- Ethereum, Polkadot, and Chainlink each faced 3–5% daily losses, signaling a coordinated downturn across the altcoin sector.

- Trading activity dropped sharply across all three assets ETH (-27.46%), DOT (-36.31%), and LINK (-31.67%) indicating a broad reduction in market participation.

- While prices declined, each project’s core fundamentals remain solid Ethereum’s DeFi dominance, Polkadot’s cross-chain ecosystem, and Chainlink’s oracle utility

Ethereum (ETH) , Polkadot (DOT), and Chainlink (LINK) reveal a synchronized decline across the altcoin market, reflecting broader selling pressure and weakening sentiment within the crypto sector. Each asset has recorded daily losses ranging between 3% and 5%, with trading volumes also contracting significantly—signaling cooling momentum following recent rallies.

Ethereum (ETH) Market Overview

Ethereum is currently trading at $3,954.08, down 3.62% over the last 24 hours, with a market cap of $477.25 billion. The chart shows ETH struggling to maintain upward traction after peaking above $500 billion in market value earlier in the session. Trading volume fell by 27.46%, indicating reduced activity as market participants turned defensive.

The downtrend began mid-session, with ETH losing momentum amid broader market weakness. The decline suggests short-term profit-taking following recent price gains, while the $4,000 level remains a critical psychological threshold for traders. If ETH fails to reclaim this level soon, the asset could retest near-term support around $3,900 before attempting a rebound.

Despite the pullback, Ethereum maintains strong network fundamentals and utility dominance in decentralized applications and DeFi activity. Market sentiment remains stable in the long term, but near-term volatility may persist due to macroeconomic factors and risk-sensitive positioning across major cryptocurrencies.

Polkadot (DOT) Price Performance

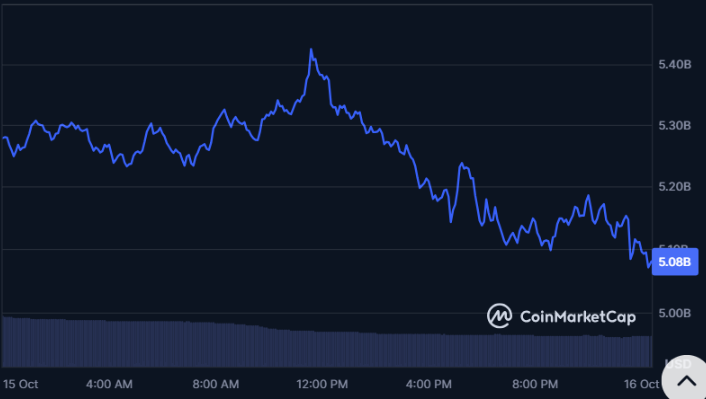

Polkadot is priced at $3.12, marking a 3.08% daily decline, with a market capitalization of $5.08 billion. The price action shows DOT trading within a defined downward channel, struggling to sustain gains above the $5.3 billion mark seen earlier in the day. The 36.31% drop in trading volume suggests reduced short-term participation and fading momentum among active traders.

The overall market structure indicates mild bearish continuation as DOT consolidates near its current levels. Support appears around the $3.00 mark, while resistance sits near $3.30. If sentiment improves, the token could attempt a short-term recovery, but sustained weakness across the altcoin sector may keep it range-bound.

Polkadot’s decline also reflects reduced interest in cross-chain and interoperability-focused projects amid tightening liquidity. Nonetheless, the protocol’s strong technical foundation and growing parachain ecosystem continue to support its long-term value proposition.

Chainlink (LINK) Market Sentiment

Chainlink trades at $17.94, down 5.03% in the past day, with a market cap of $12.16 billion. The price chart highlights a steady downward trajectory throughout the session, as LINK fell from near $13 billion in market value earlier in the day. Daily trading volume dropped 31.67%, reinforcing the narrative of cooling market momentum and declining speculative interest.

Despite the correction, Chainlink remains one of the most active oracle networks, underpinning data integration across decentralized applications. The token’s 7.75% volume-to-market cap ratio suggests consistent engagement, even as prices decline. However, the market may require a resurgence in risk appetite before LINK can regain upward momentum.

Technically, LINK faces short-term resistance near $18.50 and support around $17.50. Holding above this support could prevent deeper losses, while a rebound toward $19 may signal renewed buying interest.

Overall Analysis

Ethereum, Polkadot, and Chainlink all exhibit correlated declines, underscoring broad-based weakness in the altcoin segment. The uniform drop in prices and volumes points to market-wide profit-taking rather than project-specific issues. Despite the temporary downturn, each asset remains supported by strong fundamentals—suggesting that current weakness may represent a consolidation phase before the next potential recovery wave.