Key Market Intelligence on October 22nd, how much did you miss?

1. On-chain Volume: $40.5M USD flowed into Arbitrum today; $69.0M USD flowed out of Ethereum 2. Biggest Gainers and Losers: $EVAA, $ATONE 3. Top News: Binance Alpha Point Rules Update: Balance points must be kept non-zero

Featured News

1.Meme Coin 'Sorarara' Surges to a Market Cap of Over $20 Million, Hitting an All-Time High

2.Spot Gold Plunges 6%, Marking Its Largest Drop in Over 12 Years as Analysts Warn of Bubble Risk

3.Public Blockchain Kadena Announces Shutdown, KDA Plunges Over 60% in 24 Hours

4.US Department Store Chain Bealls Announces Acceptance of Cryptocurrency Payments

5.Over $528 Million Liquidated in the Past 24 Hours as Longs and Shorts Both Get Rekt

Articles & Threads

2.《Behind the Popularity of 'Sorarara', Meme Creator Earns from Protocol for the First Time》

A few days ago, the social protocol platform Trends launched the "Chinese Name Collection for Solana" activity, and set up a 100 SOL prize pool for the event. Users were required to quote retweet the official tweet and suggest a Chinese name for Solana to participate. After the activity started, the Solana official account, Solana founder Toly, and Solana Foundation Chair Lily Liu all retweeted Trends' activity tweet and actively engaged with the community during the event. A large number of players enthusiastically participated, including users from the English-speaking community.

Market Data

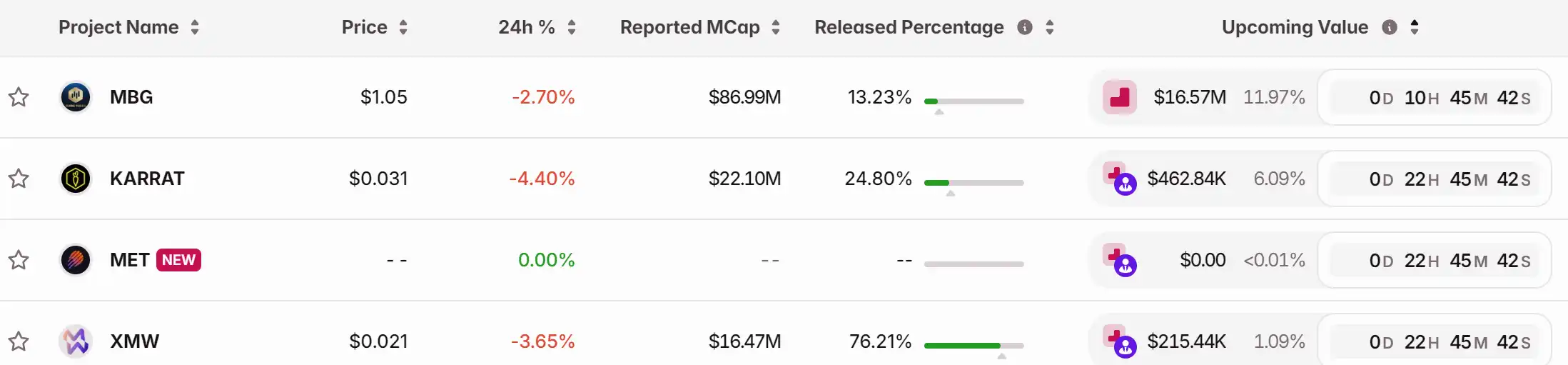

Daily market overall funding heat (reflected by funding rate) and token unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Workday HR System Enhancements and Their Effects on Public Sector Payroll and Compliance: Improving Operational Performance and Reducing Risks for State HR Technology

- Workday's 2025R2 release introduces automation and compliance tools to modernize public sector payroll systems. - Features like Time Management Hub and Acknowledgment lessons reduce manual errors while ensuring regulatory adherence. - AI-driven tools like Workday Assistant mitigate risks by proactively resolving payroll discrepancies in real time. - Case studies show $100k annual savings for Washington county but highlight Oregon's $15M error risk from poor implementation. - Success depends on strategic

Thea Energy unveils Helios, a fusion power facility modeled after pixel technology

Nvidia is said to be considering increasing H200 output to address rising demand in China

Snapchat launches its annual year-end Recaps