Alibaba Subsidiary Drives Attention to its Ethereum Layer 2 Blockchain

Jovay Network, an Ethereum Layer 2 (L2) network backed by Ant Digital, a subsidiary of Alibaba, is catching eyes today after it proclaimed its alignment with Ethereum on social media.

Despite many investors being surprised by the news, Jovay was originally revealed as an Ethereum L2 in April at the RWA Real Up conference in Dubai.

Jovay touts itself as financial-grade blockchain infrastructure, focused on global real-world asset (RWA) tokenization via its “modular Layer2 infrastructure that bridges Web2 and Web3.”

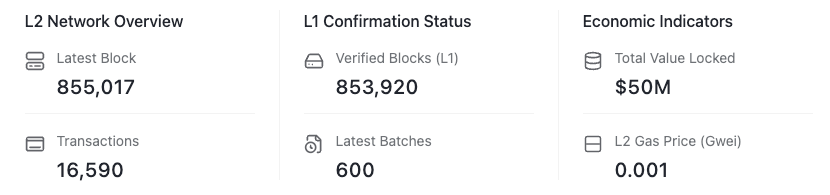

According to the chain’s block explorer, the network currently hosts $50 million in total value locked, but has only finalized 16,600 total transactions.

Alibaba Group ($BABA) is the 30th-largest company in the world by market capitalization, with a $385 billion valuation, making it the second-largest company in China.

The company first began exploring blockchain via Ant in 2019 with Alibaba Cloud, its blockchain-as-a-service (BaaS) platform for supply chain management tasks such as product traceability.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TWT's Tokenomics Revamp for 2025: Supply Structure Adjustment and Lasting Value Impact

Aster DEX: Connecting Traditional Finance and DeFi by Streamlining Onboarding and Encouraging Institutional Participation

- Aster DEX bridges TradFi and DeFi via a hybrid AMM-CEX model, multi-chain interoperability, and institutional-grade features. - By Q3 2025, it achieved $137B in perpetual trading volume and $1.399B TVL, driven by yield-bearing collateral and confidential trading tools. - Institutional adoption surged through compliance with MiCAR/CLARITY Act, decentralized dark pools, and partnerships with APX Finance and CZ. - Upcoming Aster Chain (Q1 2026) and fiat on-ramps aim to enhance privacy and accessibility, pos

Fade the Fear: Astronomer Says BTC Next Leg to $112K–$160K Starts Now

Astar (ASTR) Value Soars as Ecosystem Broadens and User Adoption Accelerates

- Astar (ASTR) gains momentum through strategic partnerships with Sony , Toyota , and enterprise-grade blockchain solutions. - Tokenomics 3.0 and Burndrop program reduce supply inflation, boosting institutional confidence via $3. 3M OTC trades and buybacks. - Astar zkEVM and Plaza integration enhance cross-chain scalability, driving 20% Q3 2025 wallet growth and $2.38M TVL. - Governance transition to community councils by 2026 and projected $0.0167–$0.0333 price targets highlight long-term investment appea