VanEck files first Lido staked ether ETF amid SEC's shift on liquid staking

Quick Take The VanEck Lido Staked Ethereum ETF would reflect the performance of stETH, which is staked through the Lido protocol. “The filing signals growing recognition that liquid staking is an essential part of Ethereum’s infrastructure,” said Kean Gilbert, head of institutional relations at Lido Ecosystem Foundation, in a statement.

In a first, investment management firm VanEck filed for an exchange-traded fund that would give investors exposure to staked ether following the regulator's friendlier stance on liquid staking activities.

The ETF, called the VanEck Lido Staked Ethereum ETF, would reflect the performance of stETH, which is staked through the Lido protocol. If approved by the U.S. Securities and Exchange Commission, the ETF would give institutional investors a "compliant, tax-efficient way to gain Ethereum staking exposure," the Lido Ecosystem Foundation said in a statement on Monday.

"The filing signals growing recognition that liquid staking is an essential part of Ethereum’s infrastructure," said Kean Gilbert, head of institutional relations at Lido Ecosystem Foundation. "Lido protocol’s stETH has shown that decentralization and institutional standards can coexist, providing a foundation the broader market can build on."

The SEC is currently sitting on dozens of proposals for ETFs , including ones tracking DOGE and SOL. Many were set to be approved earlier this month, but were put on ice after Congress failed to reach a deal on funding, shutting down the government and leaving agencies like the SEC on pause.

VanEck's proposal comes amid a friendlier regulatory environment, particularly at the SEC. Under Chair Paul Atkins, the agency has debuted "Project Crypto" to update the agency's rules when it comes to crypto distributions, custody, and trading, among other areas. The SEC has also taken a stance on proof-of-stake staking activities and said in May that it does not constitute securities transactions.

Later in August, the SEC said that certain liquid staking activities don't involve securities. In the statement on Monday, Lido said that guidance gave a "clearer foundation for regulated products referencing liquid staking tokens like stETH by confirming that staking receipt tokens, though evidencing ownership of deposited assets, are not securities because the underlying assets themselves are not securities."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Trends Capture Attention as Market Struggles

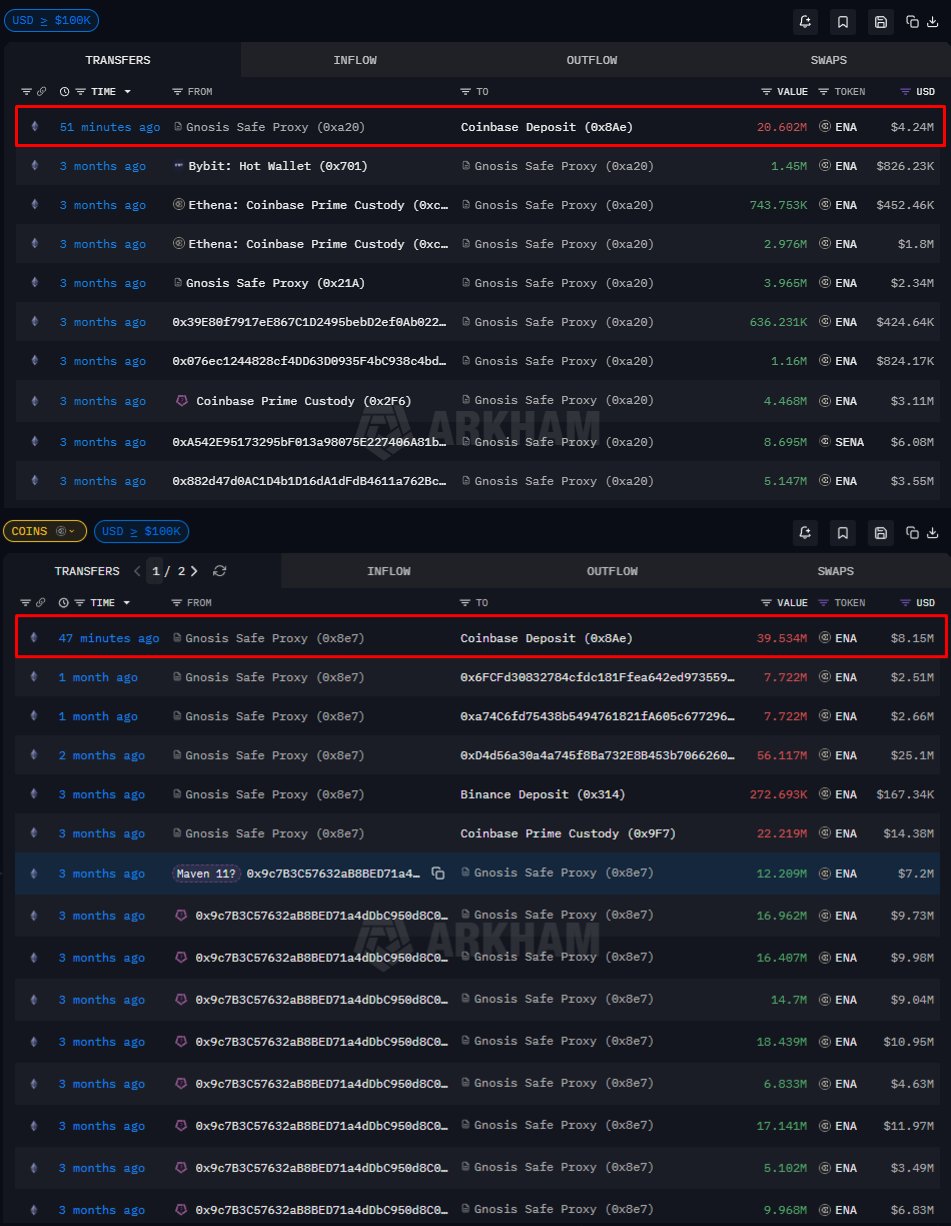

Can Ethena hold $0.20 after 101M ENA flood exchanges?

Galaxy Digital, Which Manages Billions of Dollars, Reveals Its Bitcoin, Ethereum, and Solana Predictions for 2026

A Brief History of Blockchain Wallets and the 2025 Market Landscape