Ethereum in Retreat Mode as Institutions Dump Record Holdings

Ethereum remains under pressure after record ETF outflows erased $428 million in capital. With sentiment turning bearish, ETH risks extending its dip unless new demand reignites momentum.

Ethereum’s market sentiment continues to struggle following last Friday’s market crash, despite gradual signs of broader market improvement.

As institutional investors reduce participation, spot market participants have also trimmed their holdings. This could result in continued consolidation or a definitive breakdown of the critical $4,000 resistance level around which the coin currently trades.

Ethereum Market Hits Pause Amid Record ETF Redemptions

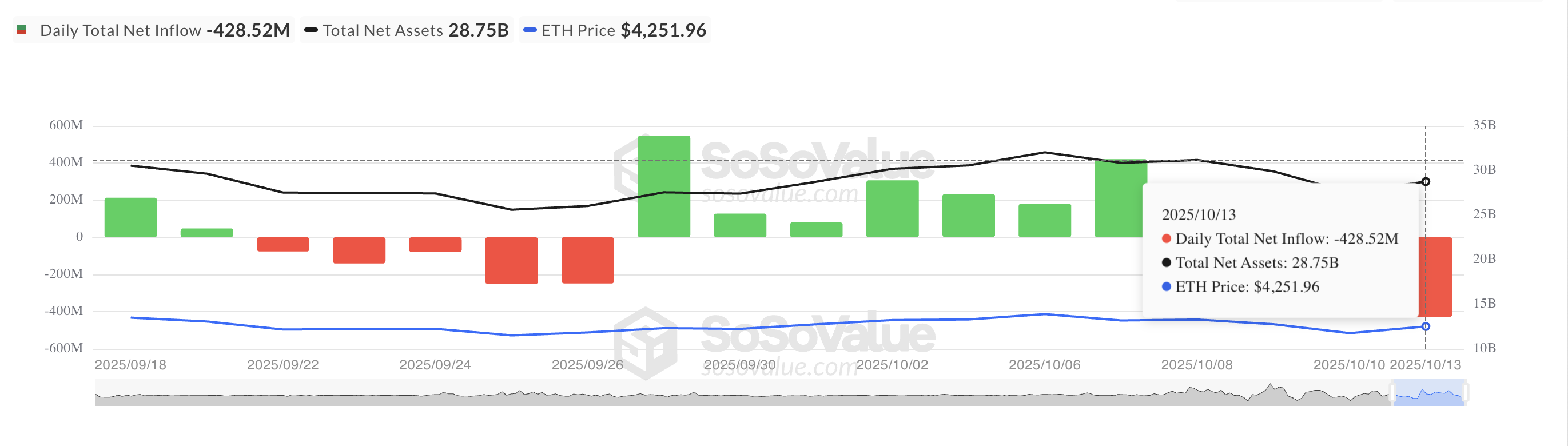

ETH-backed exchange-traded funds (ETFs) have recorded significant outflows since last Friday’s market-wide liquidation event. According to data from SosoValue, these funds registered $428.52 million in outflows on Monday.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

Total Ethereum Spot ETF Netflow. Source:

SosoValue

Total Ethereum Spot ETF Netflow. Source:

SosoValue

BlackRock’s iShares Ethereum Trust (ETHA) led ETF outflows with $310.13 million in redemptions, followed by Grayscale’s Ethereum Trust (ETHE) at $20.99 million and Fidelity’s Ethereum Fund (FETH) at $19.12 million.

Bitwise’s Ethereum ETF (ETHW) and VanEck’s Ethereum ETF (ETHV) recorded smaller declines of $12.18 million and $9.34 million, respectively, on the same day.

According to the data provider, Monday’s outflows marked the largest single-day capital exit from these funds since August 4, highlighting the decline in institutional interest following the liquidation event.

This trend may further dampen market sentiment around the altcoin and add more downward pressure on its price, limiting the coin’s ability to recover in the short term.

Bearish Signals Mount for Ethereum Amid Technical Weakness

Readings from the ETH/USD daily chart show the altcoin trading below its Super Trend indicator, which now acts as dynamic resistance at $4,561. For context, ETH is currently trading well below this level, at $3,986.

ETH Super Trend Indicator. Source:

TradingView

ETH Super Trend Indicator. Source:

TradingView

The Super Trend indicator helps traders identify the market’s direction by placing a line above or below the price chart based on the asset’s volatility.

When an asset’s price trades above the Super Trend line, it signals a bullish trend, indicating that the market is in an uptrend and buying pressure is dominant.

Conversely, as with ETH, when an asset trades below this line, it signals that the market is under bearish control. Traders usually interpret a position below the Super Trend as a warning that downward momentum could continue, making it harder for ETH to regain strength in the near term.

Bears Target Lower Levels While Buyers Wait

If bullish sentiment remains elusive, ETH could extend its decline below the critical $4,000 price level, potentially dropping to $3,626. If this level weakens, it could give way to a deeper decline toward $3,215.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

However, a rebound in new demand for the leading altcoin could invalidate this bearish outlook. In that scenario, the coin’s price could climb to $4,211.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Here’s What Could Happen if XRP ETFs Reach $10 Billion

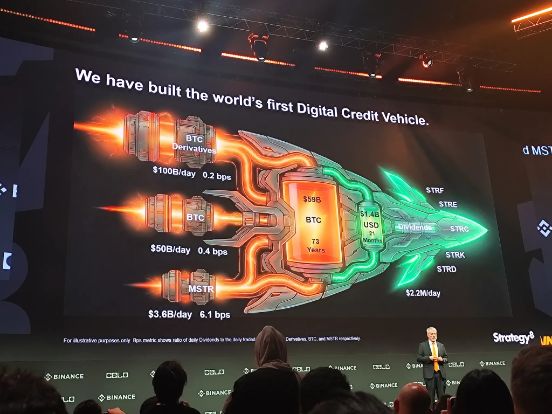

Bitcoin: The Cornerstone of the New Digital Civilization

Is the Halving Myth Over? Bitcoin Faces Major Changes in the "Super Cycle"