Ethereum Price Prediction — ETH Targets $4,300 Bounce as MAGACOIN FINANCE Presale Surges Past $17M

Ethereum is attempting to recover from a recent pullback that tested the $3,600–$3,700 range. According to market analysts, as long as ETH can recover the lost ground of $4,000, then it will be the first good indication of the revival of strength.

Although there are short-term fluctuations and ETF outflows, investor sentiment is optimistic in the long term. With Ethereum consolidation, market attention has shifted to other trending projects.

Ethereum Attempts a Technical Recovery

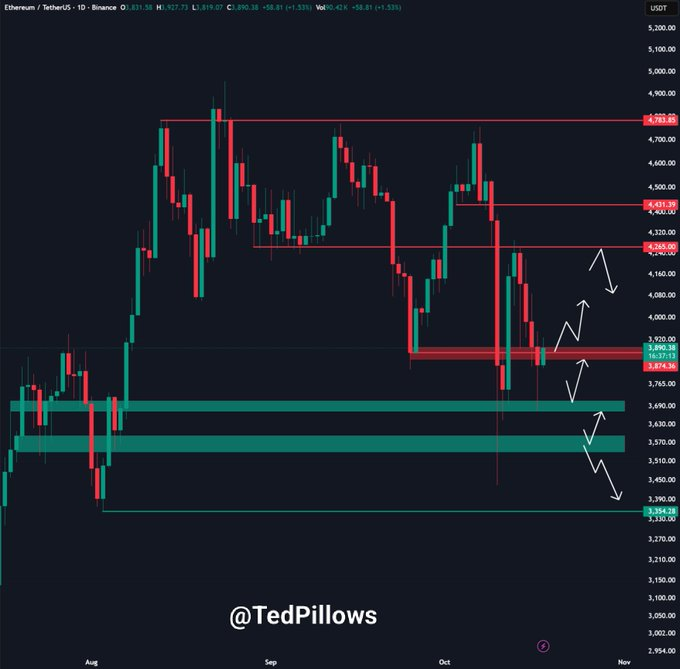

After recovering on the $3,650 support zone in the early part of this week, Ethereum is trading at the area around $3,950. Coingecko data indicates that ETH has gained almost 2% within the last 24 hours with buyers protecting major support levels. Market commentator wrote that ETH experienced a bullish recovery off the $3,600-$3,700 level. In case it retrieves $4,000, it will be an initial message of power.

Source:

X

Meanwhile, ETF data reflect a $232 million outflow by U.S. Ethereum funds, with BlackRock recording a sales level of more than $146 million. Nevertheless, there are analysts who are still optimistic of recovery targets within the medium term.’ This is an Ethereum textbook set-up, Ted added. My wave-5 goal will be $5,200, followed by $6,000 at the end of a year.”

According to market analysts, the psychological barrier is at the $4,000 mark. In case Ethereum continues to stay higher than the 20-day moving average, the next level of resistance will be around $4,300-$4,400. Nevertheless, the inability to re-evaluate above the 3,800 will clear the way to another test of the $3,600 region before another push up.

New Ethereum Treasury Plans Emerge in Asia

According to Bloomberg, a group of influential Asian investors is already planning to roll out a 1 billion Ethereum treasury. The project includes Li Lin, the founder of Huobi and chairman of Avenir Capital, who has become a member of a group of local crypto leaders. Other members of the group are HashKey Group CEO Xiao Feng, co-founder of Fenbushi Capital Shen Bo, and co-founder of Meitu Inc Cai Wensheng.

According to the sources, institutional participants have already made commitments totaling to approximately 1 billion of capital. This is in addition to the $500 million raised by HongShan Capital Group, which was once known as Sequoia China and $200 million raised by the Avenir Capital. Analysts interpret the action as a great act of confidence in the long-term network worth of Ethereum, particularly following the recent market decline.

Market researcher commented that the weekly structure still favors accumulation.“Ethereum is retesting its 20-day moving average for the second time now,” the post read. Such retests are often seen as a healthy stage before renewed growth, suggesting that long-term investors continue to build exposure.

MAGACOIN FINANCE Gains Momentum With $17M Raised

Conclusion

Ethereum’s technical structure remains in a recovery phase as buyers defend the $3,600–$3,800 zone. With large investors preparing a $1 billion Ethereum treasury, broader sentiment is slowly turning positive again.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Emergence of a Vibrant Clean Energy Market: How REsurety's CleanTrade Platform is Transforming Institutional Investments and ESG Approaches

- REsurety's CleanTrade platform, CFTC-approved for clean energy swaps, is transforming the market by enabling institutional trading of renewable assets with liquidity and transparency. - It addresses historical illiquidity in VPPAs/RECs through standardized contracts and real-time pricing, reducing transaction times and enabling $16B in notional value within two months. - The platform integrates ESG metrics with financial analysis, supporting 84% of institutional investors' growing demand for decarbonizat

COAI's Significant Recent Drop: Should Investors See This as a Chance to Buy or a Cautionary Signal?

- COAI's sharp stock decline sparks debate over short-term volatility vs. structural risks in South Africa's coal sector. - Weak domestic coal supply chains, US tariffs, and governance gaps amplify operational risks for export-dependent COAI. - Unclear AI policy implementation and media credibility issues deepen investor skepticism about COAI's transparency and adaptability. - Structural challenges including infrastructure bottlenecks and low AI adoption rates suggest the decline may reflect systemic indus

3 Future-Proof Cryptos to Add to Your Portfolio for 2026 — LINK, AVAX, and ALGO

Smart Money Bets on These 3 Altcoins for Big Gains