Date: Sat, Oct 18, 2025 | 05:34 PM GMT

The cryptocurrency market continues to struggle in its attempt to form a convincing V-shaped recovery after the October 10 crash that triggered over $19 billion in liquidations . While Ethereum (ETH) remains choppy, the weakness has spilled over into several altcoins — including Ondo (ONDO).

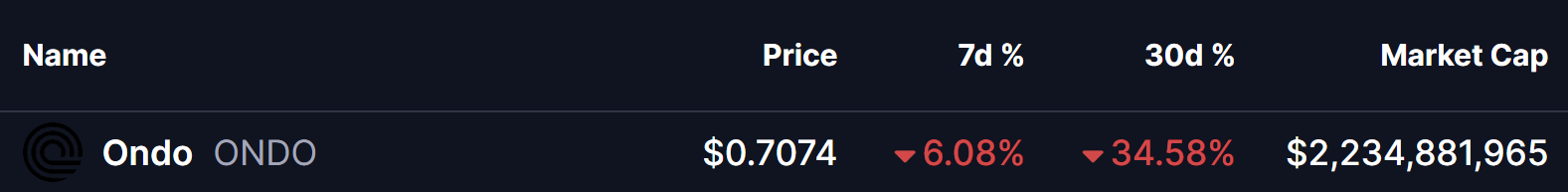

Despite being down 34% over the past 30 days, ONDO’s latest price action suggests something interesting could be brewing beneath the surface. A bullish Wyckoff Accumulation pattern is starting to form, hinting that the token might be preparing for a potential trend reversal.

Source: Coinmarketcap

Source: Coinmarketcap

Wyckoff Accumulation Pattern Forms on ONDO Chart

According to market analyst Osemka, ONDO’s daily chart has been closely tracking the Wyckoff Accumulation model — a well-known structure that signals a potential shift from a bearish phase to a new bullish cycle.

Over the past few months, ONDO has been moving through the classic Wyckoff phases, and the October 10 crash appears to have marked the Spring Phase, with the token dropping to a low of $0.58. This zone acted as a final shakeout before buyers began to re-enter the market.

ONDO Daily Chart/Credits:@Osemka8 (X)

ONDO Daily Chart/Credits:@Osemka8 (X)

Currently, ONDO is trading within the Test Phase, hovering around $0.67–$0.87, where it’s consolidating and showing signs of accumulation. This phase often represents a period when smart money starts building positions before the next breakout, offering a potential buying opportunity for patient investors.

What’s Next for ONDO?

If ONDO can successfully break out of its ongoing test phase, the next move would likely form the Last Point of Support (LPS) — a key step in the Wyckoff model that often precedes a sustained uptrend.

A decisive break above $0.87 would be an early signal that bullish momentum is taking over. Once confirmed, ONDO could aim for a potential upside target near $1.60, aligning with previous resistance zones and volume-based projections.