Major stock exchanges across Asia and Australia are increasingly rejecting companies seeking to list as Digital Asset Treasuries (DATs), a model in which firms hold significant amounts of cryptocurrency as their primary asset.

Hong Kong Exchanges & Clearing (HKEX), the National Stock Exchange of India (NSE), and the Australian Securities Exchange (ASX) are at the forefront of this pushback, according to the latest Bloomberg report.

Sponsored

Regulators cite concerns over “cash companies”, firms that hold primarily liquid assets and could be seen as shell companies lacking legitimate business operations. Such practices, they argue, violate listing rules designed to ensure financial stability and transparency.

Exchanges Apply Restrictions

Hong Kong Exchanges & Clearing has turned down at least five DAT listing applications, while India’s Bombay Stock Exchange recently rejected a company planning to use listing proceeds to invest in cryptocurrency.

Australia’s ASX enforces a rule prohibiting companies from holding more than half of their balance sheets in cash-like assets, effectively making the DAT model unfeasible in the country.

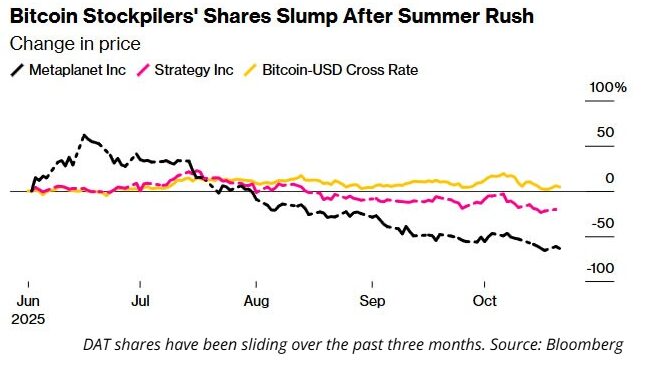

Analysts note that major Bitcoin DATs, including MicroStrategy and Metaplanet, have seen share prices fall in line with broader crypto market corrections.

Source: Bloomberg

Source: Bloomberg

In contrast, Japan remains receptive to DATs, provided companies disclose their holdings fully.

Japan hosts the largest number of DATs in Asia, including Metaplanet, one of the world’s largest Bitcoin DATs.

However, global index provider MSCI is proposing to exclude large DATs with over 50% crypto holdings from its indexes, potentially limiting passive investment inflows.

Why This Matters

Once a growth driver in the crypto sector, the DAT model now faces mounting regulatory scrutiny and market challenges. Many DATs are trading at or below their net asset values.

Discover DailyCoin’s hottest cryptocurrency news:

China Stops Tech Giants’ Stablecoin Launch in Hong Kong

Ripple Unleashes $1B XRP Treasury Amid Price Turmoil

People Also Ask:

A DAT, or Digital Asset Treasury, is a company that holds significant amounts of cryptocurrency as a core part of its balance sheet, often treating digital assets like cash reserves.

DATs maintain large crypto holdings and may rely on price appreciation of digital assets as part of their financial strategy, rather than traditional operational revenue.

Exchanges worry that DATs resemble “cash companies” or shell companies, holding mostly liquid assets with limited business operations, which may violate listing rules and pose risks to investors.

Hong Kong Exchanges & Clearing (HKEX), the National Stock Exchange of India (NSE), and the Australian Securities Exchange (ASX) are actively pushing back against DAT listings.

Global index providers, like MSCI, may exclude large DATs with over 50% crypto holdings from indexes, potentially limiting passive investment flows and market exposure.