Why did digital gold Bitcoin lose to real gold in 2025?

Young bitcoin still has a long way to go in terms of adoption and evangelism.

Author: Liam, TechFlow

Remember the end of 2024, when everyone was writing asset forecasts for 2025?

Stock investors were watching the S&P and China A-shares, while people in the crypto community were betting on bitcoin.

But if someone had told you back then that the best-performing asset in 2025 wouldn’t be bitcoin, nor any other crypto, but rather the “old relic” gold that Gen Z dislikes, you would have thought they were joking.

But reality is just that magical.

In the past five years, bitcoin has outperformed gold by nearly 10 times with a gain of over 1000%, repeatedly topping the list of the year’s strongest assets. However, by 2025, the script has completely flipped: gold has risen by more than 50% since January, while bitcoin has only increased by 15%.

The aunties who bought gold early are laughing, while elite traders in the crypto industry have fallen silent.

Even more bizarre, gold and bitcoin seem to have entered parallel worlds: when gold rises, bitcoin falls; when bitcoin falls, gold rises.

On October 21, gold suffered a heavy blow, dropping 5% in a single day, while bitcoin, as if injected with adrenaline, reversed its downward trend and started to rise…

Why has bitcoin, known as digital gold, become decoupled from physical gold?

Buying Gold in Troubled Times

In 2025, who are the craziest buyers of gold? Not retail investors, not institutions, but central banks of countries around the world.

The data doesn’t lie: in 2024, global central banks’ net gold purchases reached 1,045 tons, surpassing 1,000 tons for three consecutive years.

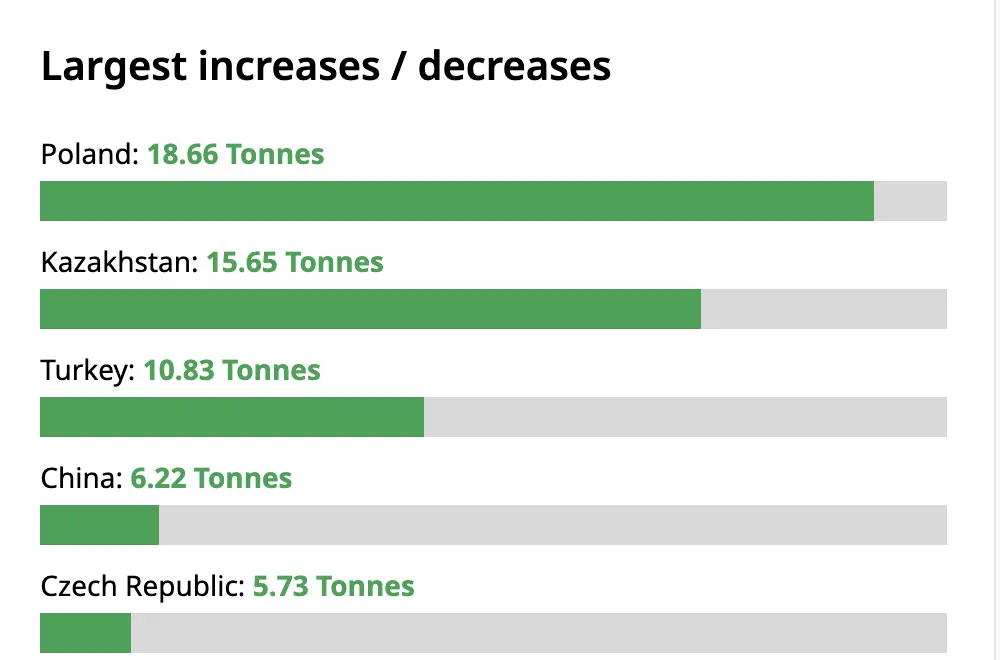

According to Q2 2025 data released by the World Gold Council, Poland increased its holdings by 18.66 tons in one go, Kazakhstan followed closely with an increase of 15.65 tons, and China’s central bank steadily added 6.22 tons…

Why is it mainly developing countries increasing their gold reserves?

Looking at the proportion of gold reserves held by central banks, developed and developing countries are worlds apart:

77.85% of the US’s asset reserves are in gold, with holdings of 8,133 tons, far ahead of second-place Germany’s 3,350 tons, followed by Italy and France, holding 2,452 tons and 2,437 tons of gold respectively.

China’s central bank’s gold reserves account for only 6.7% of its total asset reserves, but the absolute amount has reached 2,299 tons and continues to increase.

This contrast is obvious: emerging market countries still have plenty of room to increase their gold holdings. For economies like China, the proportion of gold reserves is less than 7%, while developed countries in Europe and the US are generally above 70%. It’s like a “catch-up class”—the bigger the gap, the stronger the motivation to catch up.

Exaggeratedly, the share of central bank gold purchases in total demand has soared from less than 10% in the 2000s to 20%, becoming an important support for gold prices.

Why have central banks suddenly become so obsessed with gold? The answer is simple: the world is chaotic, and the US dollar is no longer trustworthy.

The Russia-Ukraine conflict, Middle East tensions, China-US trade frictions... The global village has turned into a Warring States era.

For a long time, the US dollar has been the core foreign exchange reserve for central banks and also served as a safe haven. But now, the US is overwhelmed, with $36 trillions in debt, a debt-to-GDP ratio of 124%, an unpredictable Trump administration, external enemies, and internal divisions…

Especially after the outbreak of the Russia-Ukraine conflict, when the US could arbitrarily freeze other countries’ foreign exchange reserves, countries realized: only the gold locked in their own safes is truly their own wealth.

Gold may not yield interest, but at least it won’t suddenly “disappear” due to another country’s policies.

For both individuals and countries, gold is a form of risk hedging—the more chaotic the world, the more gold is sought after. But when news like “the Russia-Ukraine war may end” comes, a sharp drop in gold is also understandable.

Digital Gold or Digital Tesla?

The most awkward asset in 2025 might be bitcoin. Its long-term narrative is “digital gold,” but it has ended up as “digital Tesla.”

According to Standard Chartered, bitcoin’s correlation with the Nasdaq is now as high as 0.5, and even reached 0.8 at the beginning of the year. And its correlation with gold? A pitiful 0.2, and even zero at the start of the year.

In plain language: bitcoin is now tied to tech stocks—when the Nasdaq rises, it rises; when the Nasdaq falls, it falls too.

Everything has its cause.

Under the Trump administration, the US attitude toward bitcoin shifted from “illegal cult” to “welcome aboard.” In 2024, the approval of the bitcoin spot ETF marked bitcoin’s official incorporation into the US dollar system.

This was supposed to be a good thing, proving bitcoin’s legitimacy. But the problem is, once you become part of the system, it’s hard to fight against it.

Bitcoin’s original appeal lay in its rebellious spirit—not relying on any government, not controlled by any central bank.

But now? Wall Street giants like BlackRock have become the biggest buyers in the market, and bitcoin’s ups and downs depend entirely on the Federal Reserve and Trump. Crypto traders now have to stay up late listening to Powell and Trump’s speeches, turning themselves into US dollar macro analysis experts.

In terms of consensus, bitcoin is still at the “what the heck is this” stage in many parts of the world, while gold is already at the “my grandmother’s grandmother liked it” level.

The number of people holding gold bracelets and necklaces among Chinese aunties may be greater than all bitcoin HODLers worldwide.

Compared to gold, the young bitcoin still has a long way to go in spreading its gospel.

Gold in the Left Hand, Bitcoin in the Right

Many people like to make a choice between gold and bitcoin, but smart investors know it’s a fill-in-the-blank question.

Although central banks around the world are frantically buying gold and gold prices are soaring, this process cannot continue indefinitely. When gold prices reach a certain high, issues such as storage, transportation, and delivery of physical gold will arise, and that’s when bitcoin’s advantages become apparent.

Imagine a specific scenario: a war breaks out in a country, and the wealthy find that gold is too heavy and conspicuous to quickly transfer their wealth. At this time, bitcoin in a hardware wallet becomes the best choice—something that has already happened in Russia.

Simply put, gold is a “bulky store of value,” while bitcoin is a “lightweight store of value.”

If gold prices reach a terrifyingly high level, capital will look for a similar but cheaper alternative. In this case, bitcoin may gradually break free from the gravitational pull of the US dollar and Trump, benefit from gold’s capital overflow, and realign itself as “digital gold.”

In summary, the relationship between bitcoin and gold should not be seen as one replacing the other, but as inheritance and evolution.

Gold is the wealth memory of human civilization; bitcoin is the wealth imagination of the digital age.

70-year-old Aunt Li buys gold jewelry, 25-year-old programmer Li Xiaoming hoards bitcoin—everyone has a bright future.

Recommended reading:

Bloomberg Special Report: Binance’s Rival—A Comprehensive Guide to How Hyperliquid Successfully Captured Market Share

Epic Crash! BTC Barely Holds the $100,000 Mark—Why Did the Altcoin Market Suffer a Bloodbath?

The Other Side of Binance Memecoin Frenzy: 1.4% Graduation Rate, Whale Losses Exceed $3.5 Million

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dormant BTC Exodus: The Alarming $300 Billion Sell-Off Shaking Crypto Markets

Revealing Truth: Altcoin Season Index Stagnates at 18 – What This Means for Your Crypto Strategy

Federal Reserve withdraws restrictive 2023 policy severely limiting 'novel' crypto activities