ATH Silver Flips Bitcoin: Has the Age of Digital Gold Finally Ended?

Silver’s historic rally is challenging crypto’s “digital gold” narrative. With Bitcoin lagging and silver surging, investors wonder if this marks the start of a new era favoring tangible assets over digital ones.

While the digital asset market wavers, silver has quietly reached its highest price in nearly half a century.

The reversal between the two asset classes — silver and crypto — not only reflects a shift in capital flow, but also raises a bigger question: is the era of “digital gold” giving way to traditional assets?

The Silver Surge and Signs of Capital Rotation

The global asset market is witnessing a rare turning point. Silver has just reached its highest level in about 45 years, marking a historic peak for the metal. Physical silver demand is also surging unprecedentedly, with large-scale purchases and deliveries from international depositories.

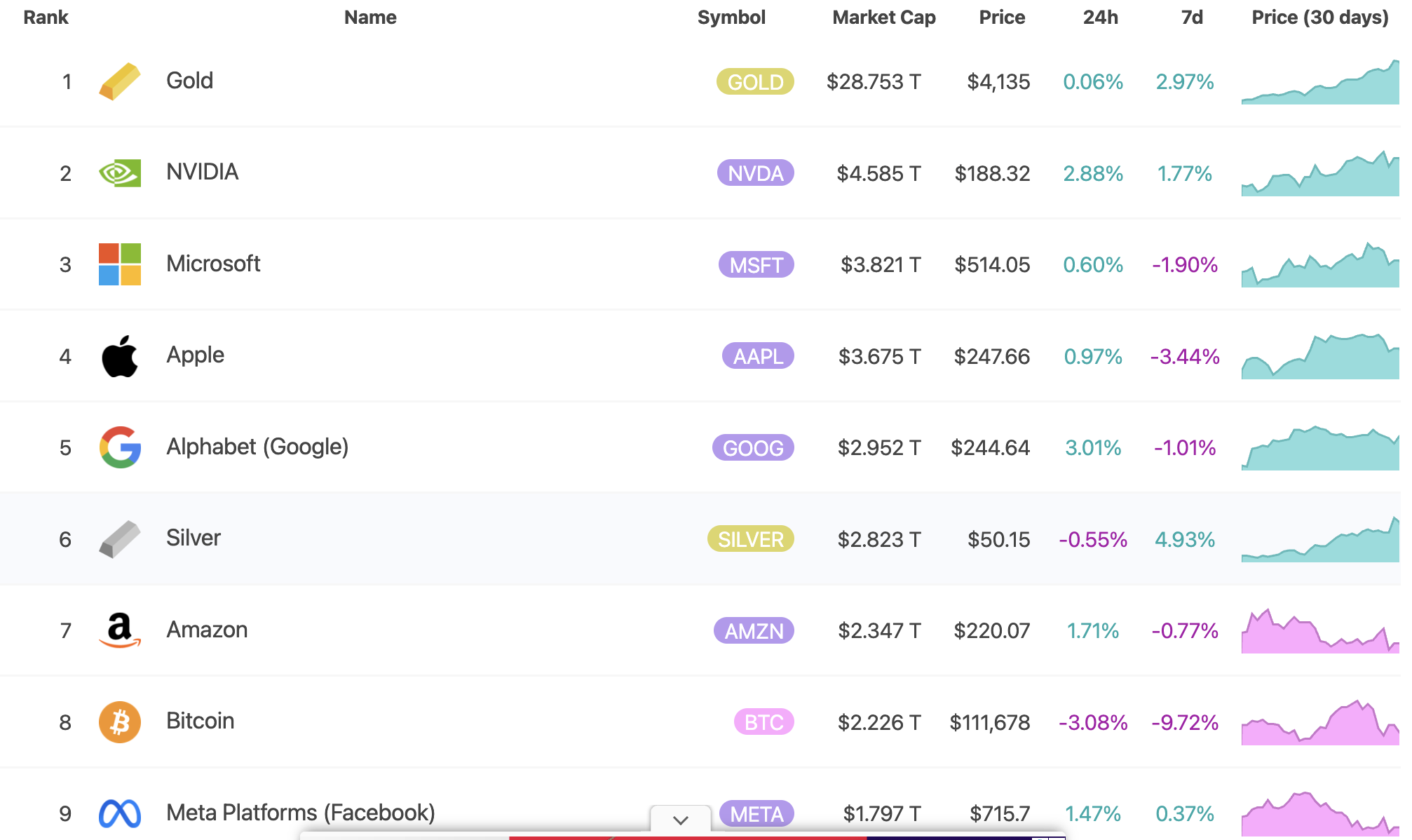

Not only has silver reached a new high, but gold is also moving in the same direction. Amid this rally of traditional assets, Bitcoin and Ethereum have fallen sharply following the recent Crypto Black Friday event. Silver’s market capitalization has now risen to the top tier of global assets, surpassing bitcoin.

Silver’s market cap has overtaken Bitcoin’s. Source:

Silver’s market cap has overtaken Bitcoin’s. Source:

The price trajectories of these two seemingly unrelated asset classes are now moving in opposite directions. This divergence is prompting investors to ask: Are we witnessing the beginning of a “bear market” for crypto versus silver?

“Gold and silver continue to melt up as Bitcoin and Ether continue to melt down. Crypto buyers are in for a rude awakening and will soon learn a very valuable but expensive lesson. Fortunately, most crypto owners are young with lots of time to earn back what they’re about to lose,” a prominent economist Peter Schiff shared.

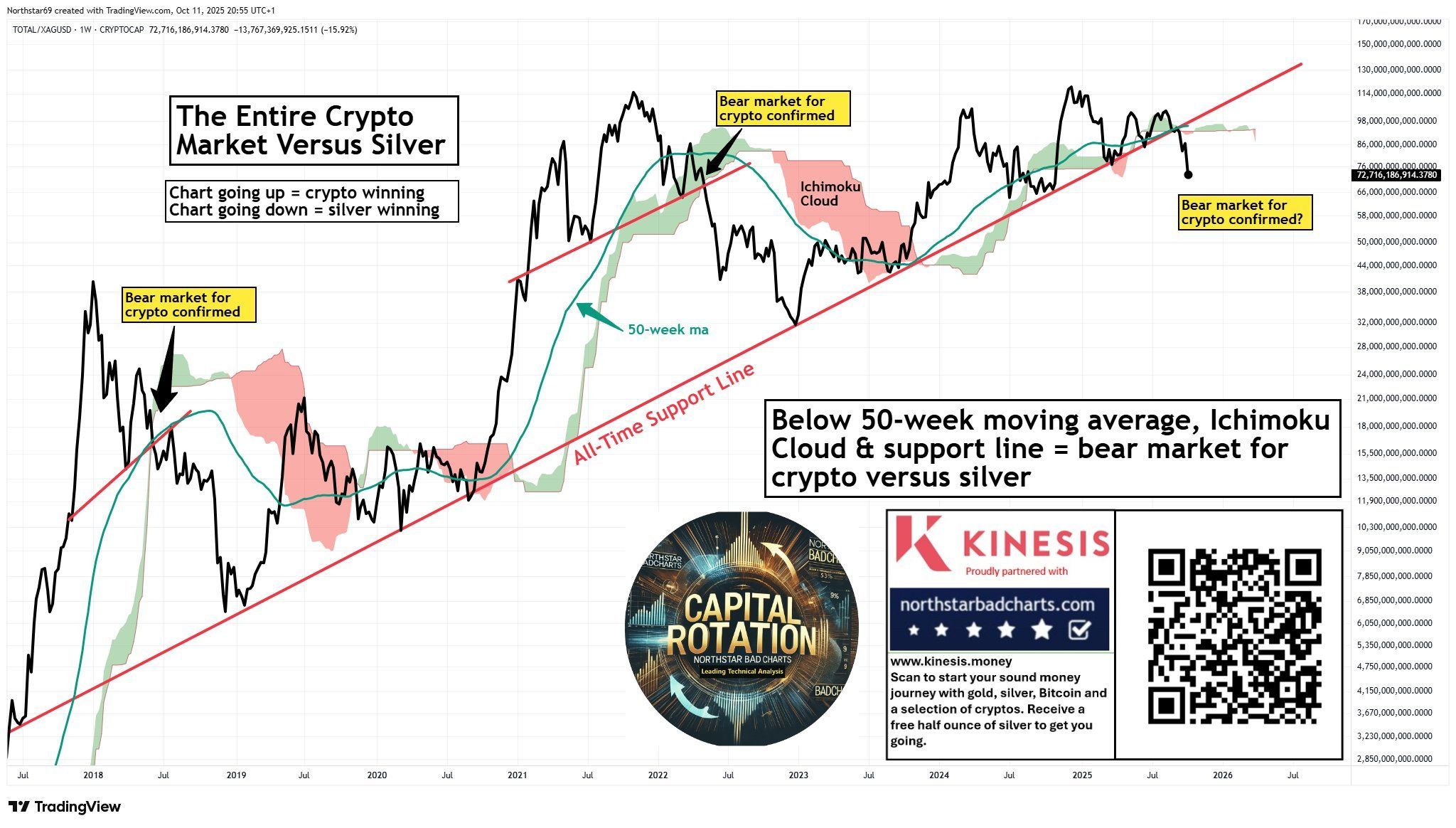

Technical data also paints a concerning picture for Bitcoin. Analyst Northstar observed that cryptocurrencies peaked against silver four years ago. Since their 2021 highs, the Bitcoin/silver ratio has continued to decline — and now it’s plunging once again.

“Objectively, the entire crypto market now appears to be entering a bear market versus silver,” Northstar said.

Correlation between the silver and crypto markets: Source:

Correlation between the silver and crypto markets: Source:

Some investors share stories of painful losses, like a trader who lost 80% of their portfolio value within hours during the recent Crypto Black Friday. Ironically, this trader had once been a “silver warrior” before selling at $39 to chase high-risk crypto assets.

When Tangible Assets Rise and Challenge Digital Conviction

This trend reflects a cyclical rotation between physical and digital assets. Amid growing fears of recession and persistently high interest rates, investors are returning to traditional safe havens. Commodity strategist Mike McGlone previously predicted that the next downturn — potentially arriving in Q4 2025 — could trigger a “mean reversion” for the crypto market, which has grown too quickly relative to its intrinsic value.

The rise of silver is due not only to its physical scarcity but also a shift in investor psychology — fears surrounding the US financial system and soaring debt are driving investors toward “real” assets.

Veteran investor Max Keiser, however, maintains that Bitcoin remains the superior scarce asset, capable of outperforming everything else in the long run. Despite Bitcoin’s recent volatility, investors may return to Bitcoin as gold and silver become increasingly challenging to acquire over the longer horizon.

“As Gold & Silver disappears from the market, unobtainable at any price, frustrated buyers will turn to Bitcoin.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Bitcoin Slides 0.7% as Bears Clash with Institutional Confidence Over Outflows

- Bitcoin dropped 0.7% below $95,000 amid prolonged bearish trends, with XWIN Research predicting corrections could persist until mid-2026 due to weak technical indicators and investor sentiment. - Institutional confidence contrasts market fragility: MicroStrategy added 487 BTC (total ~650k BTC) while Harvard allocated $442M to BlackRock’s Bitcoin ETF, surpassing tech investments. - $1.1B in Bitcoin ETF outflows and $600M+ forced liquidations accelerated the sell-off, with XWIN warning a break below $92,00

Vitalik Buterin Introduces a Novel ZK Research Initiative and Its Potential Impact on Blockchain Scalability

- Vitalik Buterin proposes deprecating Ethereum's modexp precompile to boost ZK proof efficiency, accepting higher gas costs for long-term scalability. - ZKsync's Atlas upgrade achieves 15,000 TPS with open-source liquidity tools, attracting enterprises through privacy and interoperability. - ZK Rollups outperform Optimistic Rollups in security and finality, gaining traction in finance despite higher computational costs. - ZK-based solutions align with regulatory demands, with ZKsync's deflationary tokenom

Zcash Halving and Its Effects on the Market: Limited Supply, Investor Confidence, and the Value of Privacy

- Zcash's 2025 halving cut block rewards by 50%, driving a 750% price surge to $680 amid growing demand for privacy-focused assets. - Unlike Bitcoin's store-of-value narrative, Zcash's 28% shielded supply via zk-SNARKs created a "privacy premium" during crypto downturns. - Zcash's PoS transition stabilized mining economics, attracting ESG investors while Bitcoin's PoW model faces energy cost volatility. - Institutional adoption (Grayscale Zcash Trust, Zashi wallet) and regulatory resilience position Zcash

Ethereum Updates: Major Whale Amasses $140M in ETH Despite ETF Withdrawals, Igniting Market Discussion

- Ethereum whale "66kETHBorrow" deposits $140.2M in ETH into Binance and Aave V3, amassing 385,718 ETH ($1.33B) since November. - Whale's leveraged strategy includes $120M USDT borrowing from Aave, signaling high-conviction bets on ETH's price recovery amid market volatility. - Analysts debate risks vs. resilience: Some praise "4D chess" tactics, others warn of "speedrunning liquidation mode" due to aggressive leverage. - Whale's actions contrast with $183.77M ETF outflows, creating uncertainty as accumula