Tokyo-listed Quantum Solutions becomes largest ETH treasury outside USQuantum raises $180 million to fund ETH strategy

Tokyo-listed Quantum Solutions has become the largest Ethereum treasury company outside of the United States after acquiring over 2,300 ETH over the past week.

- Quantum Solutions acquired 2,365 ETH in 7 days to become the largest Ethereum treasury outside the US.

- The firm raised roughly $180 million in September through a funding round led by ARK Invest.

- Quantum’s shares have fallen by over 28% in the past five days.

“I’m proud to announce that we have accumulated 2,365 ETH in just 7 days, officially making Quantum Solutions the largest ETH DAT outside the US,” Quantum Solutions’ founder, Francis Zhou, said while announcing the development via an Oct. 23 X post, adding that the firm plans to hoard more ETH in the coming months.

According to the numbers cited by Quantum Solutions in a press release on the same day, the company acquired over 2,000 ETH via a Hong Kong subsidiary, valued at roughly $7.85 million, on Oct. 21, pushing its total holdings to 3,865.84 ETH. At current prices, the stash is valued at approximately $14.8 million.

Following the latest acquisition, the company ranks as the 11th largest ETH DAT globally, according to data from CoinGecko, and the number one in Japan.

As previously reported by crypto.news, Quantum announced a Bitcoin treasury in July, when it said it would acquire 3,000 Bitcoin over the next year. When writing, Quantum’s Bitcoin treasury held 1.6 BTC valued at roughly $1.3 million.

Quantum raises $180 million to fund ETH strategy

Quantum’s latest purchases were supported by a recent funding initiative in which the firm raised over 26 billion yen, or approximately $180 million, to build one of the world’s largest Ethereum treasuries.

The funding round was led by three heavyweight institutional investors, including asset management firm ARK Invest, Susquehanna International Group via CVI Investments, and Hong Kong-based Integrated Asset Management.

For ARK Invest, it was the firm’s first direct foray into Asia’s public markets.

“Three months into the DAT revolution, we’re happy to support Japan’s first institutional-grade ETH DAT,” Ark Invest founder and CEO Cathie Wood said regarding Quantum’s latest milestone.

Quantum shares continue to slide

Yet the latest achievement has done little to calm Quantum shareholders, as evidenced by recent price action.

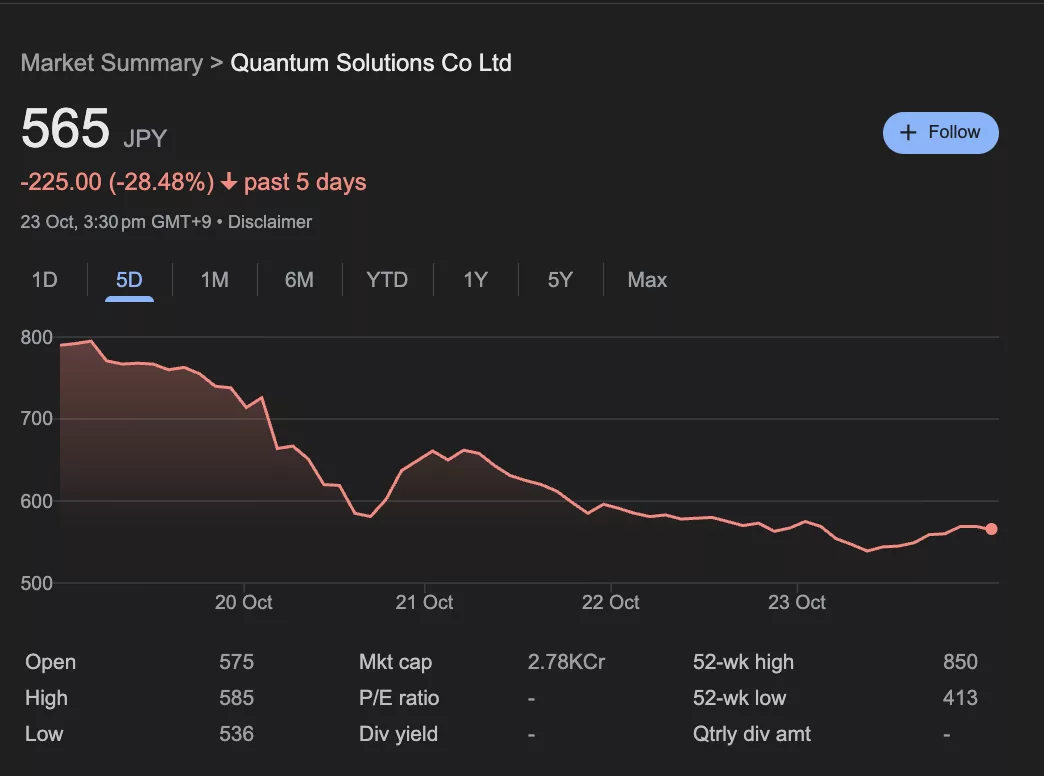

Quantum Solutions shares closed at 565 yen on October 23, slipping nearly 2% on the day and extending a sharp five-day slide that has wiped out over 28% of the company’s market value.

Quantum Solutions shares 5-day performance | Source: Google Finance

Quantum Solutions shares 5-day performance | Source: Google Finance

The downturn has not been limited to Quantum alone, with several publicly traded crypto treasury firms also seeing their valuations shrink in recent sessions as the hype around DATs seems to be fading .

However, some market participants believe investor interest in Ethereum-linked equities remains elevated, but recent profit-taking and concerns over short-term volatility have dampened appetite for stocks tied to large crypto holdings.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gain Insight into Cryptocurrency’s Promising Future for 2026

In Brief The next major crypto bull cycle will start in early 2026. Institutional investors and regulation drive long-term market confidence. Short-term shifts show investors favoring stablecoins amid volatility.

Stunning $204 Million USDT Transfer Ignites Market Speculation