Key Notes

- Privacy adoption accelerates with Zcash's shielded pool receiving over 600,000 ZEC in five days, pushing the total to 27% of supply.

- ZEC rallied 635% from August lows to $253, surviving October's market crash with minimal losses compared to other cryptocurrencies.

- Prediction markets show 67% probability of Zcash surpassing Monero's market cap by year-end as privacy discussions gain momentum.

The market capitalization of the privacy-enhancing Zcash ZEC $241.7 24h volatility: 10.0% Market cap: $3.93 B Vol. 24h: $740.43 M supply, known as shielded, has been consolidating above $1 billion as both ZEC’s price and the amount of shielded Zcash coins are increasing and sustaining at key levels, despite the overall market’s volatility in the past few days.

Zcash is one of the most popular privacy-enhancing cryptocurrencies nowadays, with impressive growth in capitalization and mindshare. “Zcash” searches have risen to record highs recently, as key opinion leaders of the crypto industry have started to support the coin publicly, including Naval Ravikant, who said, “ Zcash is insurance against Bitcoin BTC $114 822 24h volatility: 0.4% Market cap: $2.29 T Vol. 24h: $63.34 B .”

To achieve privacy, the protocol relies on anonymous transaction pools, with the currently most advanced and most used pool being Orchard, powered by zero-knowledge proof-based high-level encryption technology. Every time a user deposits ZEC from a transparent address to the Orchard Pool, this Zcash becomes shielded and absolutely untraceable at the protocol level as long as it remains shielded.

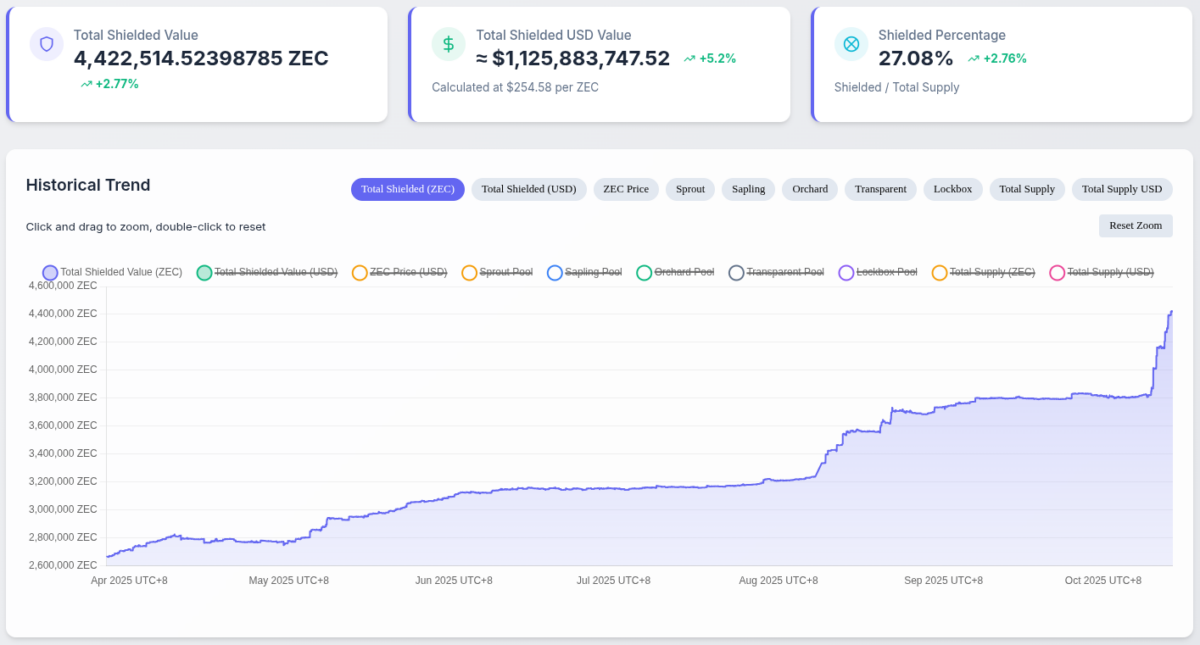

According to data Coinspeaker retrieved from zkp.baby on October 13, the total value in Zcash’s shielded pools is $1.12 billion—representing Zcash’s privacy-enhancing market capitalization. This market cap has been hovering around the $1 billion level for a few weeks, first crossing the mark without a significant increase in the shielded Zcash amount, from late August to early October, as seen in the consolidating line on the chart.

Before the significant price increase from around $50 to above $250 in a few weeks, Orchard Pool had received relevant inflow, reaching a shielded percentage of around 23% with less than 4 million ZEC shielded.

Now, the total shielded value has been registering daily increases that are even more aggressive than the previously observed growth, crossing the 27% shielded percentage with more than 4.42 million ZEC becoming privacy-enhancing and untraceable to observers and chain analyses.

Zcash total shielded value, total shielded USD value, and shielded percentage – as of October 13, 2025 | Source: zkp.baby

Based on a post by Zcash’s advocate sacha on X, the net flow of ZEC to the orchard pool was superior to 600,000 in the past five days. Pointing out that “long-term holdings are continuing to increase exponentially amidst all the speculation.”

600k+ net zec inflows into the orchard pool over the last 5 days

long term holdings are continuing to increase exponentially amidst all the speculation

— sacha 🦣 (@ssaintleger) October 13, 2025

Zcash (ZEC) Price Analysis

As of this writing, ZEC is trading at $253, with a $4 billion market cap, ranked 30th in CoinMarketCap’s index . The privacy coin is up 635% from a local bottom of $34.47 on August 20, 2025, to its current prices, with a purchasing power five times greater than the $50 level it has traded below throughout the year.

Notably, Zcash was one of the only cryptocurrencies with a green candle on October 10, a day marked by the largest liquidations in the entire crypto history . On this recent “Dark Friday,” ZEC traded as low as $152.35, offering a cheap entry 28% below Friday’s opening exchange rate.

Nevertheless, Zcash is trading with 14% losses from the chart’s local high of $298.09, so far failing to break out of the $300 psychological resistance.

Zcash (ZEC) daily price chart on October 13, 2025 | Source: TradingView

In this context, a recently added prediction bet on Polymarket now prices a 67% chance of Zcash surpassing Monero XMR $310.6 24h volatility: 1.7% Market cap: $5.73 B Vol. 24h: $168.25 M in market capitalization by December 31.

“Will Zcash flip Monero by December 31?” bet | Source: Polymarket

Privacy discussions have been growing in popularity together with Zcash’s remarkable performance in the past few weeks. Before that, Coinspeaker had already reported a surge in Google searches for “privacy coin,” which proved to be a solid signal for our readers.