Crypto and stock markets both plunge—are DAT companies' stocks holding up?

This article analyzes the severe situation faced by digital asset treasury company (DAT) under the dual shock of the crypto market and stock market after the largest liquidation in crypto market history triggered by the Trump tariff news on October 10. It also examines the relationship between DAT's stock price decline and the multiple of its core asset value (mNAV).

Original article by: David, Deep Tide TechFlow

On the afternoon of the 10th, President Trump announced on Truth Social a 100% tariff on Chinese goods. This news instantly triggered panic across global financial markets.

Within the following 24 hours, the cryptocurrency market experienced the largest liquidation event in its history, with over $19 billions in leveraged positions forcibly closed. Bitcoin plummeted from $117,000, briefly falling below $102,000, with a daily drop of more than 12%.

The US stock market was not spared either. At the close on October 10, the S&P 500 index fell 2.71%, the Dow Jones Industrial Average dropped 878 points, and the Nasdaq Composite Index fell 3.58%, all marking the largest single-day declines since April.

However, the real disaster zone was the DAT (Digital Asset Treasury) companies that hold crypto assets as treasury reserves.

MicroStrategy, as the largest corporate bitcoin holder, saw its stock price suffer as well; other crypto asset reserve companies experienced even more dramatic plunges. According to after-hours trading data, investors continued to sell off.

For these companies exposed to both crypto and stock market risks, has the worst already passed?

Why did DAT companies fall harder?

DAT companies first face a direct hit to their balance sheets. Take MicroStrategy as an example: the company holds about 639,835 bitcoins. When the price of bitcoin drops 12%, it means nearly $10 billions in asset value evaporates instantly.

Such losses must be recorded as "unrealized losses" under accounting standards. Although it's not a real loss unless sold, the numbers on the financial statements are very real.

As an investor, what you see is a company's core assets rapidly depreciating. There's also a multiplier effect regarding market confidence.

At the beginning of 2025, MicroStrategy's stock net asset value (NAV) premium was as high as 2x, but by the end of September it had shrunk to 1.44x; currently, it's around 1.2.

For some other companies, mNAV is almost returning to 1, and some have even fallen below 1. These changes reflect a harsh reality: confidence in the DAT model is wavering in extreme market conditions.

In a bull market, investors are willing to give these companies a premium, with the narrative being pioneers of crypto innovation. But when the market turns, the same story becomes an unnecessary risk exposure.

Non-bitcoin cryptocurrencies suffered huge technical damage in this round of leverage-induced crash, with some even instantly dropping to zero; even large-cap altcoins saw their prices halved or worse due to insufficient liquidity.

And the stocks of companies holding these assets became the preferred short targets as market sentiment deteriorated.

When panic strikes, investors need to reduce positions quickly. While the bitcoin market trades 24/7, large sell orders can severely impact prices. In contrast, it's much easier to sell stocks like MSTR or COIN on Nasdaq.

Selling hundreds of billions of dollars in gold won't disrupt the market, but selling $70 billions in bitcoin could cause a price collapse and trigger mass liquidations; this liquidity difference makes DAT company stocks a quick exit channel for funds.

Worse still, many institutional investors have strict risk control red lines. When volatility exceeds a certain threshold, they must reduce positions, whether they want to or not. And DAT companies happen to be among the most volatile targets.

To use an imperfect analogy, if ordinary tech companies are sitting in one boat, DAT companies are like tying two boats together—one sailing in the waves of the stock market, the other struggling in the storm of the crypto market.

When both sides encounter bad weather at the same time, the impact they endure is not additive, but multiplicative.

Who suffered the most, and who was the most resilient?

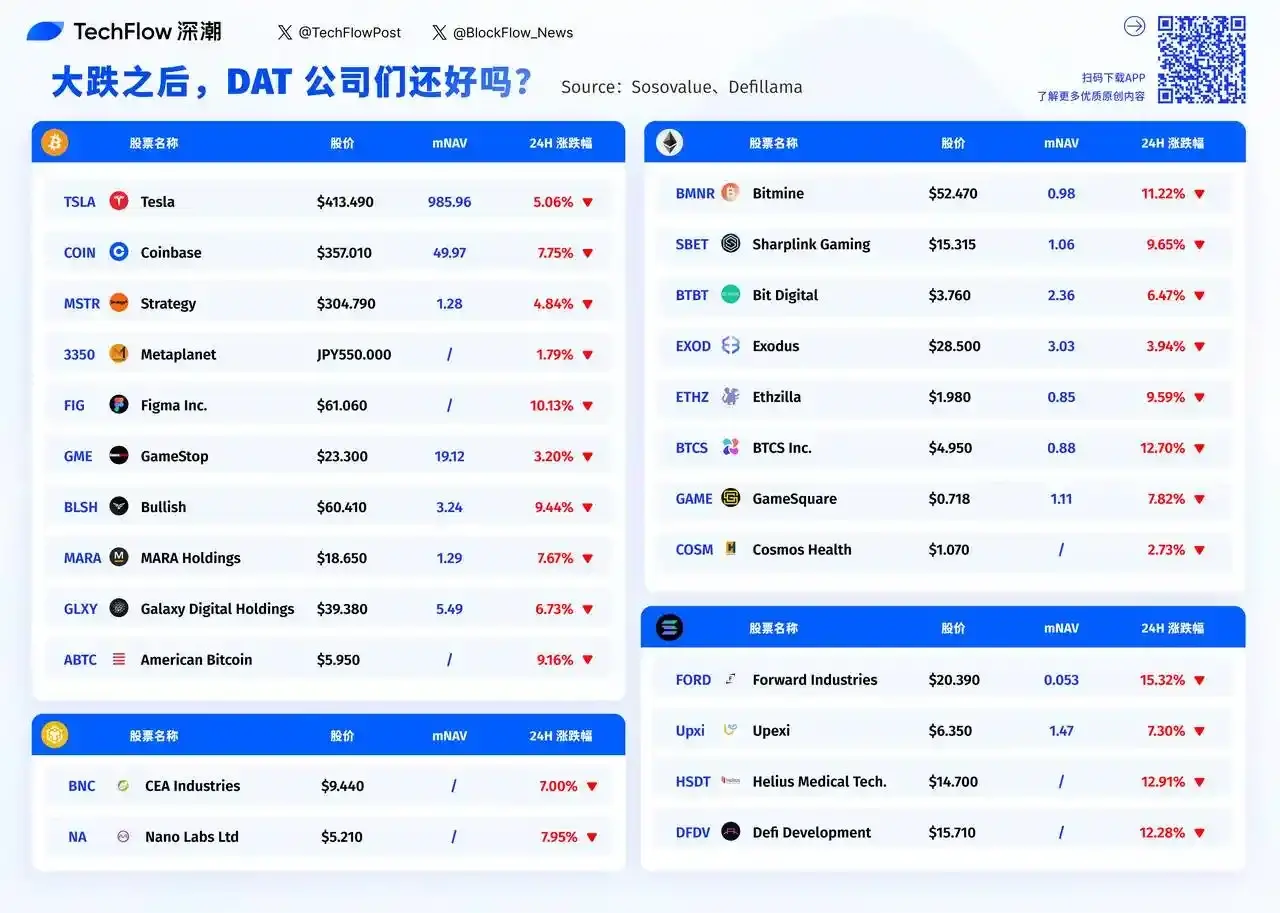

Looking at the DAT company losers list from the previous trading day, you can clearly see a pattern: the smaller the company, the harder it fell.

Forward Industries fell 15.32%, with an mNAV of only 0.053. BTCS Inc. dropped 12.70%, Helius Medical Tech fell 12.91%.

These small companies with market caps under $100 millions could hardly find buyers amid the panic. In contrast, MicroStrategy, though the largest bitcoin holder, only fell 4.84%.

The logic behind this is simple: liquidity.

When panic strikes, the bid-ask spread for small-cap stocks widens sharply, and a slightly larger sell order can crash the stock price.

On this list, Tesla stands out. It fell 5.06%, almost the smallest drop, but if you look at the data, its mNAV is as high as 985.96. This means the market values Tesla at nearly 1,000 times its crypto holdings.

That's because Tesla is not essentially a DAT company; holding crypto is just a side business. Investors buy Tesla for its electric vehicle business, and bitcoin's price fluctuations have minimal impact on its valuation; the same logic applies to Coinbase, which fell 7.75%, but as an exchange, it has real fee income.

In contrast, for pure DAT companies, the situation is completely different.

MicroStrategy's mNAV is only 1.28x, trading almost entirely based on its crypto holdings. Galaxy Digital's mNAV is 5.49x, MARA Holdings is 1.29x. The market values these companies basically at their crypto asset value plus a small premium. When the crypto market crashes, they have no other business to cushion the blow.

When a company's market cap is almost equal to the value of its crypto holdings (mNAV close to 1), it means the market believes the company has no added value beyond hoarding crypto.

Bitmine's mNAV is 0.98, American Bitcoin hasn't disclosed but is estimated to be very low as well. These companies have essentially become bitcoin ETFs in the guise of listed companies.

The question is, now that there are real bitcoin ETFs to buy, why would investors still indirectly hold through these companies?

This may explain why, during panic, these low mNAV companies fall even harder. They bear both crypto asset risk and stock market risk, yet provide no additional value.

The US stock market will open in a few hours. After a weekend cooling-off period, will market sentiment improve? Will those small DAT companies that fell more than 10% continue to be sold off, or will bargain hunters step in?

From the data, companies with mNAV below 1 may present oversold opportunities, but could also be value traps. After all, when a business model itself is being questioned, being cheap is not necessarily a reason to buy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: How Europe Wants to Enforce Its Version of the SEC

Stablecoin : Western Union plans to launch anti-inflation "stable cards"

Mars Morning News | SEC Expected to Issue "Innovation Exemptions" for the Crypto Industry in "About a Month"

The SEC is expected to issue an innovation exemption for the crypto industry. The UK "Digital Assets and Other Property Act" has come into effect. BlackRock's CEO revealed that sovereign wealth funds are buying bitcoin. Bank of America recommends clients allocate to crypto assets. Bitcoin selling pressure is nearing its end. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model continues to iterate.

a16z: Inefficient governance and dormant tokens pose a more severe quantum threat to BTC.