A 35% XRP Price Rally? One Metric Says “Yes”, Another Says “Wait”

XRP’s price has rebounded after the crash, but an old pattern may be repeating. The same on-chain signal that preceded a 35% rally last time has appeared again, while cautious long-term holders could delay the breakout above $2.72.

The XRP price has steadied after the recent crypto market crash, climbing over 7% in the past 24 hours to around $2.55. The move mirrors the broader recovery across major altcoins. Even after the turbulence, XRP’s one-year trend remains up more than 350%, showing that the broader uptrend is still intact.

This makes the crash look more like a short-term reset than a trend reversal. But while one key on-chain metric signals that XRP could be setting up for a 35% rally, another shows that a key group of holders isn’t ready to commit just yet — which could delay the move.

One Metric Flashes a Rare Bullish Signal Seen Before Major Rallies

The Spent Output Profit Ratio (SOPR) — a metric that shows whether investors are selling at a profit or loss — has dropped to 0.95 after the crash, its lowest level in six months. A reading below 1 means that most holders are selling at a loss, often marking exhaustion among sellers before a reversal.

The last time SOPR fell close to this low was on April 7, when it touched 0.92. Back then, XRP rebounded from $1.90 to $2.58 within a month — a 35% rise. With the XRP price forming a low of $2.38 (on the SOPR chart), a similar move this time would put the next potential target near $3.10-$3.35.

XRP’s Bullish Metric Hints at Upside:

Glassnode

XRP’s Bullish Metric Hints at Upside:

Glassnode

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

That setup makes SOPR one of the few early indicators hinting at a rebound, showing that selling may have reached its limit and buyers could soon regain control.

Long-Term Holders Are Still Reducing Exposure

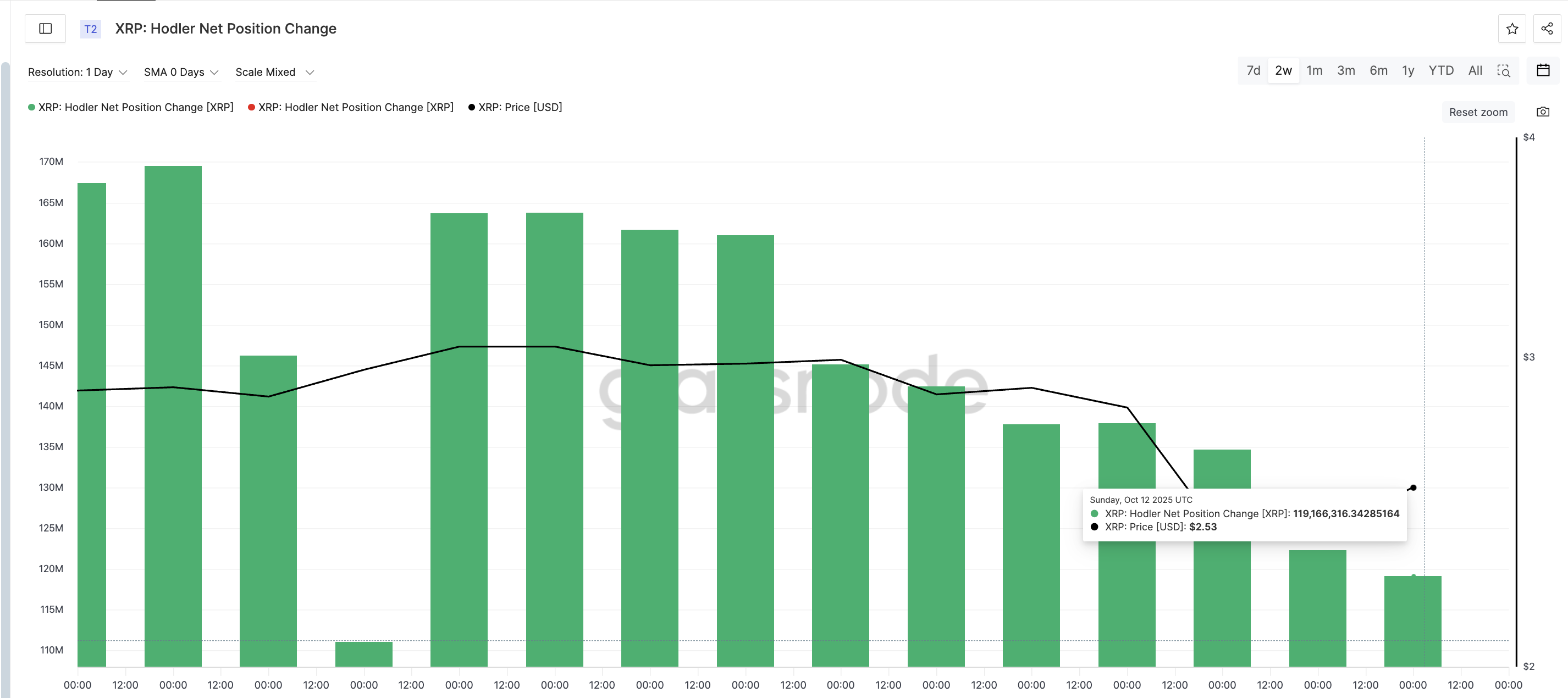

While SOPR suggests recovery, long-term holders are not fully on board yet. Data from Glassnode’s Hodler Net Position Change — which measures how much XRP long-term investors are adding — shows that accumulation has slowed since early October.

On October 2, long-term wallets added about 163.68 million XRP, but by October 12, that number had dropped to 119.16 million XRP, a 27% decline. This means older holders have been gradually reducing their positions even as the market stabilized.

Long-Term XRP Investors Are Dumping:

Glassnode

Long-Term XRP Investors Are Dumping:

Glassnode

These investors usually provide stability during volatile phases, so their hesitation suggests that the rebound may take time to build momentum. Until long-term wallets start buying again, any XRP price recovery could remain fragile and range-bound.

XRP Price Still Awaits a Breakout From Its Triangle Pattern

On the daily chart, the XRP price is still trading within a symmetrical triangle, signaling consolidation after weeks of volatility. The immediate resistance sits near $2.72.

XRP Price Analysis:

TradingView

XRP Price Analysis:

TradingView

A daily candle breakout above $2.72 would confirm renewed buying strength and could open the XRP price door to $3.10, $3.35, and $3.66, matching the 30%-40% (35% on average) rally projection based on SOPR’s historical behavior.

However, failure to hold above the $2.30 support could invalidate this bullish structure and push the XRP price lower.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Federal Reserve's Major Shift: From QT to RMP, How Will the Market Transform by 2026?

The essence of RMP, the mystery surrounding its scale, and its impact on risk assets.

Questioning the Necessity of Gas Futures: Does the Ethereum Ecosystem Really Need Them?

How did the Do Kwon trial trigger an 1.8 billion USD speculative frenzy?