Bitcoin (BTC) Price Analysis for October 18

Buyers are trying to seize the initiative on Saturday, according to CoinStats.

BTC/USD

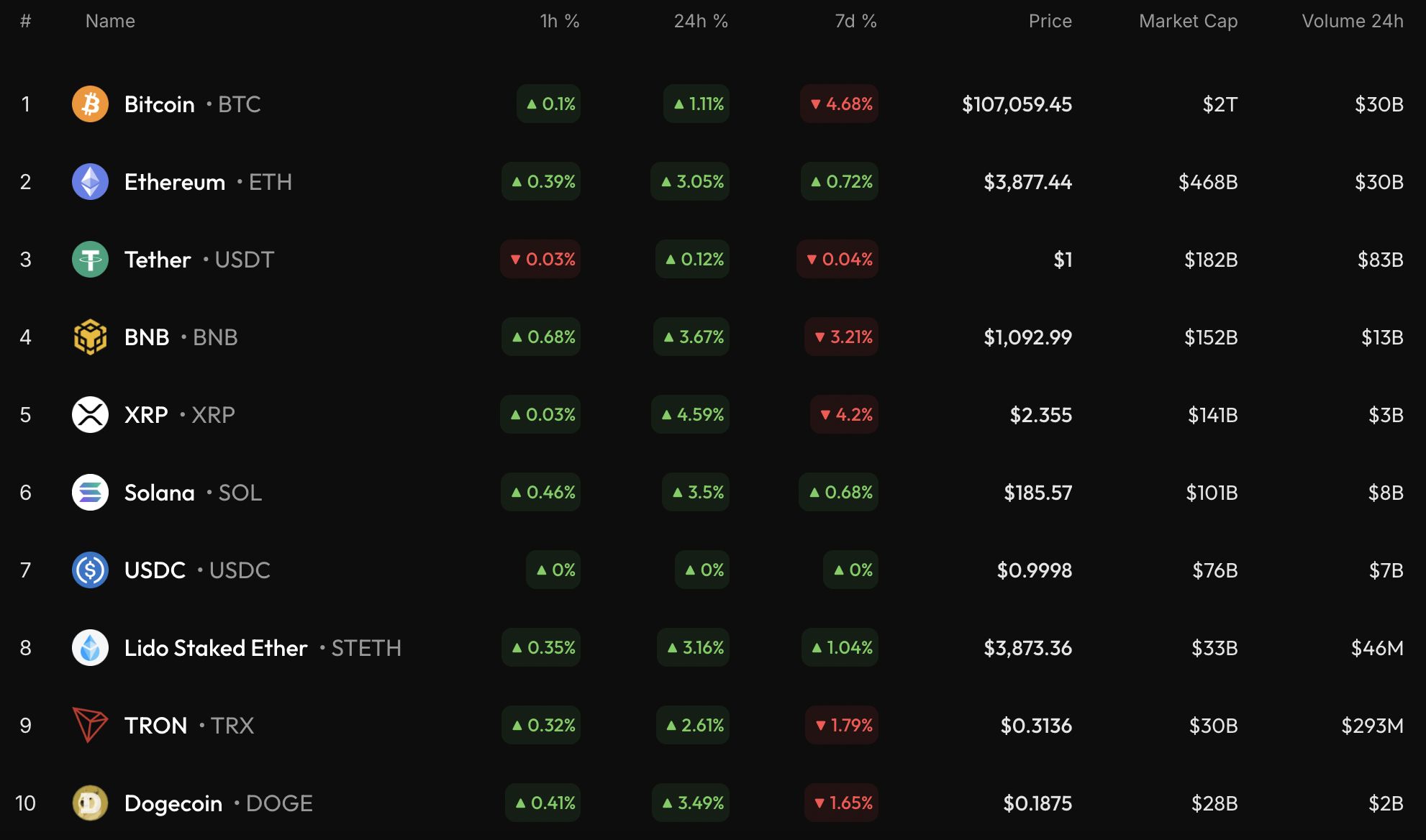

The rate of Bitcoin (BTC) has risen by 1.11% since yesterday.

On the hourly chart, the price of BTC is far from the support and resistance levels. The volume is low, which means traders are unlikely to witness increased volatility by tomorrow.

On the bigger time frame, there are no reversal signals so far. In this regard, one should pay attention to yesterday's bar low of $103,530.

If bulls lose it, the decline may continue to the $100,000 area.

From the midterm point of view, sellers are also more powerful than buyers. If a breakout of the $100,426 support happens, the accumulated energy might be enough for a move to the $95,000 zone.

Bitcoin is trading at $106,909 at press time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Assessing How COAI's Abrupt Price Decline Influences Technology and Security Shares: Shifts in Sector Risk and Changes in Investor Sentiment After the Crash

- COAI index's 88% 2025 collapse exposed fragility of speculative crypto AI assets due to governance failures and regulatory uncertainty. - Institutional investors shifted capital to cybersecurity (e.g., CrowdStrike) and AI infrastructure (Nvidia) as post-crash safe havens. - Divergent investor psychology emerged: 60% retail optimism vs. 41% institutional skepticism toward AI valuations. - U.S. AI Action Plan and cybersecurity policies accelerated capital reallocation to secure-by-design infrastructure and

Ripple celebrates milestones – while XRP struggles below USD 2

MicroStrategy retains its place in the Nasdaq-100 despite Bitcoin dominance

Interactive Brokers allows account funding with stablecoins