- Solana’s rebound above $189 signals fragile bullish momentum amid market caution

- Rising open interest highlights growing speculative confidence in Solana futures

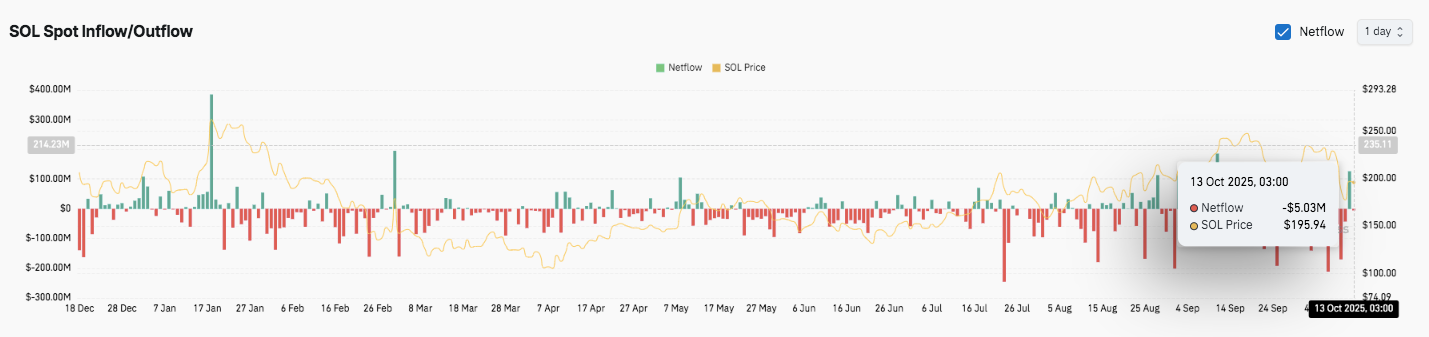

- Spot outflows suggest traders remain cautious despite Solana’s short-term recovery

Solana (SOL) has regained attention in recent sessions as the token rebounded from recent lows near $170, showing resilience despite market uncertainty. The sharp recovery lifted prices above the $189 support level, signaling renewed buying pressure from traders.

However, short-term data now suggests that Solana’s spot market activity is beginning to slow, even as futures participation strengthens, revealing a split between speculative and long-term investor sentiment.

Technical Setup Shows Fragile Bullish Recovery

The 4-hour SOL/USDT chart reveals a rebound from the $169.74 low, with prices consolidating above the 23.6% Fibonacci retracement level near $189.50. Buyers appear to be reentering the market at this zone, indicating confidence after a period of selling exhaustion.

Immediate resistance stands at the 38.2% level of $201.72, while further upside could push the token toward $211.59 and $221.47 key mid-term targets aligned with prior consolidation phases.

SOL Price Dynamics (Source: TradingView)

SOL Price Dynamics (Source: TradingView)

On the downside, the $189 support remains critical. A drop below it could expose $170 again, aligning with the 0% retracement zone. The market structure points to a short-term bullish correction within a broader downtrend.

Related: Shiba Inu Price Prediction: Can SHIB’s 25% Burn Spike Ignite the Next Bullish Wave?

Sustained buying above $201.72 may confirm a reversal pattern, but rejection could renew downward pressure. Hence, traders are closely monitoring whether Solana can maintain momentum above $190 to sustain the ongoing recovery.

Futures Market Confidence Grows as Open Interest Climbs

Source: Coinglass

Source: Coinglass

Besides the price action, Solana’s open interest has surged notably in October, reflecting increasing participation in derivatives trading. As of October 13, open interest reached $10.29 billion while SOL traded near $197.23, marking its highest level since April. The steady rise in open interest alongside the price recovery indicates new long positions and growing optimism among traders.

Historically, such parallel increases in price and open interest have preceded strong bullish continuation phases, suggesting that speculative appetite remains high. However, the heightened activity also implies greater volatility ahead, as leveraged traders could amplify price swings if sentiment shifts abruptly.

Spot Market Outflows Suggest Near-Term Caution

While the derivatives market shows strength, Solana’s spot inflow and outflow trends reveal a more cautious investor stance. The network recorded a net outflow of $5.03 million on October 13, as prices hovered around $195. This pattern follows alternating inflows and outflows since late September, hinting that traders are taking profits rather than adding fresh capital.

Source: Coinglass

Source: Coinglass

Moreover, earlier inflow peaks in January and May coincided with local price surges. The current decline in accumulation suggests consolidation rather than renewed bullish expansion. Consequently, Solana’s next major move may depend on whether spot demand revives to complement the ongoing futures enthusiasm.

Technical Outlook for Solana (SOL) Price

Key levels remain well-defined heading into mid-October. Upside targets include $201.72, $211.59, and $221.47 levels aligned with the 38.2%, 50%, and 61.8% Fibonacci retracement zones. A confirmed breakout above $201.72 could open the door for a broader recovery toward the $230–$235 range, reinforcing bullish continuation if momentum sustains.

Related: Dogecoin Price Prediction: DOGE Eyes V-Shaped Rebound As U.S.–China Rhetoric Calms Markets

On the downside, immediate support lies at $189.50, followed by $179.00 and the recent swing low at $169.74. A break below this structure could reintroduce bearish pressure and extend losses toward $160, invalidating short-term recovery hopes.

The current setup suggests that Solana is moving within a corrective rebound inside a broader downtrend. Momentum indicators point to early bullish traction, but conviction remains fragile.

If buyers maintain control above $190 and volume strengthens, a sustained climb toward $220 appears achievable. However, failure to defend $189.50 may trigger renewed selling pressure.

Will Solana Sustain Its Recovery?

Solana’s mid-October outlook hinges on whether bulls can secure a breakout above $201.72 and attract sustained inflows from both spot and derivatives traders. The ongoing rise in open interest reflects growing speculative optimism, yet net outflows from spot exchanges imply cautious sentiment among investors. Hence, SOL remains at a pivotal juncture where renewed buying momentum could define its next major trend.

Related: Chainlink Price Prediction: LINK Recovery Faces Key Resistance