House of Doge Acquires Italian Soccer Team

House of Doge, the corporate arm of the Dogecoin Foundation, has acquired a majority stake in Italy’s soccer team US Triestina Calcio 1918, marking a milestone in the convergence of digital assets and traditional industries. The move comes as cryptocurrency firms seek tangible footholds in regulated sectors. By acquiring a century-old European football club, House

House of Doge, the corporate arm of the Dogecoin Foundation, has acquired a majority stake in Italy’s soccer team US Triestina Calcio 1918, marking a milestone in the convergence of digital assets and traditional industries.

The move comes as cryptocurrency firms seek tangible footholds in regulated sectors. By acquiring a century-old European football club, House of Doge is translating token-based enthusiasm into real-world ownership and signaling a shift in how crypto brands pursue legitimacy and growth.

Crypto and Football: A Growing Alliance

House of Doge becomes Triestina’s largest shareholder, bringing capital and blockchain plans. The club, based in Italy’s Serie C, will test cryptocurrency-based ticketing and merchandise payments.

The acquisition was executed in collaboration with Brag House Holdings, House of Doge’s publicly traded merger partner. Brag House provided the listed structure that enabled the purchase and continues to oversee governance and market access. Together, the firms are integrating Brag House’s gaming and fan ecosystem with House of Doge’s blockchain network, creating a single framework that connects digital communities with traditional sports audiences.

“Our investment is about proving that digital assets can drive real-world value, culture, and passion. Football provides the ideal stage to demonstrate how decentralized communities can create sustainable impact,” said Marco Margiotta, CEO of House of Doge.

It’s official! House of Doge is now the majority owner of U.S. Triestina 1918, one of Italy’s oldest professional football clubs!Dogecoin was founded on Community—and the world’s game is one of the biggest communities there is. We will support Triestina with immediate capital…

— House of Doge (@houseofdoge) October 20, 2025

Analysts note that crypto firms are converting on-chain communities into off-chain assets that generate revenue. By entering sports, gaming, and entertainment, companies like House of Doge aim to balance volatility with stable operations.

Expanding the Industry’s Legitimacy

The link between cryptocurrency and football is growing quickly. Clubs now use blockchain for sponsorships, fan-voting, and tokenized loyalty systems. For crypto firms, partnerships with trusted teams bring access to millions of fans and help reinforce credibility.

In 2025, Tether increased its stake to 10.7% in Juventus F.C., becoming the second-largest shareholder. The firm aims to expand fan-token integration and stablecoin payments in Serie A. Bitpanda also teamed with Arsenal F.C. and Paris Saint-Germain F.C. to enhance blockchain-based fan rewards. Socios continues its partnerships with FC Barcelona and Inter Milan to build global fan engagement.

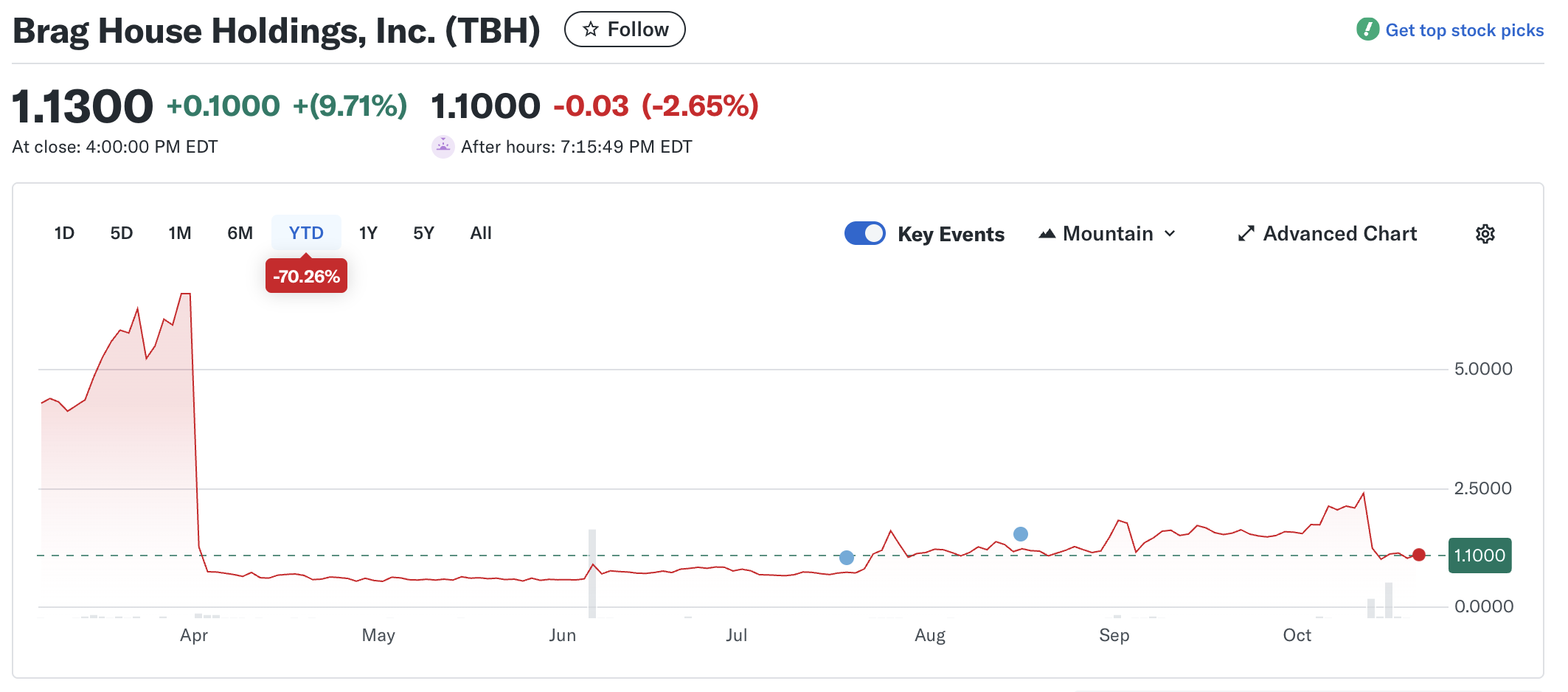

The House of Doge deal aligns with its plan to go public via a reverse merger with Brag House Holdings (TBH). TBH also began trading in March at about $4.30 per share but has since fallen to $1.13, a drop of nearly 74%. This reflects the broader volatility among small-cap digital asset firms.

TBH Performance Since Launch /

Source:Yahoo

TBH Performance Since Launch /

Source:Yahoo

Dogecoin (DOGE) trades near $0.20—up 1.9% from yesterday but down 25% over the month. Its one-year high was $0.466, recorded on December 8 last year. At that time, optimism about a potential $1 breakout was strong, but the current price represents a decline of roughly 57% from that peak.

DOGE performance over the past year / Source: BeInCrypto

DOGE performance over the past year / Source: BeInCrypto

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The ZK Transformation: Evaluating How Zero-Knowledge Technology Influences the Future Development of Blockchain

- ZK-rollups scale blockchain networks by bundling transactions, achieving 43,000 TPS and 30% lower gas fees, attracting institutions like Goldman Sachs and JPMorgan . - ZK technology resolves privacy-scalability paradox by enabling verifiable transactions without data exposure, adopted by EU regulators and enterprises like Nike and Sony . - Challenges persist: ZK-SNARKs require heavy computation, trusted setup risks exist, and privacy conflicts with AML regulations in some jurisdictions. - $725M+ VC inves

The Influence of Vitalik Buterin's Support for ZKsync on the Advancement of Scalable Blockchain Technologies: Evaluating the Prospects for Long-Term Investment in Pr

- Vitalik Buterin's 2025 endorsement of ZKsync accelerated its rise as a scalable Ethereum Layer-2 solution with 30,000 TPS and $3.3B TVL. - ZKsync's EVM compatibility and institutional partnerships contrast with StarkNet's quantum-resistant STARK proofs and Aztec's privacy-first architecture. - Analysts project ZK token prices at $0.40–$0.60 by 2025, while StarkNet faces adoption barriers and Aztec navigates regulatory challenges in privacy-focused DeFi. - The $7.59B ZKP market (2033 forecast) hinges on b

ZK Atlas Enhancement: Transforming Blockchain Scalability and Paving the Way for Institutional Integration

- ZKsync’s 2025 Atlas Upgrade achieves 15,000–43,000 TPS with $0.0001/transaction costs, boosting blockchain scalability for institutions. - Deutsche Bank , Sony , and Citi adopt ZKsync for tokenized assets and privacy-driven transactions, citing compliance and efficiency gains. - Market forecasts predict 60.7% CAGR for ZK Layer-2 solutions through 2031, with Fusaka upgrade targeting 30,000 TPS to solidify ZKsync’s leadership.

Hinge’s latest AI tool assists singles in skipping dull introductory conversations