US National Debt Hits Record $38 Trillion in 2025

- New record national debt, financial administration, and potential economic impacts.

- Surge in federal debt amid fiscal debates.

- Potential rise in interest payments impacting economic policy.

The US national debt reached a historic high of $38 trillion on October 21, 2025, amid a government shutdown and fiscal debates. This rise is attributed to increased federal spending and interest costs, foreshadowing projected deficits of $22.7 trillion over the next decade.

Points Cover In This Article:

ToggleUS national debt reached an unprecedented $38 trillion as of October 21, 2025, amidst ongoing government shutdown and fiscal debates.

The milestone highlights growing fiscal challenges, raising concerns about future economic policies and interest costs.

The US National Debt Situation

The US national debt has surpassed $38 trillion for the first time, occurring during a government shutdown amid fiscal policy debates. Historical comparisons show similar situations during the COVID-19 pandemic when national debt increased significantly over short periods.

The US Treasury Department, led by Treasury Secretary Scott Bessent, oversees federal debt management. Scott Bessent stated, “During his first eight months in office, President Trump has reduced the deficit by $350 billion compared to the same period in 2024 by cutting spending and boosting revenue.” The rising debt results from increased spending and interest costs.

Impact on Financial Markets

The new debt level may influence financial markets and government spending. There’s a possibility that such economic pressures might drive a “flight to safety” strategy among investors. Historically, fiscal instability often prompts discussions about alternative assets like Bitcoin.

Financial entities anticipate rising interest payments, which might affect federal budgets through 2035. Despite the economic uncertainty, no significant cryptocurrency market impacts have been directly linked to this debt milestone, according to official sources.

Future of Fiscal Policy

Past fiscal environments indicate potential shifts in investment strategies, although direct effects on cryptocurrencies remain unsubstantiated. However, any technological, financial, or regulatory changes will depend on future policy adjustments and market responses.

Current government shutdown and fiscal policy challenges highlight the complexity of managing national finances. Michael A. Peterson, CEO of the Peter G. Peterson Foundation, expressed, “Reaching $38 trillion in debt during a government shutdown is the latest troubling sign that lawmakers are not meeting their basic fiscal duties.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

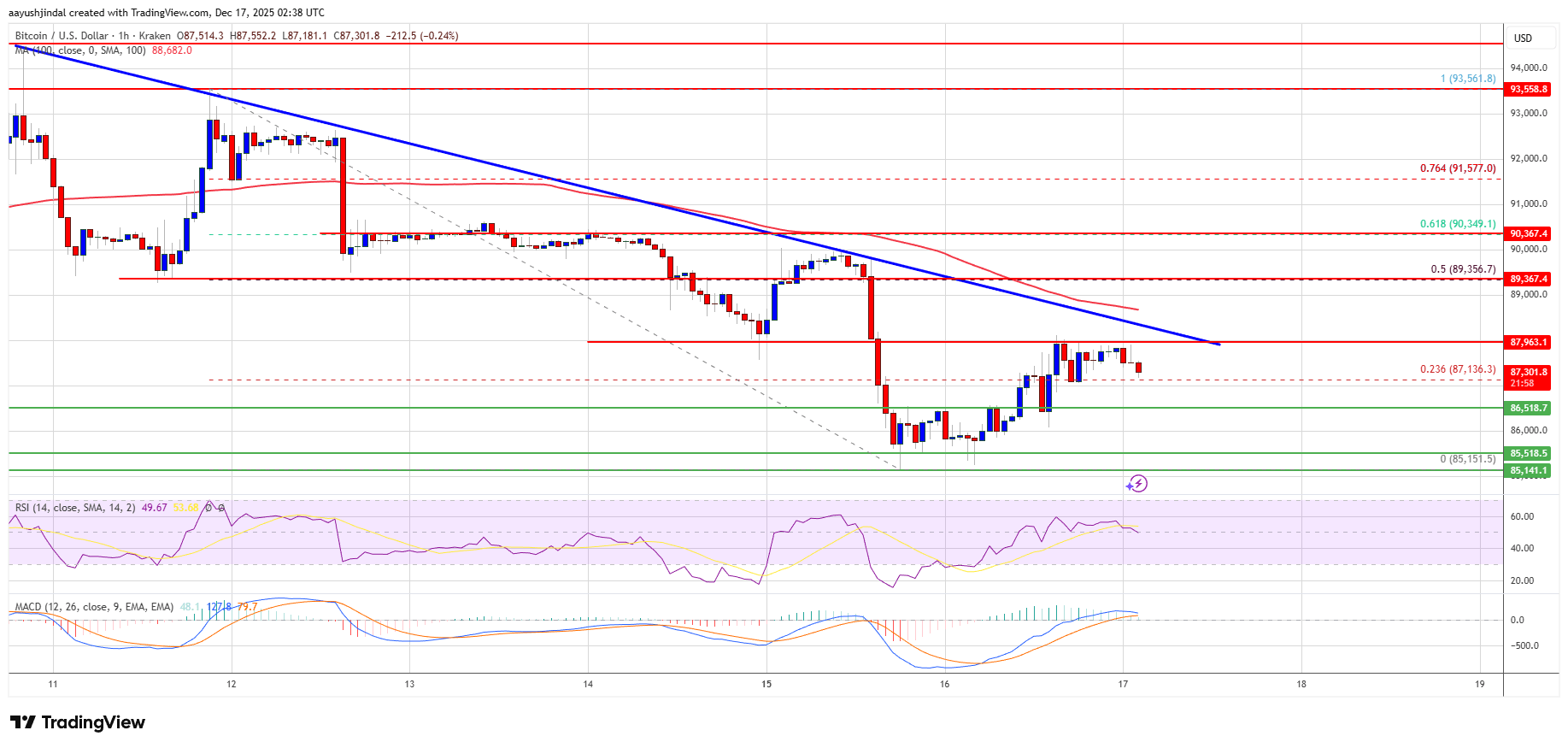

Bitcoin Price Regroups After Losses—Is Directional Break Near?

Bitcoin’s Quantum Leap: Saylor Says Upgrades Harden Security, Reduce Supply, and Freeze Lost Coins