In October 2025, the Bitcoin network quietly completed a leap in capability.

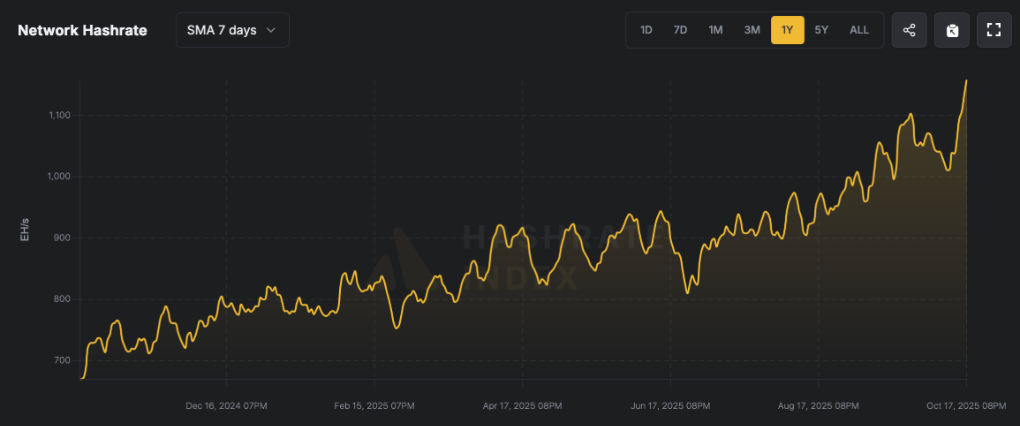

The Bitcoin network has once again proven its robust vitality and appeal. As of October 20, 2025, Bitcoin's hash rate soared to a historic high of 1,161 EH/s, breaking all previous records. The subsequent mining difficulty adjustment pushed it to a new all-time high of over 150T.

Despite recent fluctuations in Bitcoin's price, dropping from $121,000 to below $105,000 in October, miners have not retreated. Instead, they have increased their investments against the trend, demonstrating strong confidence in Bitcoin's long-term value.

1. The Era of 150T: The Endgame and Starting Point of the Hash Rate Race

The peak hash rate of 1,161 EH/s means far more than just a record-breaking number. It signifies that a global, never-ending computational engine has been established. This engine, with computing power thousands of times greater than the sum of all global supercomputers, safeguards this distributed ledger, making the cost of attacking it prohibitively high for any rational entity.

This milestone was achieved based on several key pillars:

● Breakthroughs in the Physical Limits of Mining Machine Technology: By 2025, mining machines using 3nm and even more advanced processes have become the absolute mainstream. Their energy efficiency ratio is generally below 20J/TH, meaning their computational output grows exponentially under the same power consumption.

● Refined Global Energy Arbitrage Operations: Mining has become a key force in balancing the global energy market. From associated natural gas in the Middle East, wind power in North America, to hydropower in Siberia, previously wasted marginal energy is efficiently capitalized and converted into unique digital assets.

● Steadfast Long-Term Value Conviction: Miners are the most steadfast bulls in the Bitcoin world. They invest hundreds of millions of dollars based on strong expectations for Bitcoin's value in the coming years. The current hash rate level is the most intuitive physical manifestation of this conviction.

However, Bitcoin's most ingenious design—the difficulty adjustment mechanism—immediately responded. At the beginning of October, the network difficulty was raised to over 150 T. What does this number mean? Simply put, the amount of computation required to mine a block has increased by more than 20 billion times compared to Bitcoin's early days. It's like a marathon where all runners keep accelerating, and the organizers must continuously lengthen the track to ensure a winner emerges roughly every 10 minutes.

2. Survival Threshold: Differentiation and Game Among Miners

The surge in difficulty is like a sudden high wall, clearly dividing the miner community. This differentiation revolves around two key cost concepts:

● First is the general upward shift of the "shutdown coin price".

Take a mainstream mining machine from two years ago as an example. Before the difficulty adjustment, it could remain operational when the coin price was $70,000. But after the difficulty surpassed 150T, its output dropped sharply, and to cover unchanged electricity costs, the coin price might need to approach $80,000 to continue running. This new survival line pushes a large number of less efficient, older generation miners to the brink of elimination.

● More strategically significant is the systematic rise in the "average production cost across the network".

Almost all miners who can continue to profit in the current environment are large mining farms with the latest machines. While these top-tier devices are outstanding in performance, their purchase costs and depreciation pressures are also unprecedentedly high. Considering equipment, electricity, operations, and capital costs, industry analysis shows that the average mining cost across the Bitcoin network has risen to the $78,000–$85,000 range.

This high cost line is shaping a new miner landscape:

● Exiters and Migrators: Miners with old machines face an ultimate choice: either exit completely or move their equipment to the last few places on earth with low electricity prices. Their departure is itself an efficiency evolution for the network.

● Dominators and the Pressured: Large publicly listed mining companies, leveraging capital advantages, dominate the new generation of hash rate, but they also bear heavy financial pressure—equipment loans and shareholder return requirements force them to continuously produce and sell part of their Bitcoin.

● Strategic Hoarders: A group of the most visionary miners have adopted a completely different strategy. They believe that the current price does not reflect Bitcoin's long-term value. Therefore, they use the profit margin brought by efficient mining machines to transfer most of their new output into cold wallets for strategic hoarding. For them, the long-term return of hoarding Bitcoin at such a high cost base far outweighs immediate cashing out.

This structural change leads to complexity in miner behavior. On one hand, miner reserves showed an overall growth trend in October, indicating a dominant hoarding mentality; on the other hand, there was also a phase of large-scale selling in mid-October due to profit pressure. This shows that the miner community is not monolithic; their behavior is differentiated and dynamic, but overall, high costs suppress the desire for indiscriminate selling.

3. Value Foundation: Pricing Logic in the High-Cost Era

With both hash rate and difficulty hitting new highs, Bitcoin's pricing logic is undergoing a fundamental shift.

1. The Abyss of Cost Has Become the Foundation of Value

● The $78,000–$85,000 average production cost across the network forms the most solid "safety net" for Bitcoin's price. This price range represents the minimum economic incentive required to maintain current network security. If the market price stays below this range for a long time, a large number of miners will become unprofitable and shut down, leading to a drop in hash rate, a downward adjustment in difficulty, and the network will automatically seek a new, lower-cost equilibrium.

● This process, though painful, ensures the system's long-term resilience. Therefore, this ever-rising production cost provides a dynamic but clear value bottom for Bitcoin's price.

2. Hash Rate Is a "Lagging Confirmation" of Confidence

It should be made clear that hash rate growth is a confirmation of past confidence, not a prediction of future prices. The current 1,161EH/s is the result of miners investing heavily only after seeing positive developments such as Bitcoin ETF approval, accelerated institutional adoption, and macro environment changes become established facts. Therefore, today's new hash rate high is more like a solid footnote to value discoveries that have already occurred.

3. The Game at New Heights

With production costs so high, the market is looking for the next catalyst for value discovery. High costs provide bottom support, but to open up new upside, stronger narratives from the demand side are needed, such as:

● More mainstream financial institutions allocating Bitcoin as a legitimate asset class.

● Breakthrough development in the Bitcoin Layer2 ecosystem, evolving from "digital gold" to a "settlement network".

● Intensified global macroeconomic uncertainty, strengthening its status as a safe-haven asset.

4. Challenges Behind Hash Rate Growth

The rapid growth of hash rate is not without concerns. As the hash rate continues to climb, miners are facing increasing profit pressure.

According to AiCoin data, although Bitcoin's hash rate is breaking records, miners' revenues are actually decreasing—hash price has dropped by 15.61% over the past 30 days.

● A month ago, on September 18, the hash price—the price earned per petahash (PH/s) per second—was $54.71. As of October 18, this price had dropped to $46.17 per petahash.

More hash rate does not always mean more profit.

● At the same time, network mining difficulty has also soared. On October 16, the average block time was slower, hovering around 10 minutes and 21 seconds.

● By October 18, the average block time had shortened to 9 minutes and 29 seconds, reshaping predictions for the next difficulty retarget expected on October 29, 2025.

● At that time, the forecast showed an increase of 3.39%—but as of October 18, the estimate had risen to 5.43%.

5. Potential Impact on Bitcoin Price

What impact does the continued growth of Bitcoin's hash rate have on market price?

● Analysis shows that in the short term, hash rate growth may provide price support, but the medium- and long-term impact is more complex. It is commonly believed that changes in Bitcoin's hash rate affect BTC price. But in reality, this is not the case.

● The real dynamic is that changes in BTC's market value affect the hash rate, not the other way around.

Therefore, except in certain specific cases, it is unrealistic to use hash rate trends to predict price movements. If miners are forced to sell large amounts of BTC at low prices to quickly exchange for fiat to pay electricity bills, it may increase selling pressure.

● However, data shows that since October 12, selling pressure has actually decreased. This means miners have not yet started large-scale selling of their BTC reserves.

● Historically, increases in hash rate often coincide with significant rises in Bitcoin price.

For example, in March 2025, the Bitcoin network's hash rate reached a new all-time high, and Bitcoin's price rose from $65,000 to $72,000 during the same period. This correlation indicates strong bullish sentiment among miners and investors, who see increased network security as a positive signal for Bitcoin's value proposition.

Indicator | Current Value (2025.10) | Historical Comparison | Price Impact |

Hash Rate | 1,161-1,241 EH/s | ATH +20% (vs. 2024) | Positive lead, supports rebound |

Difficulty | 146.72 T | +15% QoQ | Short-term profit compression, volatility ↑ |

Hash Price | $47-49/TH/s | -8% WoW | Neutral, price alert if < $40 |

BTC Price | ~$108,833 | +25% YTD | Bull market continues, but high-level volatility |

Source: AiCoin compilation

6. Conclusion: Between the Shadow and the Light of Hash Rate

Looking ahead, the Bitcoin mining industry may show two major trends: first, the global hash rate competition will remain intense; second, miner efficiency will become the key winning factor.

As the hash rate reaches new highs, the Bitcoin network's resistance to attacks has also significantly increased. This indicates growing confidence in the network's robustness, which may positively impact Bitcoin's market price. Increased hash rate may bring greater stability and resistance to attacks.

At the same time, miners may face industry consolidation. As network conditions tighten, small operations may face greater pressure than industrial-scale miners. If market dynamics do not change quickly, industry consolidation may accelerate, benefiting those enterprises that have already optimized for cost, energy acquisition, and long-term strategy.