Key Notes

- CoinGlass data shows that 308,750 traders were liquidated in the crypto industry.

- Their liquidations ran to the tune of $1.20 billion, with long traders affected the most.

- Bitcoin price is fast heading towards $100,000 amid cascading selloffs.

Over the last 24 hours, 308,750 traders were liquidated in the crypto industry and the total liquidations within this time came in at $1.20 billion.

These large liquidations are becoming a trend in the market. At this point, investors and traders are beginning to question the safety of their crypto investments.

Long Traders Impacted by Crypto Liquidations

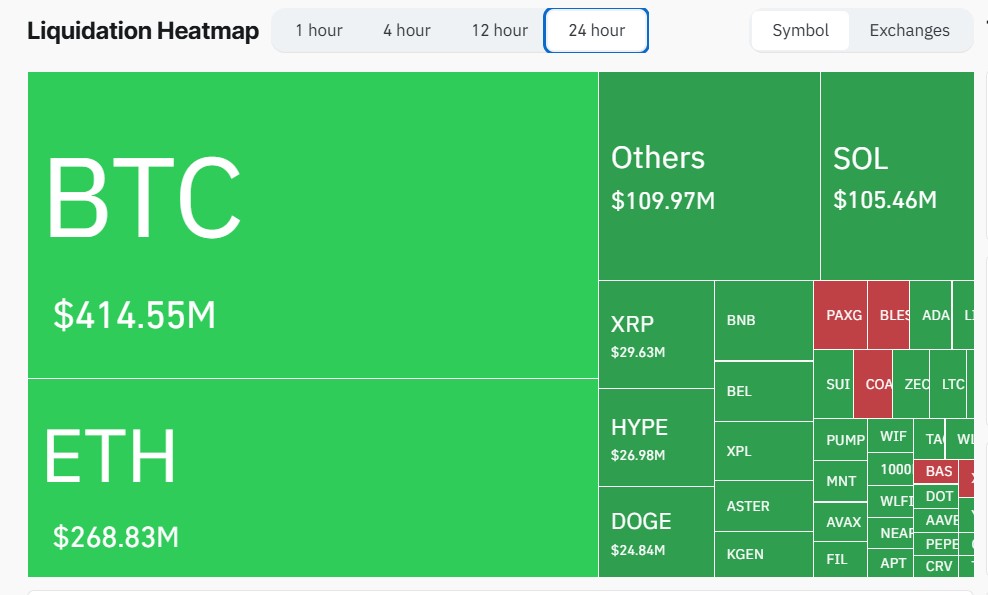

CoinGlass liquidation heatmap for the last 24 hours shows that the largest single liquidation order happened on Hyperliquid HYPE $35.50 24h volatility: 4.4% Market cap: $9.62 B Vol. 24h: $870.29 M , with ETH-USD worth about $20.42 million liquidated.

Collectively, the total crypto liquidations from the listed exchanges summed up to $1.2 billion.

Flagship cryptocurrency Bitcoin BTC $107 028 24h volatility: 1.0% Market cap: $2.14 T Vol. 24h: $107.25 B led the liquidation at $414.55 million, with long traders being affected the most.

Precisely, short traders’ liquidations were valued at only $82.8 million, while long traders saw as much as $331.2 million in losses. Next was Ethereum ETH $3 831 24h volatility: 1.4% Market cap: $462.64 B Vol. 24h: $56.55 B with $268.83 million: long traders at $198.79 million and short traders at $70.04 million.

Crypto market liquidations show more long trader offset. | Source: Coinglass

Solana SOL $183.8 24h volatility: 2.1% Market cap: $100.42 B Vol. 24h: $11.70 B , Dogecoin DOGE $0.19 24h volatility: 1.9% Market cap: $28.16 B Vol. 24h: $3.80 B , and XRP XRP $2.31 24h volatility: 2.1% Market cap: $138.40 B Vol. 24h: $8.42 B were all impacted by the huge liquidations.

The prices of these digital assets are struggling to pull off a recovery since Donald Trump’s October 10 China tariff announcement.

After losing support from $126,000, the BTC price has been struggling to remain above $110,000. However, the situation has worsened, and it is now trading at $105,094.03.

Judging by this situation, it does not look like the worst is over. Crypto enthusiasts, traders, and investors would have to endure until the macroeconomic outlook, especially US-China tariffs and rate cuts, are well defined.