Bloomberg Analyst Eric Balchunas Shares a Key List of Altcoin ETFs! Here Are the Details…

The government has been shut down in the US since the beginning of October, so official institutions are operating on a limited basis.

The government shutdown has affected all sectors, and cryptocurrency is one of them. The wave of ETF approvals for altcoins like XRP and Solana (SOL) expected in October has also been delayed.

At this point, it seems that the number of altcoin ETFs, whose final approval decisions have not been announced by the SEC due to the government shutdown in the US, will increase in the coming period.

Bloomberg senior ETF analyst Eric Balchunas predicted in his post that more than 200 crypto ETPs could be launched within a year.

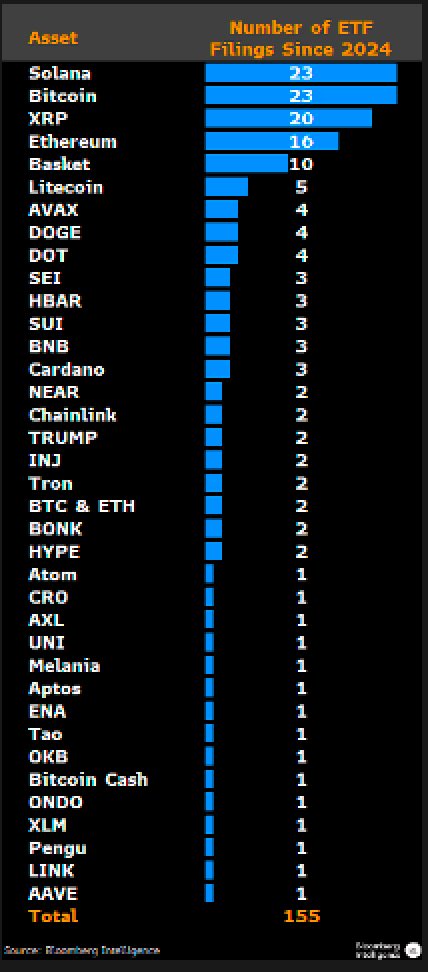

According to Eric Balchunas, there are currently 155 ETFs on the market that track 35 different cryptocurrencies.

Balchunas predicted that more than 200 ETFs are likely to launch in the next 12 months.

The cryptocurrencies with the most ETFs are Solana (SOL) and Bitcoin (BTC), followed by XRP and Ethereum (ETH).

Popular altcoins such as Litecoin (LTC), Avalanche (AVAX), and Dogecoin (DOGE) also top the list.

Analysts expect more institutional investors to enter the market with the SEC's approval of crypto ETFs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

LUNA Drops 9.92% in 24 Hours Following Recent Intense Volatility

- LUNA token fell 9.92% in 24 hours on Dec 12 2025 but gained 59.74% weekly, contrasting with a 61.25% annual decline. - Amazon Luna cloud gaming expanded to Xfinity devices via voice-activated access, offering Prime members free play on 50+ titles. - Comcast reports 30% annual growth in gaming traffic, with cloud gaming now accounting for 70% of network usage. - Analysts note no direct link between Amazon-Comcast's cloud gaming expansion and LUNA token's price movements. - Market volatility persists for L

Investing in eco-friendly urban infrastructure as an approach to reduce climate impacts

- Global climate goals demand urgent urban action to limit warming to 1.5°C by 2050, with cities responsible for 70% of emissions. - Decentralized energy systems, solar transit, and behavioral interventions reduce emissions while delivering 18–30% ROI through regenerative models. - Cities like Copenhagen and New York demonstrate feasibility, with decentralized systems cutting emissions by 80% and energy costs by 20%. - IPCC mandates emissions peak by 2025, making urban sustainability investments critical f

The Comeback of Momentum (MMT): A Tactical Move for 2026?

- Momentum investing's 2026 resurgence hinges on macroeconomic clarity, tech innovation, and institutional adoption of systematic strategies. - 2025 performance showed 113-basis-point U.S. outperformance led by Tesla/NVIDIA, bolstered by Fed rate cuts and AI optimism. - Institutional crypto adoption accelerated via $50B+ ETFs and tokenization, with 2-5% 2026 digital asset allocations projected. - 2026 catalysts include regulatory reforms, 74% market correction expectations, and agentic AI/quantum computing

LUNA Drops 11.32% as Amazon Luna Rolls Out to Xfinity Devices

- LUNA dropped 11.32% on Dec 12 2025 amid broader market sentiment, despite prior gains, with no direct project-specific triggers. - Amazon expanded Luna cloud gaming to Xfinity devices, enhancing accessibility via voice commands and Prime subscriptions. - Analysts note no direct link between Luna's expansion and LUNA token performance, emphasizing macroeconomic and cross-sector influences.