SignalPlus Macro Analysis Special Edition: Liquidation

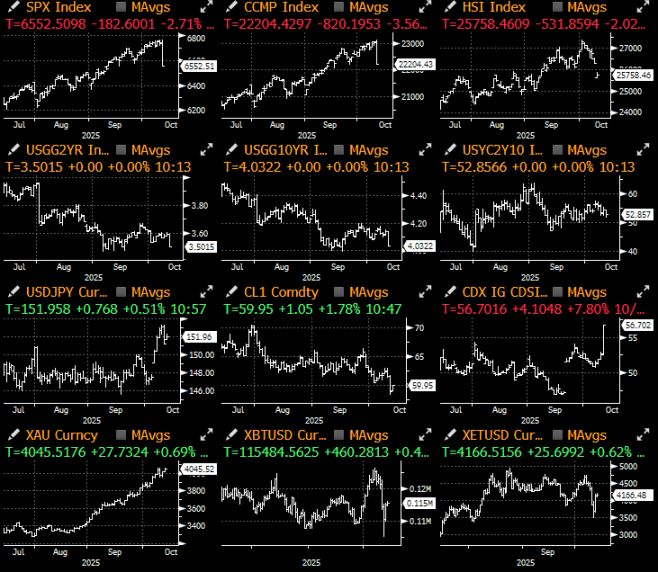

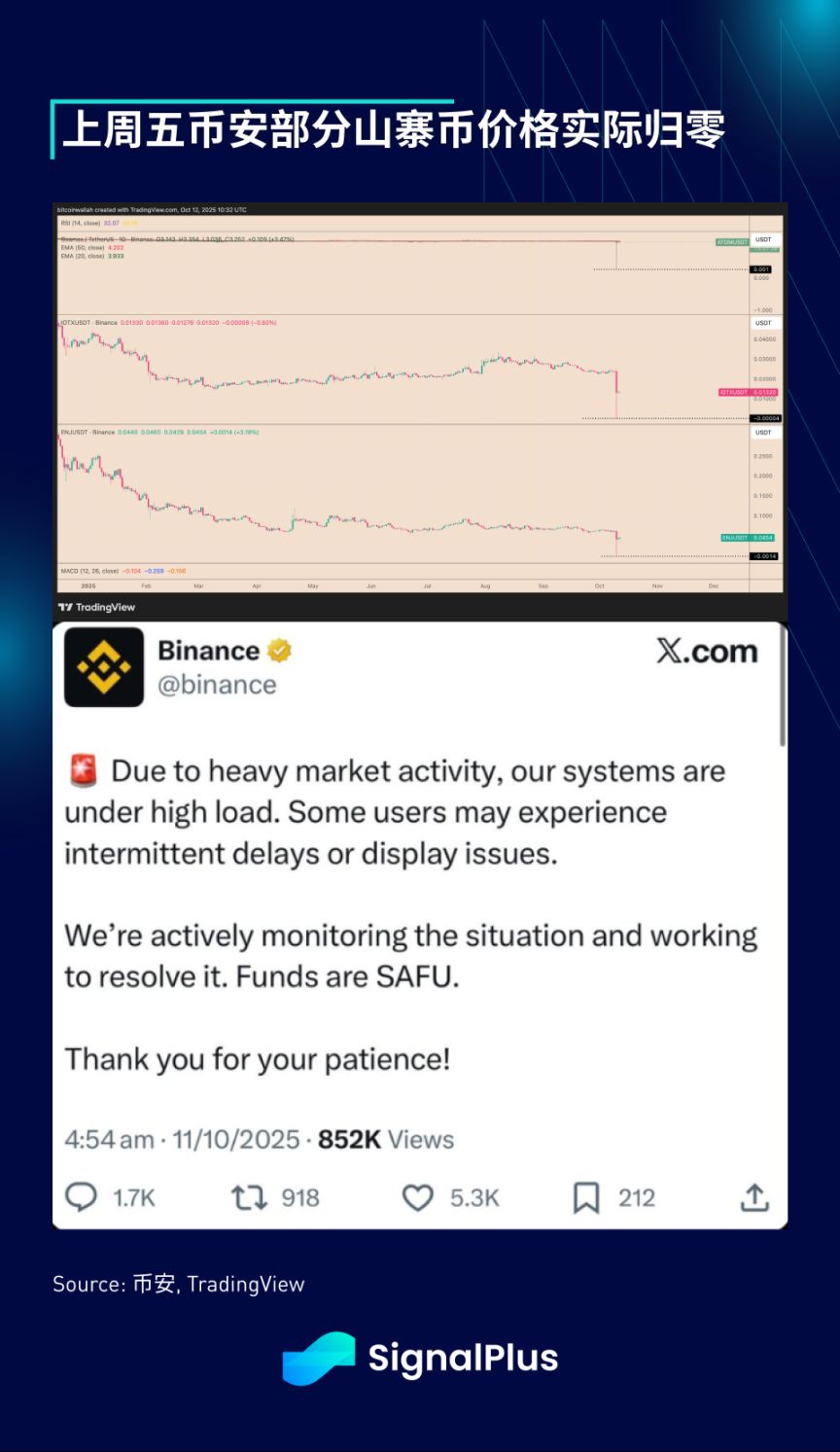

This is the most brutal liquidation day since the FTX collapse... The automatic deleveraging algorithms of centralized exchanges have wiped out $19 billion (or even more than that)...

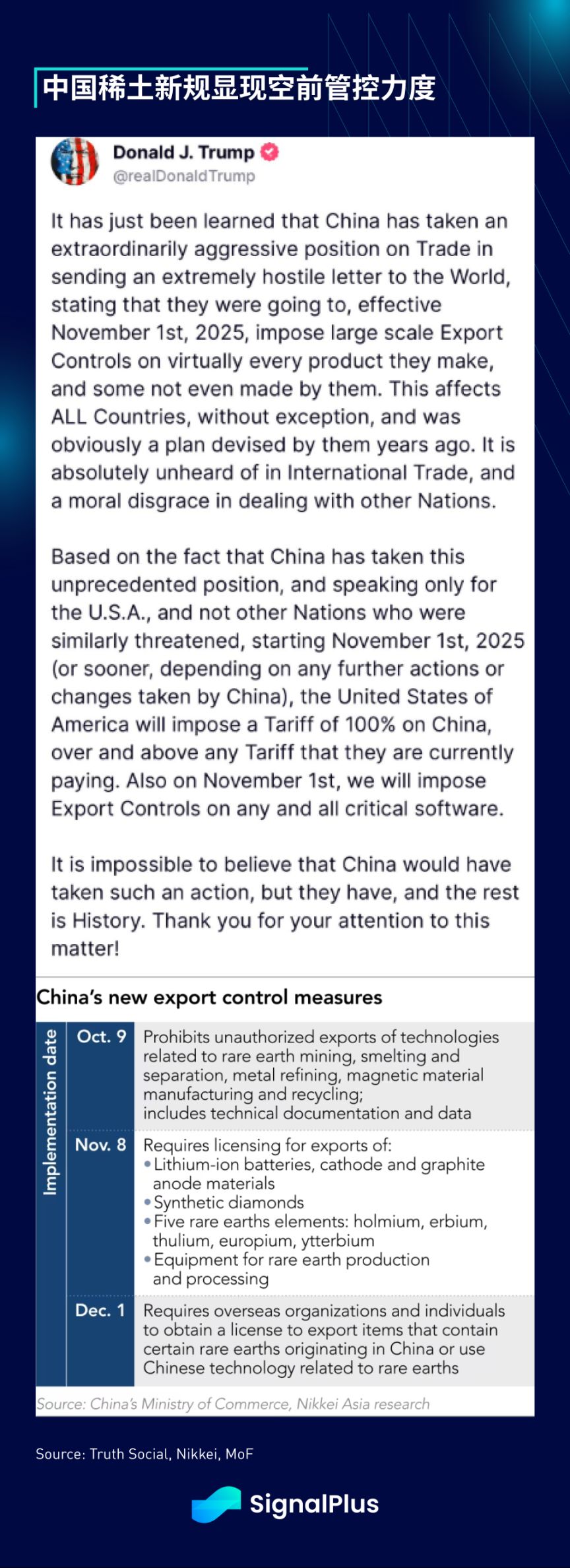

This was the most brutal liquidation day since the FTX collapse... The automatic deleveraging algorithms of centralized exchanges wiped out 19 billions USD (or even more) in profits and losses, and the withdrawal of market makers caused the prices of altcoins to nearly hit zero... This ruthless Friday close needs no further explanation for cryptocurrency traders and macro investors.

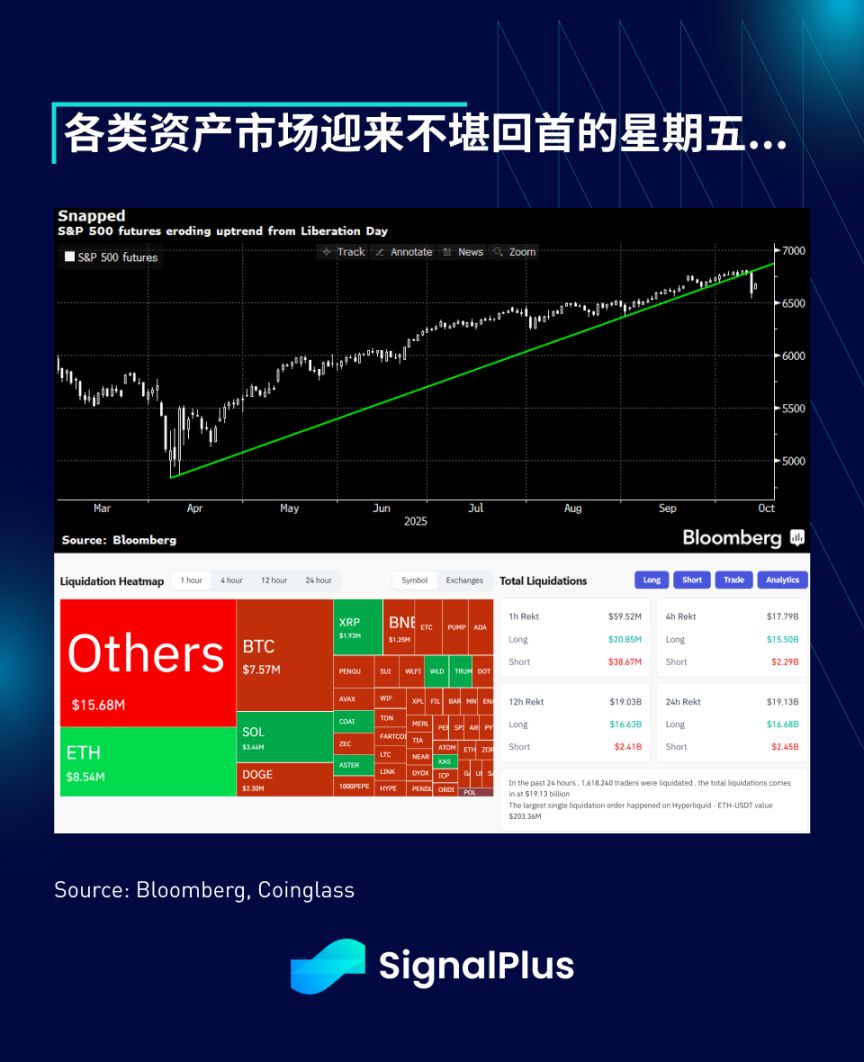

The US-China trade truce came to an abrupt end—President Trump responded to China's latest export control measures with harsh rhetoric, shattering market calm. These controls shocked the market with their unprecedented complexity and comprehensiveness. Coinciding with a long weekend in the US and Japan, the market crashed before Friday's close, causing the Nasdaq to drop 4% in a single day and many altcoins to plummet to zero.

This storm gave the crypto community a deep understanding of the ADL mechanism (Automatic Deleveraging), which is the equivalent of the maintenance margin system in traditional finance. Although theoretically sound, automatic stop-losses are ineffective in a liquidity-starved, gapping market—when the order book is empty, prices can cliff-dive toward zero. What traders often overlook is that in a one-sided market, market makers collectively disappear, causing the price discovery mechanism to fail. At this point, the automatic deleveraging system mechanically executes liquidations, forcibly closing positions at any bid price, no matter how low, creating a "reflexive spiral" that accelerates price declines.

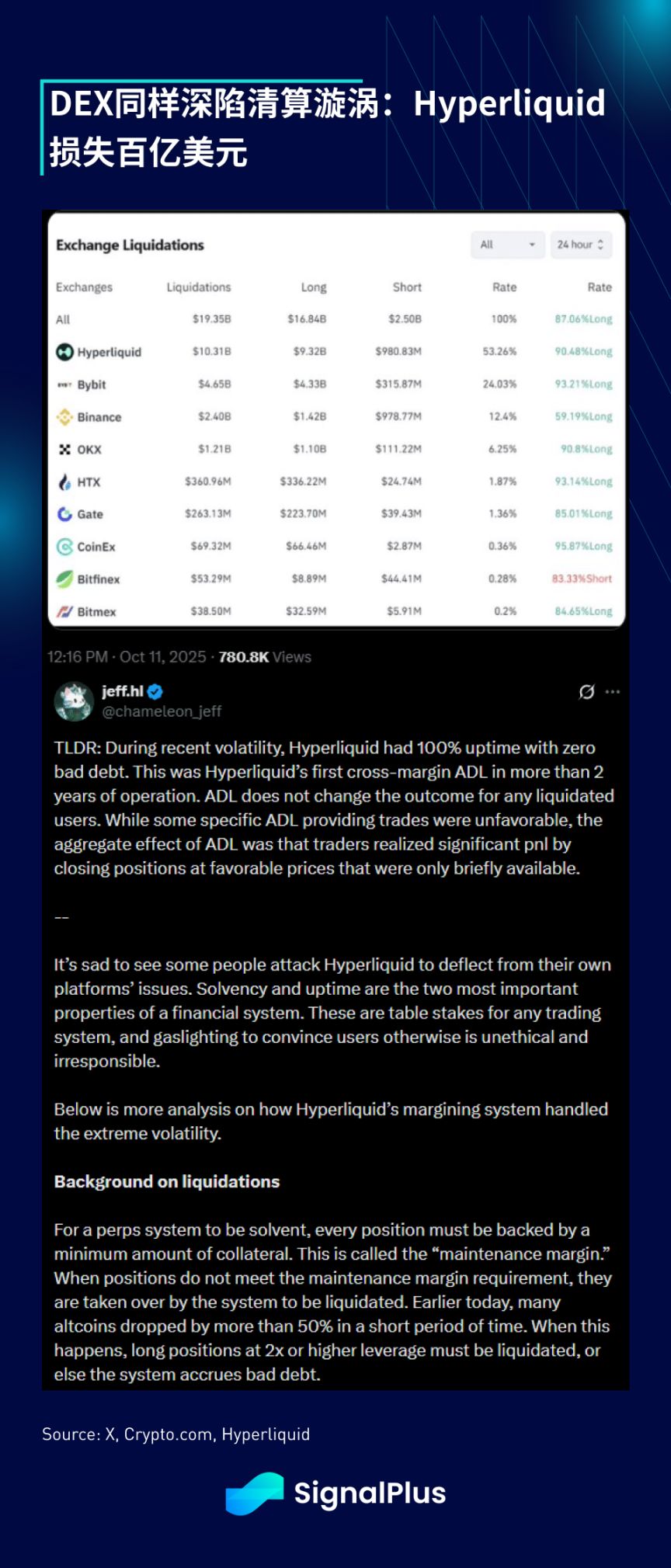

To make matters worse, the surge in data flow overloaded exchange systems, and delayed data transmission and order congestion further disrupted the automatic liquidation mechanism. This disaster swept not only mainstream centralized exchanges but also decentralized exchanges—Hyperliquid "led" the liquidation leaderboard with 10 billions USD in on-chain liquidations within 24 hours. The liquidity black hole doesn't care whether your assets are stored on-chain or off-chain.

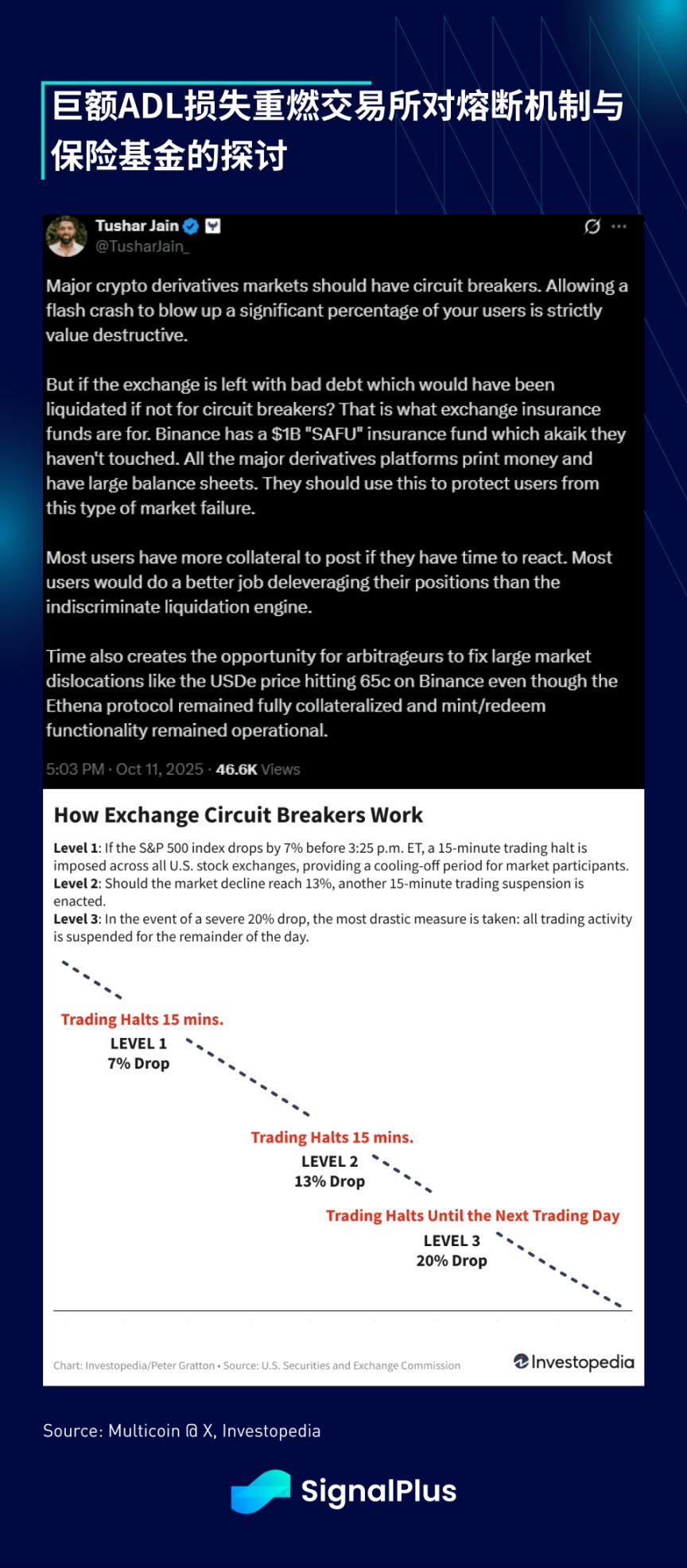

In traditional finance, circuit breakers can help mitigate such crises by shifting part of the losses to the exchange, which requires the establishment of reserve/insurance funds similar to the Federal Deposit Insurance Corporation. However, this would increase trading costs on centralized exchanges and reduce leverage limits (which is one reason why crypto exchanges can offer higher leverage than CME), and it also goes against the crypto market's cherished "24/7" continuous trading feature. Everything in the world comes with trade-offs. We expect this liquidation event to prompt the industry to re-examine its infrastructure, especially if crypto wants to continue its institutionalization process.

Looking ahead, thanks to the lack of further escalation between the US and China, combined with the long weekend effect in the US and Japan, the market saw a technical rebound on Monday. Although the mainstream view is that the recent dispute is just a bargaining chip before the "Trump-Xi meeting" (which is still in doubt), we believe the macro decoupling theme has been accelerated as a result. The upgraded rare earth ban is by no means an ordinary provocation and further highlights the declining effectiveness of US tariff countermeasures.

The short-term consensus is that both sides will try to cool down the situation (signs of this already appeared over the weekend), giving asset prices a chance to catch their breath. However, given the deep damage to the current profit and loss structure, and the fact that this year's bitcoin-led market has left many native investors on the sidelines, we remain cautious about whether altcoins can achieve an effective rebound.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Don't be fooled by the rebound! Bitcoin could retest the lows at any time | Special Analysis

Analyst Conaldo reviewed bitcoin’s market performance last week using a quantitative trading model, successfully executing two short-term trades with a total return of 6.93%. The forecast for this week is that bitcoin will continue to fluctuate within a range, and corresponding trading strategies have been formulated. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still being updated and iterated.

Espresso co-founder’s decade in crypto: I wanted to disrupt Wall Street’s flaws, but witnessed a transformation into a casino instead

Everything you've been hoping for may have already arrived; it just looks different from what you expected.

Solana Foundation Steps In as Kamino and Jupiter Lend Dispute Intensifies

Bitcoin Firms Confront the Boomerang Effect of Excessive Leverage