ARK Invest reports Solana revenue hits $223M in Q3 2025

ARK Invest’s third-quarter report shows that Solana has generated the largest share of blockchain revenue compared to all the other networks, amounting to $223 million.

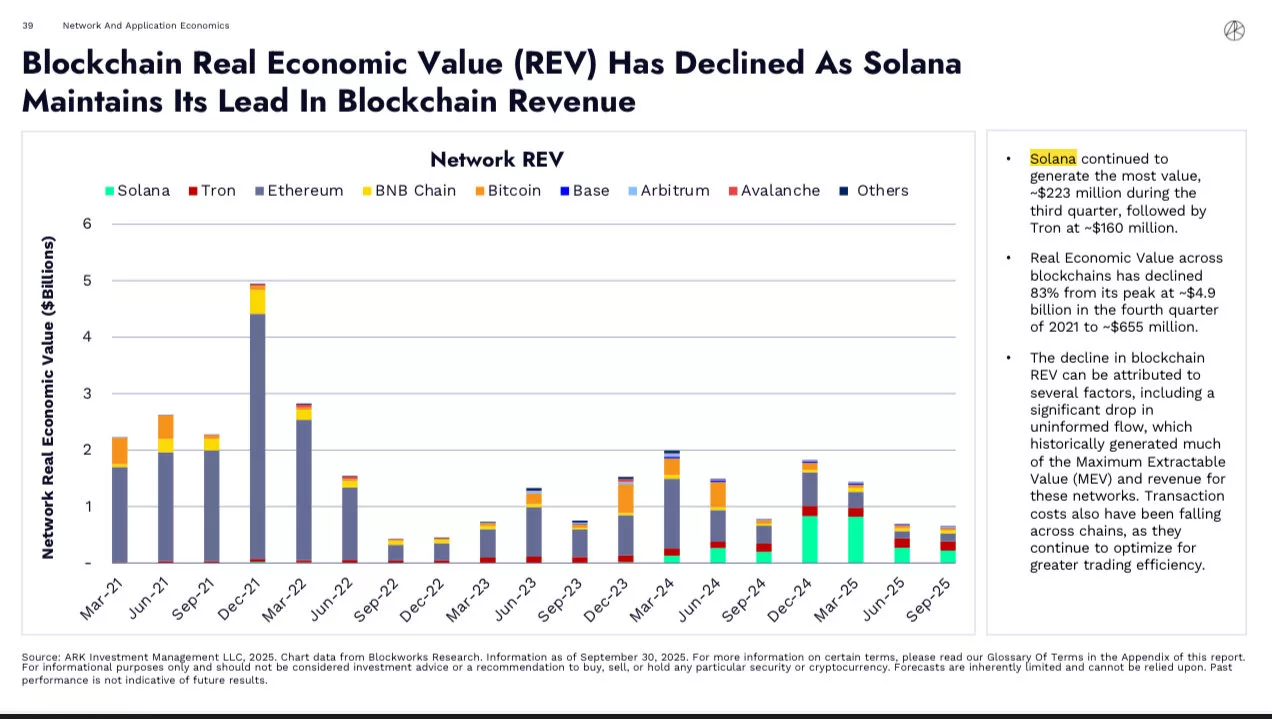

- Solana led all blockchains in Q3 2025, generating $223 million in real economic value, followed by Tron at $160 million, even as total blockchain REV plunged 83% from its 2021 peak.

- ARK Invest attributed the decline in overall REV to reduced uninformed capital flows and falling transaction costs.

According to ARK Invest’s third-quarter DeFI report, Solana continued to generate the most economic value, amounting to around $223 million, leading the charge on all networks listed that create value. The report highlights the Solana ecosystem’s growth and ability to generate more revenue compared to other networks.

The quarterly report covered key metrics in decentralized finance, including on-chain activity, stablecoins, and decentralized exchanges. In total, Solana ( SOL ) generated about $223 million in value, surpassing all other networks.

Coming in at second place is Tron ( TRX ) network, which has generated around $160 million in value.

ARK Invest’s report revealed that Solana leads the charge on real economic value | Source: ARK Invest

ARK Invest’s report revealed that Solana leads the charge on real economic value | Source: ARK Invest

Based on the report, the overall real economic value or REV across networks on-chain has gone down as much as 83% compared to its highest peak at $4.9 billion, which occurred back in the fourth quarter of 2021. In the third quarter of 2025, the overall value has plummeted to $655 million.

ARK Invest concluded that there are several factors that have fueled the downturn of REV among blockchains. The first factor is the significant drop in uninformed flow, which is historically known for generating most of the Maximum Extraction Value and revenue for these networks.

Another reason for the decline in REV is the drop in transaction costs across multiple chains, as they continue to lower costs to attract more users on-chain by optimizing for greater trade efficiency.

According to data from DeFi Llama, Solana’s REV in the past 24 hours has reached $1.1 million. Meanwhile, the chain’s total value locked has amounted to $11.36 billion, rising by 0.74% in the past day. So far, the largest share of fees comes from Gauntlet $12.71 million, while the largest TVL comes from Jupiter.

ARK Invest’s Solana investments

In the past, ARK Invest has invested large amounts of its funds into Solana-related ventures. On Sept. 19, ARK Invest bought about $162 million worth of shares in Solmate or BREA after taking part in the company $300 million funding round. The company now holds about 6.5 million BREA shares.

Back in July 2025, ARK Invest moved its validator operations for its Digital Asset Revolutions Fund to SOL Strategies, a Toronto-based firm specializing in Solana.

Meanwhile, in April 2025, ARK Invest made its first direct Solana investment through the SOLQ ETF, a Canadian-based SOL staking ETF. The purchase made ARKW and ARKF the first-ever U.S.-listed ETFs to add Solana to their portfolios.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Assessing How Federal Reserve Policies Influence Emerging Blockchain Assets Such as Solana

- Fed's 2025 rate cuts and liquidity injections initially boosted Solana prices by 3.01% but triggered 6.1% drops during October 2025 liquidations. - Regulatory frameworks like EU MiCA and U.S. GENIUS Act drove 8% institutional ownership of Solana, attracting $101.7M in November 2025 inflows. - 35% of crypto volatility stems from Fed policy shifts, with high-rate environments eroding Solana's appeal as investors favor cash equivalents. - Solana's SIMD-0411 proposal aims to reduce token issuance by $2.9B by

Sustainable Transportation in Cities and the Adoption of Renewable Energy in Developing Economies

- South Africa and India are leading solar-powered transit growth, driven by decarbonization goals and energy security needs in emerging markets. - Solar bus markets project $17.79B value by 2033 (21.6% CAGR), supported by falling solar costs, EV affordability, and policy frameworks in Africa/Asia. - Behavioral economics shapes e-mobility adoption, with South Africa targeting 18,000 tonnes CO₂ reduction via 120 electric buses and India using social nudges to boost EV uptake. - Cross-regional collaboration

A detailed overview of technology layoffs in 2025

PENGU Price Forecast for 2025: Steering Through Regulatory Challenges and Growing Institutional Confidence

- Pudgy Penguins (PENGU) faces regulatory uncertainty from SEC delays and EU MiCA, causing 30% price drops due to compliance risks. - Institutional interest grows with $273K whale accumulation and rising OBV, contrasting retail fear (Fear & Greed Index at 28). - Ecosystem expansion via Pudgy World and penguSOL, plus Bitso partnership, aims to boost utility but depends on user adoption and regulation. - Expert forecasts diverge: $0.02782 (CoinCodex) vs. $0.068 (CoinDCX), with technical analysis highlighting