SHIBJPY Jumps 53.33% Within a Day as Market Experiences High Volatility

- SHIBJPY surged 53.33% in 24 hours on Oct 23, 2025, reversing a 1392.69% 30-day decline amid extreme volatility. - Analysts attribute the rally to shifting market sentiment and algorithmic trading, but warn of continued short-term swings and a bearish long-term trend. - Technical indicators show overbought conditions (RSI/MACD) and mixed momentum, with no significant institutional activity detected post-surge. - Backtesting efforts stalled due to missing SHIBJPY price data, as inconsistent ticker formats

On October 23, 2025, SHIBJPY experienced a sharp 53.33% increase in just 24 hours, climbing to $0.001512. This notable short-term recovery occurred even as the pair had already risen 73.48% over the previous week. The recent surge comes after a dramatic 1392.69% drop in the last month and an even steeper 5471.47% decline over the past year. These movements underscore the ongoing volatility in the SHIBJPY market, where rapid price jumps are set against a backdrop of significant long-term losses.

The latest 24-hour upswing seems to be fueled by shifts in market sentiment and algorithm-driven trades, though no clear trigger has been pinpointed. Market experts suggest that such volatility is likely to persist in the short run, but warn that the overall outlook remains negative due to the prolonged downward trend and underlying structural issues. The lack of a concrete reason for the 53.33% spike highlights the speculative dynamics dominating SHIBJPY trading.

Technical analysis presents a mixed outlook following the recent price jump. Short-term momentum indicators suggest the rally could continue, but longer-term signals remain pessimistic. Both the RSI and MACD have entered overbought zones, indicating a possible short-term correction. Despite the sharp movement, there has not yet been a notable increase in institutional trading, implying the market may still be consolidating or testing important price levels.

Backtest Hypothesis

Given the unpredictable nature of SHIBJPY, there is interest in assessing strategies designed to take advantage of sudden price spikes like the recent 53.33% rise. However, efforts to set up a backtesting system have hit a major obstacle: daily price data for SHIBJPY cannot be retrieved. The data provider reported an error, likely due to inconsistent ticker symbols across different platforms. Crypto-to-fiat pairs are often listed with various codes—such as SHIB/JPY, SHIBJPY=X, or other vendor-specific formats—making data collection challenging.

To move forward with backtesting, it is essential to determine the correct ticker symbol. This will enable accurate access to historical price records and help identify previous instances of 5% or greater surges, which are crucial for evaluating the effectiveness of volatility-based strategies. At present, the system lacks the necessary identifiers, and without reliable historical data, it is not possible to properly test or validate the strategy’s potential.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

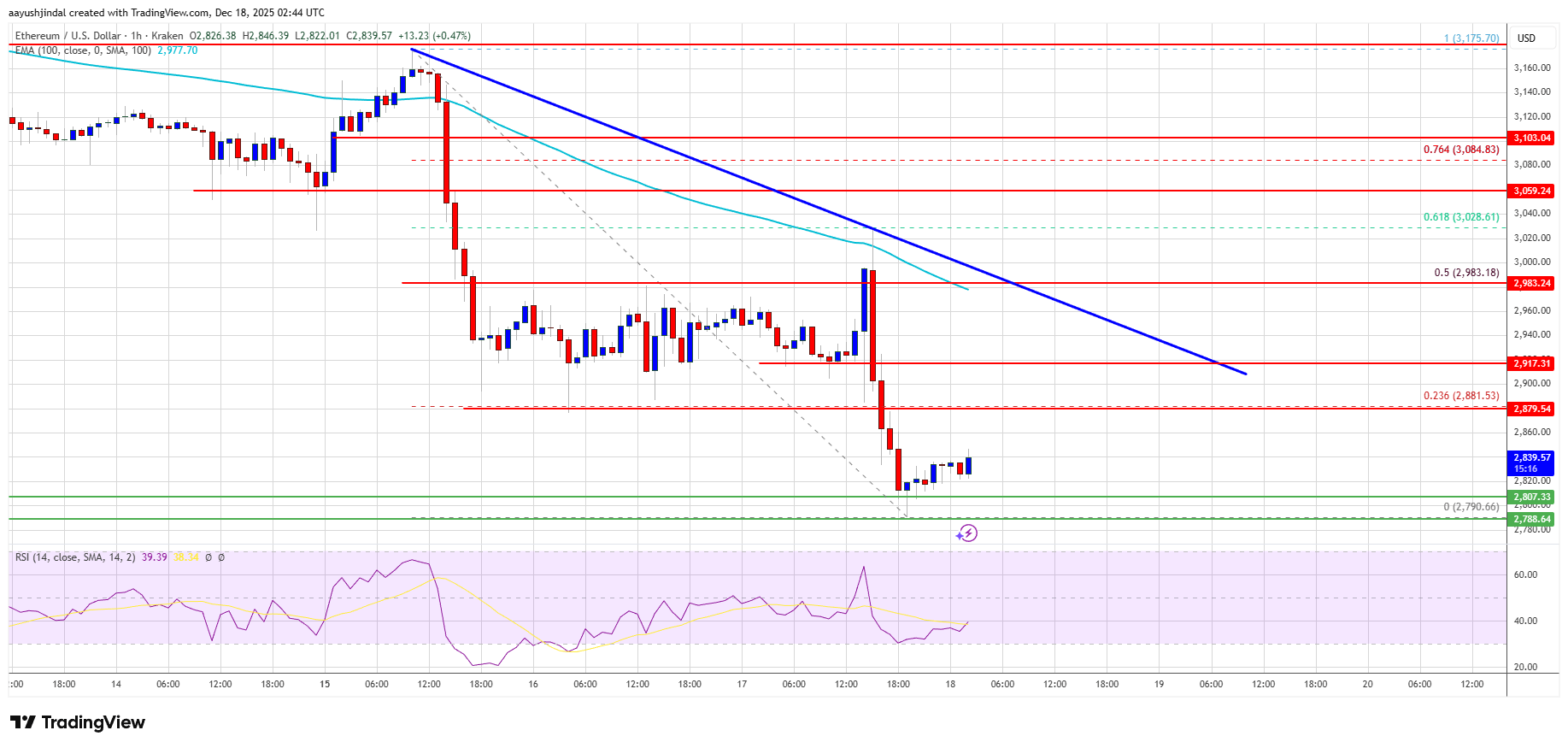

Ethereum Price Continues to Slide—Where Is the Next Support?

Ethereum Whale Sells Entire ETH Position After 1127-Day Hold, Realizes $4.245 Million Profit

Tether’s USDT Payment Stats Show the Real State of Crypto Adoption in 2025

Circle Launches Arc Developer Fund to Accelerate Real-World Finance Apps on Arc Network