Paying income taxes is a reality for anyone earning money in the U.S., and those with higher earnings often face substantial IRS payments. This is due to the progressive nature of the American tax system.

Different portions of your income are taxed at varying rates, depending on which tax bracket your earnings fall into. As your income increases, the extra amount is subject to higher tax rates.

The IRS has recently revealed updates to the tax brackets for 2026. These adjustments typically happen each year to keep up with inflation and rising wages. With these new brackets, you’ll need to earn more before reaching the highest tax rate.

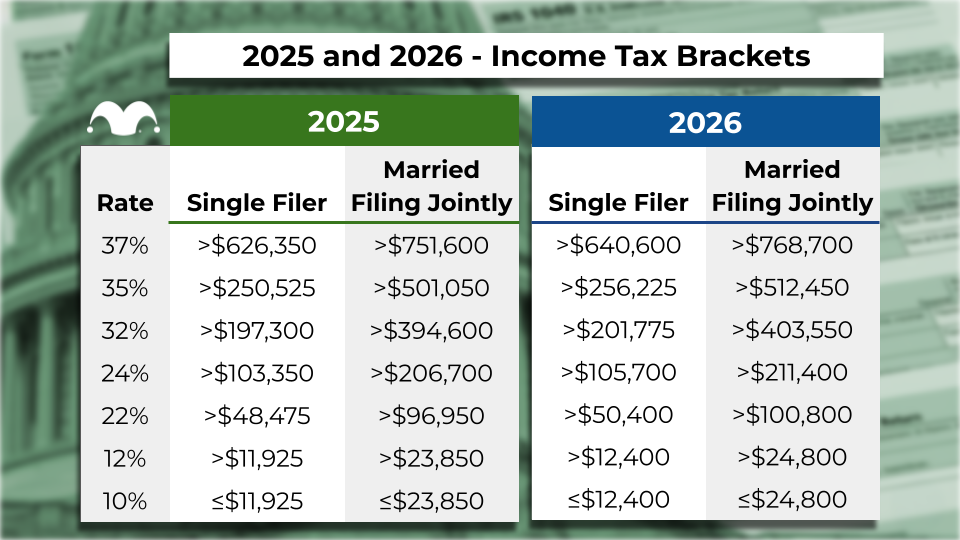

Below is the income required to fall into the top tax bracket for 2026.

Income needed for the top tax bracket in 2026

The following chart compares the 2026 tax brackets with those for 2025, allowing you to see how the income thresholds are shifting. Keep in mind, the 2026 brackets won’t affect the tax return you file in April 2026, since that return covers income from the previous year. The 2025 brackets will still be in effect for that filing.

As shown, in 2026, the income required to move into a higher tax bracket will increase—meaning you’ll need to earn more to reach the top bracket.

For 2025, single filers enter the highest bracket at $626,350, and married couples filing jointly at $751,600. In 2026, however, the 37% top marginal rate won’t apply until singles earn $640,600 or joint filers make $768,700.

Only a portion of your income is taxed at the highest rate

Although a 37% tax rate sounds steep, it’s crucial to understand that this rate applies only to the income above the threshold for that bracket. For instance, if you’re a single filer making $700,000, you won’t pay 37% on the entire amount—just on the portion above $626,350.

With the brackets shifting upward, those whose earnings remain unchanged in 2026 will see lower federal tax bills. The highest earners will benefit most, as more of their income will be taxed at the lower rates of 10%, 12%, 22%, 24%, 32%, and 35% compared to previous years.

The standard deduction will also rise for the 2026 tax year. Single filers can deduct $16,100, up from $15,750, while married couples filing jointly can deduct $32,200, up from $31,500.

However, many individuals with higher incomes may choose to itemize deductions instead, claiming specific expenses such as charitable donations, mortgage interest, and state and local taxes.

Itemizing is only worthwhile if your total deductions exceed the standard deduction. Higher earners are more likely to benefit from itemizing, as they may own valuable property or pay significant state taxes. (Despite changes from the "Big, Beautiful Bill," there is still a limit on how much state and local tax you can deduct.)

In summary, reaching the top tax rate requires a significant income—and starting in 2026, you’ll need to earn even more before the IRS taxes you at 37%.