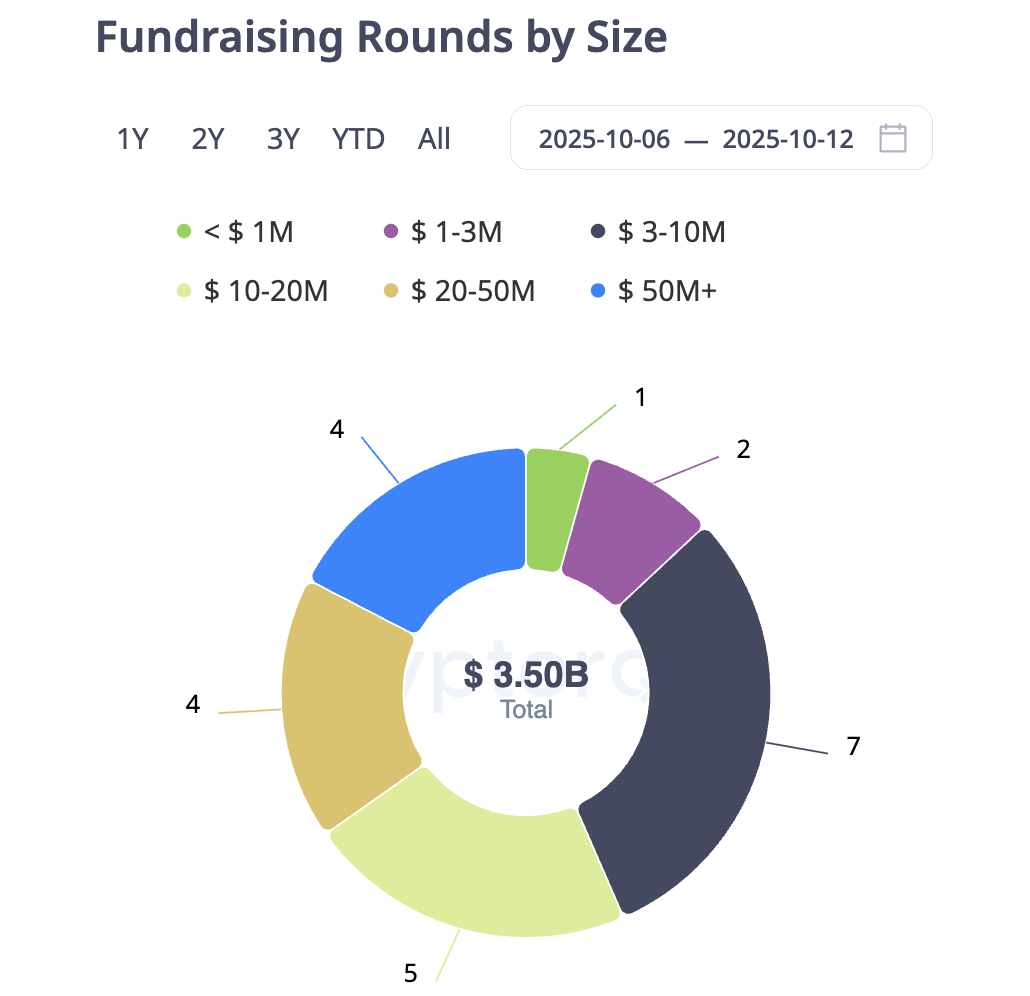

The most common funding bracket during the week was the $3–10 million range, which accounted for 7 rounds. Another 5 rounds fell within the $10–20 million range. Larger rounds also played a significant role.

There were 4 fundraises each in the $20–50 million and $50 million+ categories. This contributed heavily to the overall record total.

Crypto VC Fundraising Rounds Size in October. Source: CryptoRank

Crypto VC Fundraising Rounds Size in October. Source: CryptoRank

Notably, this weekly peak builds on a strong third quarter for crypto venture funding, which tallied $8 billion across 275 deals. While this was marginally below the $10 billion achieved in the second quarter, it still ranked among the strongest periods since 2021. CryptoRank stressed that the slight downturn from Q2’s heights suggests a maturation phase rather than contraction.

“The modest decline signals a healthy normalization after two consecutive quarters of growth rather than a reversal of momentum,” the report read.

Moreover, CeFi and blockchain infrastructure captured over 60% of Q3 funding, driven by projects emphasizing cash flow generation and regulatory compliance. In contrast, decentralized finance (DeFi) and blockchain-specific initiatives secured approximately 25%.

Meanwhile, GameFi, non-fungible tokens (NFTs), and SocialFi combined for less than 10%. This reallocation signals a departure from hype-driven narratives toward models with verifiable economic utility.

Looking ahead, CryptoRank projects $18–25 billion in total venture inflows for 2025, positioning it as the strongest year since 2021.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

HYPE Token Experiences Rapid Growth: Could This Signal the Emergence of a Fresh Crypto Trend?

- HYPE token surged to $41.28 driven by speculation, ecosystem growth, and institutional interest. - November 29 unlock released 9.92M tokens but saw only 23.4% sold, with 40% re-staked, showing strong internal confidence. - Protocol upgrades (HIP-3) boosted trading volume by 15%, while HyperEVM and HyperCore expanded DeFi utility beyond futures trading. - Institutional backing from BlackRock/Stripe and $581M Paradigm stake contrasts with $410M potential sell pressure from future unlocks. - Token's long-te

The ChainOpera AI Token Crash: A Warning Story for AI-Based Cryptocurrency Initiatives Facing Regulatory and Market Challenges

- COAI token's 90% collapse highlights risks of centralized governance and unregulated AI in crypto. - Regulatory ambiguity under the CLARITY Act exacerbated volatility and investor uncertainty. - Unaudited AI algorithms and lack of stress-testing mirrored past financial crises, prompting calls for global oversight. - Investors now prioritize decentralized, auditable projects amid lessons from COAI's implosion.

Momentum (MMT) Gaining Traction Through Key Alliances and Growing Attention from Institutions

- Momentum (MMT) gains traction in 2025 via strategic partnerships with Sui , Coinbase , and OKX, boosting institutional adoption. - A $10M HashKey Capital funding round and regulatory clarity underpin MMT's cross-chain DEX launch and RWA tokenization efforts. - Ve(3,3) governance and buybacks drive deflationary dynamics, with TVL exceeding $600M and $1.1B daily trading volumes. - Technical indicators signal potential bullish reversal at $0.52–$0.54, despite 70% post-TGE price correction and volatile forec

ALGO Falls by 3.33% Amidst Market Developments and Announced Restructuring Plans

- ALGO drops 3.33% in 24 hours, part of a broader 61.02% annual decline amid volatile market conditions. - Upcoming Swiss rate decisions, U.S. jobless claims, and bond auctions may intensify market uncertainty affecting crypto assets. - Argo Blockchain's approved restructuring plan, including new mining equipment, could indirectly impact ALGO supply/demand dynamics. - Market participants monitor macroeconomic indicators and blockchain sector developments to gauge ALGO's future trajectory.