Bulls anticipate a reversal, bears await a crash—who will be proven right?

In the past few weeks, the sentiment in the crypto market has been more divided than ever before.

On one side are the staunch bulls, convinced that last week’s plunge was the final shakeout;

On the other side are the stubborn bears, certain that a deeper correction is still on the way.

So—who is right?

We must return to the macro level to find the answer.

❶ Macro Uncertainty: Rates Are Falling, But the Market Isn’t Rising

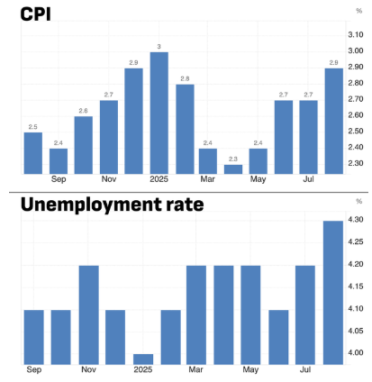

The Federal Reserve has cut interest rates three times this year, lowering the benchmark rate to 4.00–4.25%.

Logically, this should be a bullish signal for risk assets—

But the market has not cheered as expected.

The reasons are:

Inflation has rebounded to 2.9%

Unemployment rate has risen to 4.3% (a three-year high)

The U.S. government has experienced a partial shutdown, delaying economic data releases

The Federal Reserve is “flying blind,” and both institutions and retail investors lack direction

When uncertainty rises, volatility returns.

This is the fundamental backdrop for October’s plunge.

❷ Charts Don’t Lie: The Crash Was Triggered by “External Shocks”

In just a few days:

BTC fell from $126,000 to $104,000

ETH dropped from $4,950 to $3,430

Most major altcoins were cut in half

The trigger came from Trump announcing a 100% tariff on China.

Global markets panicked instantly, and in 24 hours, crypto contract liquidations exceeded $19 billions.

This was a typical macro event-driven deleveraging—

Fear first destroys the most liquid assets: cryptocurrencies.

❸ But Institutions Didn’t Panic—They Increased Their Positions

While retail investors were panic selling,

Crypto ETFs recorded nearly $6 billions in net inflows in the same week:

Bitcoin ETFs saw $3.5 billions in inflows

Ethereum ETFs saw $1.5 billions in inflows

In other words:

Retail investors sold in panic, while institutions bought in calm.

The bull market hasn’t ended; it’s just moved from exchange accounts to cold wallets.

❹ Subtle Policy Shifts: The Government Begins Absorbing Crypto

Even more surprisingly, the U.S. Treasury is adjusting its strategy:

Seized bitcoin reserves are no longer being sold

Stablecoin legislation is bringing a clearer regulatory framework

Some policies even allow banks to participate in ETH staking

This signals one thing:

Crypto assets are gradually being absorbed by the system, not rejected.

Bitcoin is becoming part of the financial system, not an external threat.

❺ Ethereum’s “Silent Rebound”

ETH held key support levels during the crash,

On-chain data shows:

Active addresses have reached a multi-year high

ETH demand has hit a historical peak

U.S. financial institutions have begun allowing ETH staking services

Even without major bullish news,

ETH is steadily rebuilding its structure.

This kind of “silent strength” is often the prelude to a major move.

❻ The Current Core Contradiction: Macro Risks vs. Liquidity Game

The market is currently in a tug-of-war between “macro and liquidity”:

If the global economy continues to deteriorate, the market will pause its rise;

If the pace of rate cuts accelerates, the market will explode again.

This is why the market now looks “like both a bull and a bear market.”

Because we are in a period of structural transition.

❼ Has the Bull Market Really Ended?

The answer is: No.

It’s just that this bull market is completely different from the frenzy of 2021.

Deeper corrections, but faster recoveries

Retail investors are leaving, but institutions are taking the lead

The market is calmer, but the structure is healthier

This is not the end of the bull market,

but a new type of bull market driven by liquidity, institutions, and long-term capital.

Conclusion:

The current crypto market is not “collapsing,” but “rebuilding.”

When short-term leverage is flushed out, sentiment returns to rationality, and institutions reposition—

This is the stage where the next trend is gathering strength.

What investors need to do is not to guess the top or bottom,

but to observe the structure:

When fear stabilizes, capital returns, and volatility converges—

The true second phase of the bull market will quietly begin.

This time, the winner is not the fastest, but the most stable.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Passkey Wallet: The “Tesla Moment” for Crypto Wallets

The real transformation lies not in better protecting keys, but in making them impossible to steal. Welcome to the era of Passkey wallets.

The market is not driven by individuals, but dominated by emotions: how trading psychology determines price trends

Crypto Coins Surge: Major Unlocks Impact Short-Term Market Dynamics

In Brief Crypto market anticipates large-scale unlocks, exceeding $309 million in total market value. Significant cliff-type unlocks involve ZK and ZRO, impacting market dynamics. RAIN, SOL, TRUMP, and WLD highlight notable linear unlocks within the same period.

Bitcoin Stable But Fragile Ahead Of BoJ Decision