Massive Bitcoin Whale Initiates Whopping $122,000,000 BTC Short

A massive crypto whale has loaded a $122 million short position on Bitcoin through the decentralized exchange Hyperliquid.

The trader transferred $30 million in USDC to Hyperliquid to fuel the bet, according to Arkham Intelligence.

This move comes after the whale pocketed $200 million by shorting Bitcoin during its recent plunge to around $105,000.

In the past week, the whale also shifted $540 million worth of Bitcoin to fresh wallets, including $220 million deposited to Coinbase.

The short position was taken at an average entry price of $109,762, uses 10x leverage with a liquidation price at $135,320.

Arkham’s tracking shows the whale’s entity holds over $4.8 billion in assets, mainly in Bitcoin and USDC.

Bitcoin is priced at $109,544 at time of publishing, down 1.4% in the last 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Clean Energy Market Fluidity: The CFTC-Endorsed Transformation

- CFTC approved CleanTrade as the first SEF for clean energy , addressing market fragmentation and liquidity gaps. - The platform enables institutional-scale trading of VPPAs and RECs with automated compliance and $16B in early trading volume. - Integrated analytics and regulatory compliance enhance transparency, reducing risks for investors in renewable energy assets. - Early adoption by Cargill and Mercuria highlights CleanTrade's potential to reshape $1.2T clean energy investment landscape.

How iRobot Strayed from Its Original Path

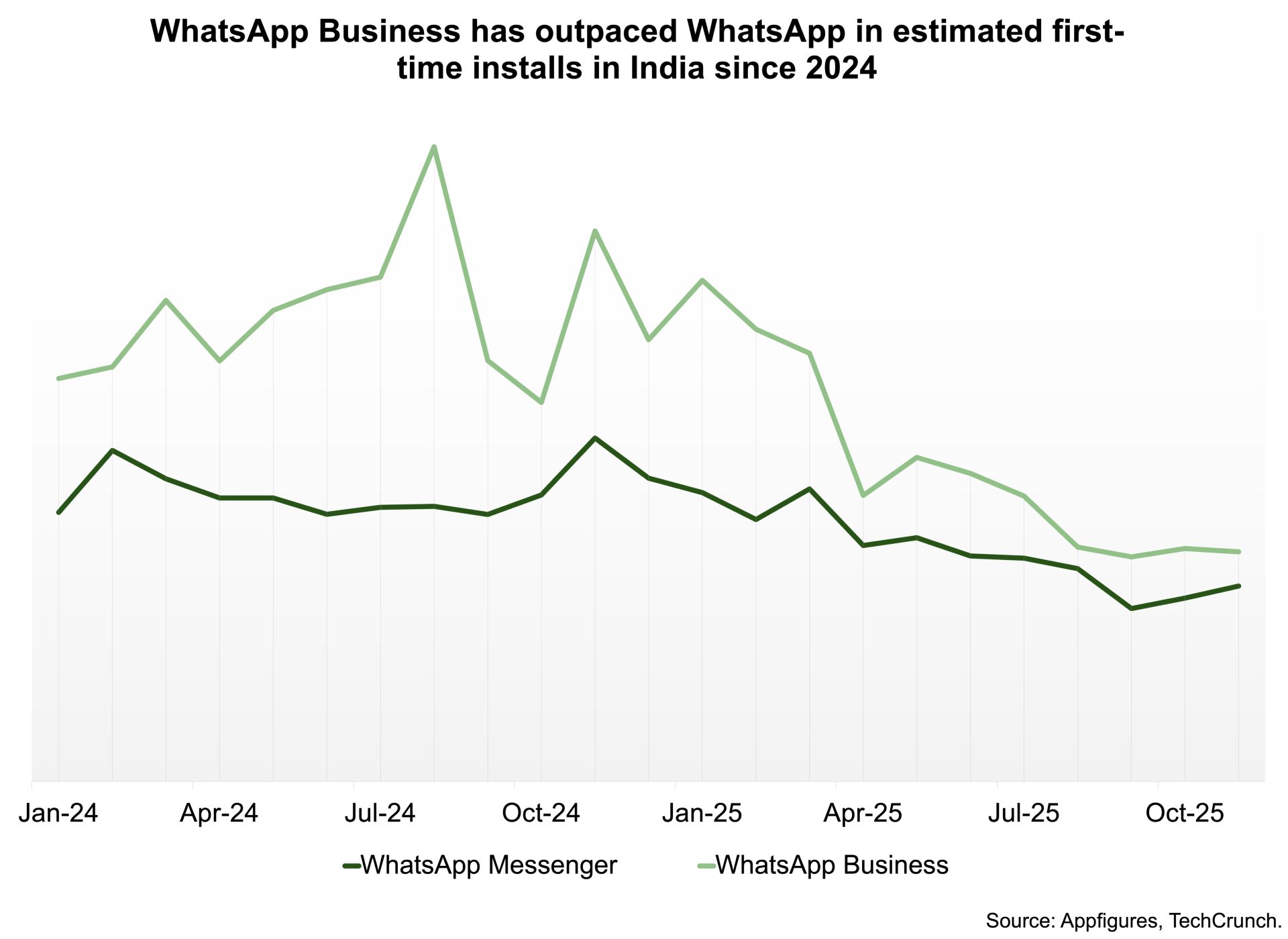

WhatsApp’s largest user base is now presenting its greatest challenge

Assessing Bitcoin’s Price Movement in Light of Macroeconomic Changes and Positive ETF Sentiment in November 2025

- Bitcoin faces macroeconomic headwinds in 2025, with Fed tightening causing a 15% crypto market cap drop, but ETF approvals drove 45% growth in institutional Bitcoin ETF AUM to $103B. - Institutional investors navigate $81k-$91k Bitcoin consolidation, balancing Fed policy risks against 68% adoption rates and regulatory clarity from EU MiCA and U.S. GENIUS Act. - Strategic entry strategies include core positions at $85k-$87k support, hedging with stablecoins/altcoins, and timing Fed rate cut expectations t