SHIB Rebounds, Stellar Gains Fintech Momentum, and BlockDAG Leads Q4 With Verified Audits and $430M+ Presale Surge

The crypto market is evolving rapidly as major players prepare for the next growth cycle. Shiba Inu (SHIB) is beginning to rebound with renewed community strength, while Stellar (XLM) continues to impress with fintech integrations and renewed institutional attention. Yet amid this recovery phase, BlockDAG (BDAG) stands apart as a future-ready contender. Recently verified by CertiK and Halborn, the project is positioning itself as a strong participant in the upcoming crypto wave, backed by $430 million raised, over 27 billion coins sold, and an expanding global holder base.

Points Cover In This Article:

ToggleAs SHIB rebuilds retail momentum and XLM captures cross-border traction, BlockDAG’s combination of transparency, verified audits, and functional tech represents the model for sustainable growth in the next bull cycle.

Shiba Inu Sparks Rebound: Is the Momentum Real?

Shiba Inu (SHIB) has started to recover following weeks of uncertainty, with on-chain data showing promising signals. Over 38.5 billion SHIB coins have exited exchanges, suggesting traders are holding long-term rather than selling off. Daily transactions and active wallet activity have both risen, marking the start of a renewed accumulation trend across the SHIB community.

However, the road ahead remains mixed. SHIB must break key resistance at $0.0000124–$0.0000128 to sustain any significant upside, and momentum indicators show consolidation rather than breakout energy. Still, as overall sentiment improves across meme-based assets, Shiba Inu’s recovery is sparking cautious optimism.

If positive on-chain patterns continue, SHIB could see incremental gains and reestablish a stable base for growth. For traders exploring what crypto will explode in 2025, SHIB’s strong community and deflationary mechanisms may help it stay relevant, though its reliance on sentiment keeps it volatile.

Stellar’s 7.2% Climb Reinforces Its Fintech Edge

Stellar (XLM) has surged 7.19%, gaining renewed attention from fintech traders after securing new partnerships focused on cross-border payment infrastructure. Currently trading around $0.3489, Stellar remains above its long-term support zones, and momentum is building as trading volume increases.

Still, XLM must push past the $0.365–$0.375 resistance range to confirm a sustainable rally. Analysts believe the project’s strong position in global finance, coupled with its institutional partnerships, could spark a more defined uptrend over the next quarter.

Stellar’s mission to bridge digital assets and traditional finance keeps it in the conversation for 2025 relevance. However, while it benefits from adoption, it must accelerate integration speed to maintain its lead among payment-focused cryptocurrencies.

BlockDAG Certified by CertiK & Halborn: The Data-Backed Contender for 2025

Among all current contenders, BlockDAG (BDAG) has captured global attention as the most verifiable growth story in crypto today. The project has officially cleared CertiK and Halborn audits, confirming the integrity and security of its smart contracts, treasury management, and ecosystem architecture.

BlockDAG’s hybrid DAG + Proof-of-Work architecture solves the long-standing blockchain trilemma of scalability, security, and decentralization. It already runs on its Awakening Testnet, enabling high throughput and developer-ready smart contract functionality. These tangible results make it one of the only verified infrastructures preparing to go live, not just on paper but in practice.

As the project nears Genesis Day (November 26), the combination of global audits, hardware miner shipments, and transparency-driven marketing confirms its credibility. For many traders, BDAG is positioned as one of the most trustworthy examples of what crypto will explode in 2025.

The Forward View: Real Projects, Real Progress

The latest market updates reveal a shift in sentiment. Shiba Inu (SHIB) reflects a revival in community engagement. Stellar (XLM) represents established growth through fintech partnerships. But BlockDAG (BDAG) stands for measurable progress, security validated, utility confirmed, and a community already built before launch.

With its hybrid architecture, verified audits, and impressive achievements, BlockDAG is answering the industry’s most pressing question: what crypto will explode in 2025? The data points toward BDAG as the frontrunner, not just for hype, but for execution and reliability.

Its model combines proof of delivery with technical scalability, offering traders a rare opportunity to enter before a potential global breakout. BlockDAG’s blend of trust, transparency, and high-performance design may redefine what legitimacy looks like in crypto’s next growth cycle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Market Cap Surge Threatens Ethereum’s ‘Main Altcoin’ Status in 2026

XRP Price Prediction: Short-Term Momentum Improves While Downtrend Remains Intact

Best Meme Coins to Buy – AIC, DOGE, PEPENODE, SHIB, PEPE

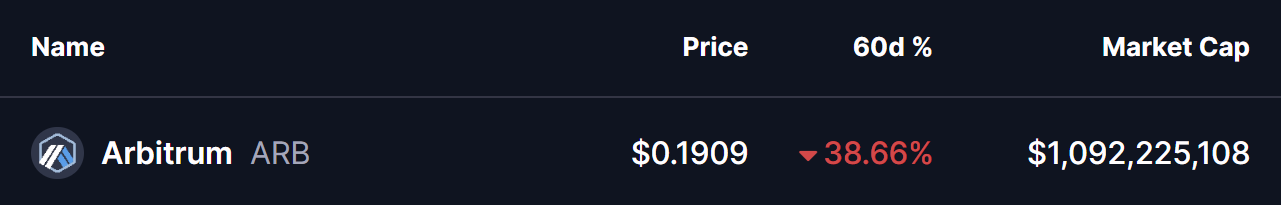

Arbitrum (ARB) Flashes Potential Reversal Setup – Will It Rise Higher?