Aave freezes PYUSD markets after unprecedented 300T mint and burn

Blockchain data showed stablecoin issuer Paxos both minted and burned about $300 trillion worth of the PayPal USD stablecoin within 30 minutes, leaving many crypto users scratching their heads.

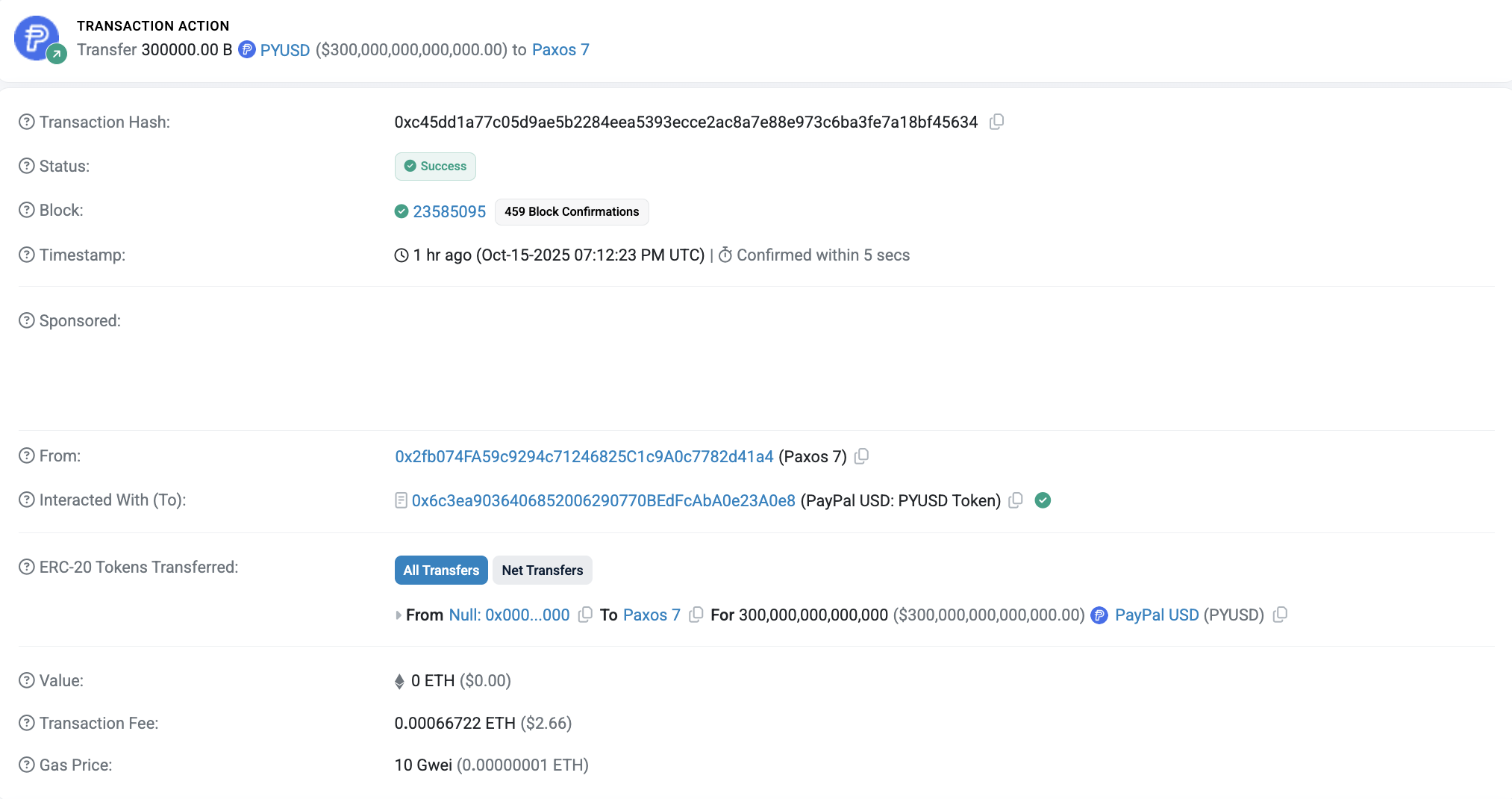

In a Wednesday X post following the mint and burn, Chaos Labs founder Omer Goldberg said Aave would be temporarily freezing trades for PayPal USD (PYUSD) after an “unexpected high-magnitude transaction” of minting and burning the stablecoin. Ethereum blockchain data showed Paxos minting 300 trillion of the US dollar-pegged stablecoin at 7:12 pm UTC and then burning the entire amount 22 minutes later by sending it to an inaccessible wallet.

Reporting from The Defiant suggested that it had been an “accidental mint” given the timing. Others online have speculated that such a large mint and burn may have been some kind of test or simulation authorized by Paxos.

Cointelegraph reached out to the stablecoin issuer for comment but had not received a response at the time of publication, nor had Paxos or PayPal publicly commented on the move.

$300 trillion is more than twice the Gross Domestic Product for every country on earth, according to data from the International Monetary Fund.

This is a developing story, and further information will be added as it becomes available.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TWT's Tokenomics Revamp for 2025: Supply Structure Adjustment and Lasting Value Impact

Aster DEX: Connecting Traditional Finance and DeFi by Streamlining Onboarding and Encouraging Institutional Participation

- Aster DEX bridges TradFi and DeFi via a hybrid AMM-CEX model, multi-chain interoperability, and institutional-grade features. - By Q3 2025, it achieved $137B in perpetual trading volume and $1.399B TVL, driven by yield-bearing collateral and confidential trading tools. - Institutional adoption surged through compliance with MiCAR/CLARITY Act, decentralized dark pools, and partnerships with APX Finance and CZ. - Upcoming Aster Chain (Q1 2026) and fiat on-ramps aim to enhance privacy and accessibility, pos

Fade the Fear: Astronomer Says BTC Next Leg to $112K–$160K Starts Now

Astar (ASTR) Value Soars as Ecosystem Broadens and User Adoption Accelerates

- Astar (ASTR) gains momentum through strategic partnerships with Sony , Toyota , and enterprise-grade blockchain solutions. - Tokenomics 3.0 and Burndrop program reduce supply inflation, boosting institutional confidence via $3. 3M OTC trades and buybacks. - Astar zkEVM and Plaza integration enhance cross-chain scalability, driving 20% Q3 2025 wallet growth and $2.38M TVL. - Governance transition to community councils by 2026 and projected $0.0167–$0.0333 price targets highlight long-term investment appea