Corporate creep could corrupt Ethereum's ethos, dev warns

Ethereum developer Federico Carrone says the growing influence of corporations such as Paradigm on the network could be “tail risk” for the Ethereum ecosystem.

In a post on Sunday, the Ethereum core dev, who goes by “Fede’s intern” on X, argued that while Paradigm has “created valuable things for the community,” he is worried about the growing influence of a venture fund whose ultimate goals are driven by profit and influence.

“I’ve been saying for the past two years that the influence of @paradigm within Ethereum could become a relevant tail risk for the ecosystem. I believe this will become increasingly clear to everyone in the months ahead.”

Carrone added that while Paradigm’s hiring of key Ethereum researchers and funding of open source libraries that are “critical to Ethereum” looks good on the surface, it’s not for those who think that Ethereum should represent a “philosophical and political” movement that is “larger than any corporation.”

Paradigm has made a series of Ethereum plays over the years, which also includes the Rust-language-based Ethereum development software Reth.

One of the most recent notable plays includes the incubation of a competing layer-1 blockchain, Tempo, in partnership with fintech giant Stripe.

Tempo is still in the works and will be a stablecoin and payments-focused L1 with Stripe essentially being in control of the network. Its ethos marks a stark contrast to Ethereum’s decentralized and open-source nature, given that it will be a corporate-controlled chain.

Ultimately, Carrone’s concerns center around the differing aims of decentralized and centralized entities, and the dangers of allowing any type of fund — not just Paradigm — to have too much sway over the Ethereum ecosystem.

“Ethereum should be extremely cautious about developing a technical deep dependency on a fund that is playing cards in a very strategic way.”

“When corporations gain too much legibility and influence over open source projects, priorities start to drift away from the community’s long-term vision and toward corporate incentives. That’s how misalignment begins.”

Cointelegraph reached out to Paradigm for comment, but did not hear back by the time of writing.

Paradigm crypto ventures

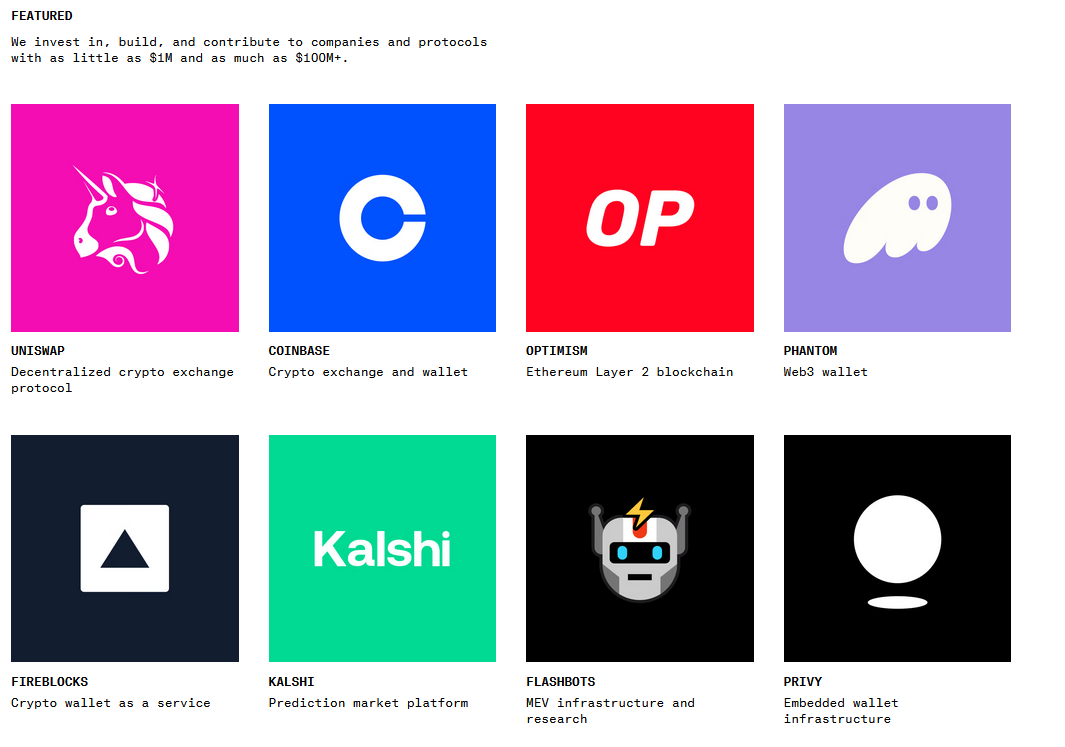

Paradigm is a crypto and AI investment firm founded in 2018 by Matt Huang, a veteran from VC giant Sequoia, and Coinbase co-founder Fred Ehrsam.

It has invested widely across the market, covering anything from DeFi and NFTs to blockchain security, infrastructure and startups.

In its initial announcement of Tempo in September, Paradigm outlined its goal was to push forward the technology and adoption of crypto through a “mix of investing, building, and researching.”

“This helps us understand friction points and opportunities, and keeps us close to the edge of what’s possible,” the announcement reads.

Outside of purely financial plays, it has made several moves that display a firm conviction in the crypto community. From submitting an amicus brief in support of Tornado Cash co-founder Roman Storm, to hiring respected blockchain sleuth ZachXBT as an adviser to fund research and help protect its VC companies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ECB shifts stance! Will interest rate hikes resume in 2026?

In the debate over "further tightening" versus "maintaining the status quo," divisions within the European Central Bank are becoming increasingly public. Investors have largely ruled out the possibility of the ECB cutting interest rates in 2026.

On the eve of Do Kwon's trial, $1.8 billion is being wagered on his sentence

Dead fundamentals, vibrant speculation.

Space Review|When the US Dollar Weakens and Liquidity Recovers: Cryptocurrency Market Trend Analysis and TRON Ecosystem Strategy

This article reviews the identification of macro turning points and the capital rotation patterns in the crypto market, and delves into specific allocation strategies and practical approaches for the TRON ecosystem during market cycles.

30-Year Wall Street Veteran: Lessons from Horse Racing, Poker, and Investment Legends That Inspired My Bitcoin Insights

What I focus on is not the price of bitcoin itself, but rather the position allocation of the group of people I am most familiar with—those who possess significant wealth, are well-educated, and have successfully achieved compounding returns on capital over decades.