US Crypto Investor Loses $3,000,000 in XRP in Devastating Hack

An American crypto investor says he just lost his retirement savings after hackers stole $3 million in XRP.

Brandon LaRoque, a 54-year-old from North Carolina, says he had accumulated 1.2 million XRP since 2017 as a retirement fund with his wife.

But according to blockchain researchers including ZachXBT, attackers drained the crypto on October 12th after initiating two 10-XRP test transfers, sweeping the rest to a new address.

LaRoque says the loss has turned he and his wife’s financial future upside down.

“That was our whole retirement for my wife and I. And I don’t know what we’re going to do. I guess we’re going to go back to work.

Fortunately, I did diversify into some metals, which thank God I did. Nowhere near anything like what I had in crypto. Crypto was supposed to be the touchdown.”

Ellipal says the loss is not due to a hardware flaw, but happened after LaRoque imported his hardware wallet’s seed phrase online, creating a hot wallet vulnerable to online risks like malware and remote attack.

“Our hearts go out to Brandon during this difficult time. No one should ever have to experience such a loss.

After discussing the situation with Brandon and reviewing the available details, we understand that this was not a cold wallet hack, but a hot wallet theft — meaning the wallet involved was connected to the internet.”

The funds went through over 120 Ripple-to-Tron swaps via Bridgers, consolidating on Tron before dispersal on Huione, a Cambodian entity sanctioned by US authorities.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

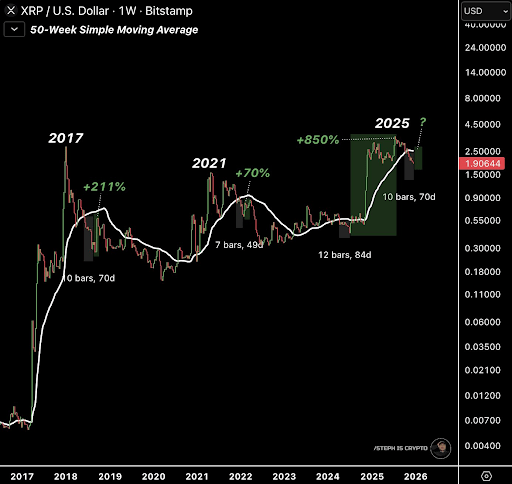

XRP Enters Historical Window That Has Previously Led To Triple-Digit Rallies

Which Cryptocurrency Has the Most Active Wallets? The List is Out, and Bitcoin Isn’t Number One

Leading Solana treasury Forward Industries tokenized FWDI stock via Superstate

Forward Industries brings FWDI shares to Solana: a revolution for decentralized finance