Key Market Information Discrepancy on October 20th, a Must-See! | Alpha Morning Report

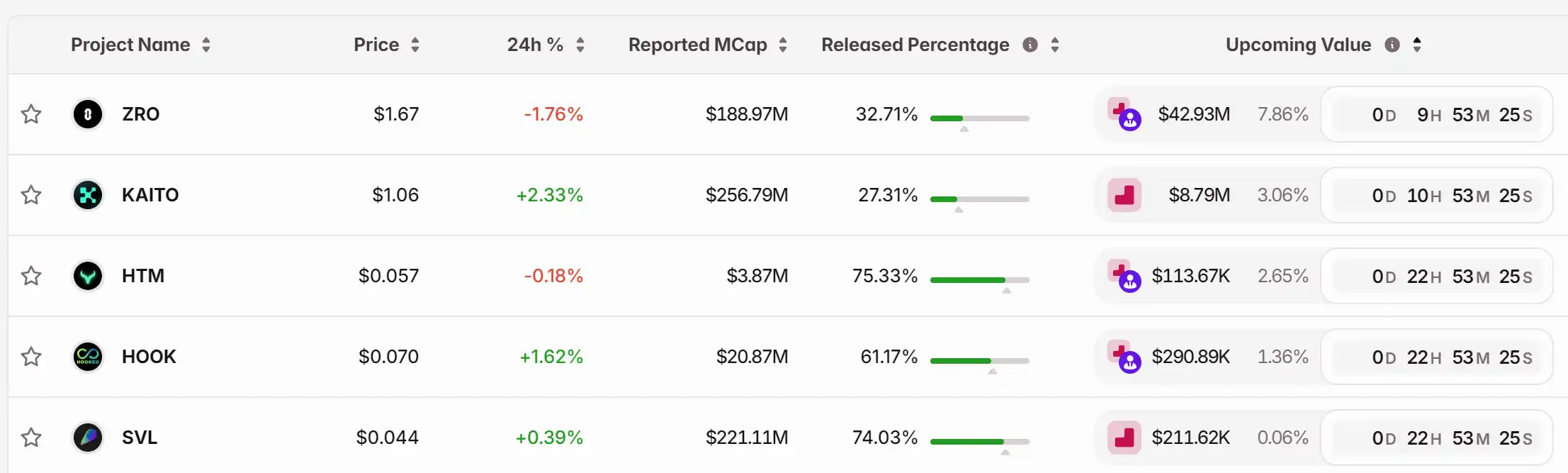

1. Top News: This week's CPI Data is Coming, Fed to Hold Payment Innovation Meeting to Discuss Stablecoins, Tokenization 2. Token Unlock: $ZRO, $KAITO, $HTM, $HOOK, $SVL

Top News

1.This Week's CPI Data Released, Fed to Hold Payment Innovation Meeting to Discuss Stablecoins, Tokenization

2.pump.fun Launches X Account Spotlight Aimed at Accelerating ICM

3."1011 Insider Whale" Once Again Shorts Bitcoin with 10x Leverage, Entry Average Price at $109,133.1

4.MLN Surges Over 73% in 24 Hours, Market Cap Reaches $25.5 Million

5.Binance Alpha to List SigmaDotMoney (SIGMA) on October 21

Articles & Threads

1. "$15 Billion Bitcoin Private Key Accidentally Cracked by U.S."

In October 2025, a massive cryptocurrency seizure case was revealed in the U.S. Federal District Court for the Eastern District of New York, where the U.S. government confiscated 127,271 bitcoins worth approximately $15 billion at market prices.

2. "New York Times: Trump Family's Cryptocurrency Scam Worse Than Watergate"

In American political history, no president has intertwined national power, personal brand, and financial speculation on a global scale like Trump. As cryptocurrency enters the White House and the digital shadow of the dollar entangles with national will, we must rethink a fundamental question: In this era of "on-chain sovereignty," do the boundaries of power still exist?

Market Data

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Cboe's Perpetual Futures Narrow the Gap Between Offshore and U.S. Crypto Markets

- Cboe will launch U.S.-regulated Bitcoin/Ether perpetual futures on Dec 15, 2025, offering 10-year contracts with daily cash adjustments. - The cash-settled products, cleared via Cboe Clear U.S., bridge offshore flexibility with domestic oversight, addressing institutional demand for long-term crypto exposure. - Trading 23/5 with cross-margining capabilities and educational sessions, the move aligns with growing ETF interest and Cboe's innovation strategy within U.S. regulatory frameworks.

Crypto Slide Driven by Leverage, Bottom May Be Near

DOGE drops 15.12% over the past month as Trump’s tariff pledges remain unmet

- DOGE fell 15.12% in 1 month amid unfulfilled Trump tariff dividend promises and political uncertainty. - Trump's Truth Social AI chatbot acknowledged no tangible economic benefits from his DOGE-linked policies. - Treasury Secretary Bessent highlighted legislative hurdles for $2,000/person tariff payments, facing legal skepticism. - Technical indicators show DOGE remains bearish, lacking catalysts for market optimism despite sector trends.

TWT’s 2025 Tokenomics Revamp: Redefining Utility and Investor Rewards on Solana

- Trader Joe's (TWT) 2025 tokenomics prioritizes utility over speculation, offering gas discounts, DeFi collateral, and governance rights. - A deflationary model with 88.9B tokens burned creates scarcity, while loyalty rewards redistribute existing tokens to avoid dilution. - Community governance allows holders to vote on platform upgrades, aligning token value with ecosystem growth and user participation. - This Solana-based approach redefines DeFi incentives by linking price appreciation to real-world ut