Key Market Information Discrepancy on October 23rd, a Must-See! | Alpha Morning Report

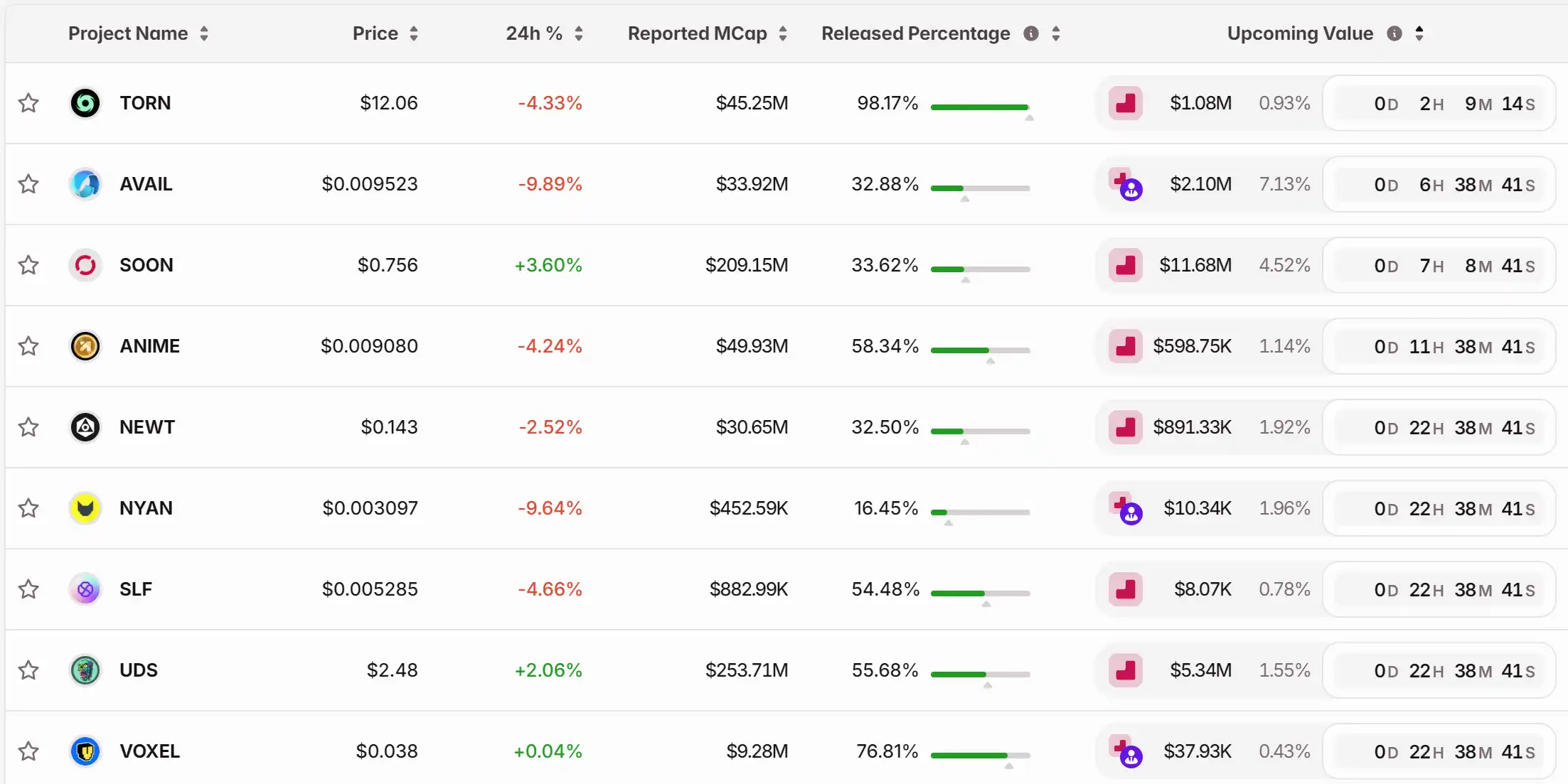

1. Top News: Polymarket Plans to Seek Funding at a Valuation of $12-15 Billion 2. Token Unlock: $TORN, $AVAIL, $SOON, $ANIME, $NEWT, $NYAN, $SLF, $UDS, $VOXEL

Top News

1. Polymarket Plans to Raise Funds at a Valuation of $12-15 Billion

2. Crypto Giants Gather at Capitol Hill, Market Structure Regulation Takes Center Stage

4. ENA Sees Brief 10% Price Plunge, Liquidates Associated Address on Hyperliquid Linked to Andrew Kang

5. Kraken Reports $648 Million in Q3 Revenue, a 114% Year-over-Year Growth

Articles & Threads

1. "120,000 Bitcoins Seized? In-Depth Analysis of the Regulatory Dilemma Behind the 'Prince Group' Case"

Amid tightening global cryptocurrency regulations, a cross-border "online pursuit" spanning Cambodia and the US/UK has captured everyone's attention. In October 2025, the US Department of the Treasury and the Department of Justice joined forces to launch the largest-ever cryptocurrency enforcement operation against the Cambodian Prince Group, freezing up to 120,000 bitcoins.

2. "From Liquidation Storms to Cloud Outages: Cryptocurrency Infrastructure's Crisis Moments"

Amazon Web Services (AWS) faced another major outage, severely impacting cryptocurrency infrastructure. The AWS issue in the US East Region (Northern Virginia data center) resulted in outages for Coinbase and dozens of other major crypto platforms including Robinhood, Infura, Base, and Solana. AWS has acknowledged "increased error rates" affecting Amazon DynamoDB and EC2, core databases and computing services relied upon by thousands of companies. This outage provides immediate and stark validation for this article's central argument: cryptocurrency infrastructure's reliance on centralized cloud service providers has created systemic vulnerabilities that repeatedly manifest under stress.

Market Data

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Federal Reserve's Change in Policy and Its Unexpected Effect on Solana's Rise

- Federal Reserve's 2025 rate cut and QT end injected $72.35B liquidity, briefly boosting Solana by 3.01%. - October 2025's $19B liquidation and government shutdown exposed crypto liquidity fragility, eroding investor confidence. - Solana's 6.1% price drop and 4.7% TVL decline in November 2025 highlighted macroeconomic policy's volatile impact on crypto markets. - Upcoming December FOMC meeting (87% rate cut chance) could reignite risk appetite or trigger corrections, mirroring October's 20% price drop. -

Solana’s Latest Price Fluctuations and Institutional Involvement: Insights for Long-Term Investors

- Solana (SOL) faced 2025 price swings from $155 to $294, driven by macroeconomic pressures, on-chain weakness, and institutional adoption dynamics. - Institutional ETFs like Bitwise's BSOL attracted $2B AUM by mid-2025, with major holders staking SOL to deepen ecosystem integration despite short-term volatility. - Risks include network centralization, competition from Ethereum 2.0, and reliability concerns after the 2024 cluster outage amid Fed rate uncertainty. - Ecosystem resilience with 500+ dApps and

Timeless Strategies for Investing Amid Market Volatility

- In 2025, R.W. McNeel's 1927 value investing principles and Warren Buffett's strategies remain critical amid market volatility driven by tech disruption and geopolitical risks. - Both emphasize intrinsic value, emotional discipline, and long-term thinking to counter crypto and stock market swings fueled by speculation and social media hype. - Buffett's $340B cash reserves and focus on undervalued sectors like healthcare contrast with crypto's intangible promises, reinforcing tangible asset preferences. -

Saylor Strikes Again: Strategy Makes Its Biggest BTC Buy Since July