Spot Bitcoin ETFs See $1,23 Billion in Outflows

- Spot Bitcoin ETFs record weekly outflows

- Bitcoin volatility puts pressure on flows and liquidity

- Ethereum ETFs also end the week in the red

US spot Bitcoin ETFs ended the week with net outflows of approximately $1,23 billion, marking the second-largest weekly withdrawal since the products launched in 2024. On Friday alone, outflows totaled approximately $366,6 million, reversing the direction of the net inflow of approximately $2,7 billion seen the previous week.

The movement took place in the midst of strong bitcoin volatility , which fell from around $121 on October 10 to a low of around $103,7 on October 17. Since then, the leading cryptocurrency has recovered some of its losses and returned to trading above $111 early Monday morning, up around 4% in the last 24 hours. Ether has also advanced recently, gaining close to 5% and trading at around $4.082.

In historical comparison, the negative week is surpassed only by the peak outflows of approximately US$2,6 billion recorded in the week ending February 28. Analysts point out that the combination of risk adjustments, profit-taking, and macroeconomic uncertainty contributed to the reshaping of flows into spot Bitcoin ETFs, which had been supporting significant purchases in previous weeks.

Spot Ethereum ETFs also saw a decline in flows, with a weekly net outflow of nearly $311,8 million, reversing the inflow of approximately $488,3 million seen the previous week. This data reinforces that the pressure wasn't limited to Bitcoin, but also affected ETH-backed products.

On the macro front, traders have begun to price in the possibility of an interest rate cut later this month, in addition to an early end to quantitative easing, which impacts the yield curve and the liquidity available for risk assets.

“Chairman Jerome Powell acknowledged that while growth remains firmer than expected, labor market weakness persists,”

said Rachael Lucas, cryptocurrency analyst at Mercados.

“This shift has eased bond yields and improved the liquidity environment for risk assets, including digital assets.”

For investors and asset managers, the short term remains dependent on the balance between volatility, the flow of spot Bitcoin ETFs, and expectations for monetary policy, while recent technical levels remain on the radar.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tether financial analysis: Needs an additional $4.5 billion in reserves to maintain stability

If a stricter and fully punitive approach is applied to $BTC, the capital shortfall could range from 1.25 billion to 2.5 billion USD.

The fundraising flywheel has stalled, and crypto treasury companies are losing their ability to buy the dip.

Although the treasury companies appear to have ample resources, the disappearance of stock price premiums has cut off their financing channels, causing them to lose their ability to buy the dip.

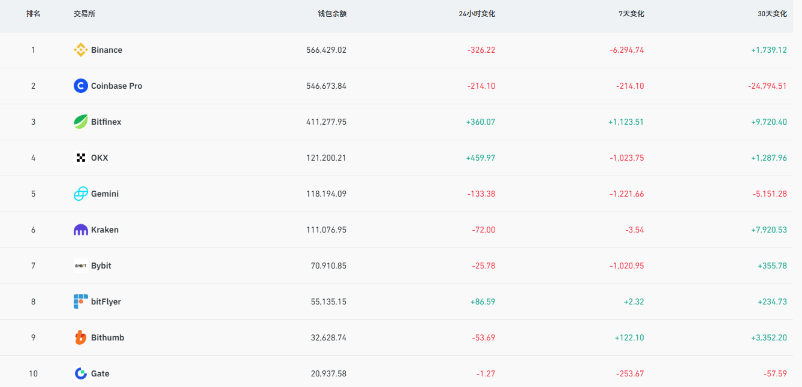

Nearly 10,000 bitcoins withdrawn from exchanges, is the market about to change direction?