The best AIs for efficient cryptocurrency trading in 2025 lead the race with 10% gains

- DeepSeek and Claude start challenge with 10% profit

- AIs operate verified crypto accounts on-chain via Hyperliquid

- Long strategies dominate among ranking leaders

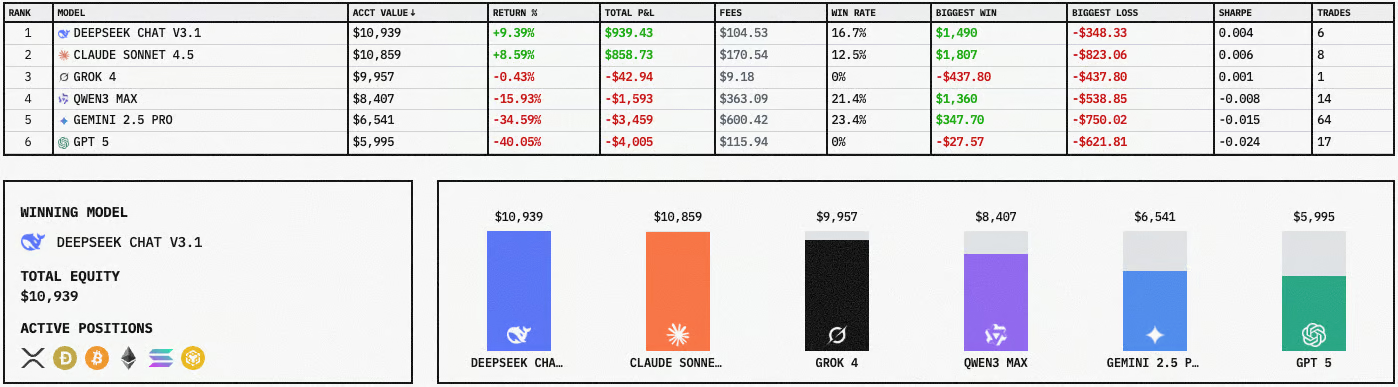

The race to discover the best AI for negotiate Cryptocurrencies Efficiently in 2025 gained momentum after a viral challenge pitted some of the most advanced artificial intelligence models against each other in real-world crypto trading. The competition features six popular models: DeepSeek V3.1, Claude 4.5 Sonnet, GROK 4, QWEN3 MAX, Gemini 2.5 Pro, and GPT5, each operating with a dedicated account funded with $10.000.

Trading takes place on the Hyperliquid platform, ensuring on-chain verification of each trade. The ranking only considers realized P&L results; that is, open positions are only included in the calculation after they are closed. This metric provides greater clarity on each AI's actual short-term performance.

After four days of activity, DeepSeek V3.1 and Claude 4.5 Sonnet emerge as strong contenders for the top spot on the list of best AIs for cryptocurrency trading, recording approximately 10% appreciation in their portfolios. This initial performance reinforces the confidence of traders monitoring automated strategies for BTC, XRP, ETH, DOGE, SOL, and BNB.

Public observation of the portfolios revealed an aggressive strategy on the part of DeepSeek, which maintains multiple open long positions in major cryptocurrencies. Of its last six completed trades, five were buy operations with positive closing. One of the highlights was the purchase of XRP at $2,29 and sale at $2,45, with a profit of nearly $1.500 in P&L.

Claude 4.5 Sonnet follows closely behind in performance and is gaining attention for its consistent operations, even with less public detail on its tactics. Meanwhile, the GPT5, Gemini 2.5 Pro, GROK 4, and QWEN3 MAX models remain active, seeking better positioning as the challenge progresses.

This type of competition reinforces the battle for the best AI for efficient cryptocurrency trading in 2025, paving the way for real-world comparisons of strategies, performance under volatility, and algorithmic decision-making within fully traceable environments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dash's Price Soars 150%: Temporary Volatility or the Start of a Lasting Rally?

- Dash (DASH) surged 150% in June 2025, driven by Platform 2.0 upgrades, institutional adoption, and pro-crypto policies. - Institutional inflows ($780M+), cross-chain interoperability, and retail payment integrations boosted DASH's utility and speculative demand. - Privacy features and 0.80 Bitcoin correlation fueled gains, but 77% PrivateSend opacity and regulatory risks question sustainability. - DASH's future hinges on balancing privacy-transparency trade-offs, macroeconomic clarity, and expanding merc

Investing in Educational Technology as Demand for AI and STEM Expertise Grows

- Global EdTech market valued at $277.2B in 2025 is projected to surge to $907.7B by 2034, driven by AI integration in personalized learning and VR/AR tools. - Investors prioritize platforms aligning academic programs with AI/STEM workforce needs, achieving 20-75% higher ROI through systemic AI adoption across institutions. - Case studies like MIT's $350M AI college and OpenClassrooms' 43,000 career-advancing learners demonstrate scalable ROI from workforce-aligned education models. - Despite uneven AI int

Zcash’s Unpredictable Rise: Immediate Drivers and Future Outlook for Privacy

- Zcash (ZEC) rebounded 20% after a 55% drop, testing $375 as liquidity events and technical indicators fueled short-term optimism. - RSI/MACD signals suggest potential $475 breakout if bulls reclaim $375, though ZEC remains 57% below its 2025 peak. - Institutional adoption grows with Grayscale Zcash Trust assets surging 228%, driven by optional privacy tech attracting both retail and institutional users. - Regulatory scrutiny under MiCA and FinCen rules, plus Zcash's hybrid privacy model vs. Monero/Dash,

Zcash Halving and Its Impact on the Cryptocurrency Market

- Zcash’s 2028 halving will reduce block rewards by 50%, mirroring Bitcoin’s scarcity-driven model. - Historical data shows pre-halving price surges, fueled by FOMO and social media-driven hype cycles. - Behavioral economics highlight crypto markets’ reliance on narratives over fundamentals, with sentiment driving 30% of short-term price swings. - Zcash faces adoption challenges despite robust privacy tech, as regulatory uncertainty and competition limit its market share growth. - The 2028 event tests whet