US Lawsuit Blames Meteora Founder for MELANIA and LIBRA Token Collapse

Investors have filed a U.S. class action lawsuit accusing Meteora co-founder Ben Chow of orchestrating a meme coin fraud tied to Melania Trump and Argentine President Javier Milei. Plaintiffs say the public figures were used as “props” in a liquidity trap, while Chow denies wrongdoing. The case highlights growing scrutiny of Solana’s meme coin market and regulators’ uncertain stance worldwide.

A newly filed US class action lawsuit accuses Meteora founder Benjamin Chow of orchestrating the infamous Libra and Melania meme coin schemes.

The filing argues that the meme coin fraud allegedly used First Lady Melania Trump and Argentine President Javier Milei as promotional “props.”

Plaintiffs Blame Meteora Founder for Melania, Libra Coin Collapse

According to the amended filing in Hurlock v. Kelsier Ventures, investors claim Meteora and Kelsier Ventures “borrowed credibility” from public figures to legitimize the MELANIA and LIBRA tokens, calling them a coordinated “liquidity trap.”

Both coins surged after launch but later plunged by over 90%.

“Defendants borrowed credibility from real-world figures or themes—such as the ‘official Melania Trump’ coin ($MELANIA) and the ‘Argentine revival’ coin ($LIBRA) tied to President Javier Milei. These faces and brands served as props to legitimize what was actually a coordinated liquidity trap. Plaintiffs do not claim those public figures were culpable; they were merely the window dressing for a crime engineered by Meteora and Kelsier,” the filing said.

In Argentina, the LIBRA scandal has widened into a criminal probe targeting two of Milei’s aides after wallet data linked them to pre-launch transfers. Over 1,300 citizens reportedly lost funds, contradicting Milei’s televised claim that “no more than five” investors were affected.

Melania Trump recently revived her Solana-based meme coin through an AI-generated video. Prices briefly rose before falling again. Analysts flagged $30 million in unexplained token sales from team wallets, raising transparency concerns.

Defense, Regulation, and Market Context

Chow, who resigned in February, previously denied wrongdoing on X. He said neither he nor Meteora received tokens or insider information. Chow described the “Dynamic Liquidity Market Maker” as a permissionless tool supporting independent launches rather than a trading entity.

There have been questions regarding Meteora and my involvement in $LIBRA, so I want to explain our role and share why we work with 3rd parties.Meteora and I personally, have never received or managed any tokens on the side, do not receive knowledge or get involved with any…

— benchow.sol (@hellochow) February 17, 2025

A US judge has unfrozen $57.6 million in USDC tied to the case, citing doubts about the plaintiffs’ chances. The filing also names Hayden Davis and Kelsier Ventures, alleging they ran at least 15 token launches using the same template.

The lawsuit arrives as regulators debate how to classify meme coins. In February, the SEC stated that meme coins are “akin to collectibles,” ending securities-law enforcement but leaving fraud cases to agencies like the CFTC.

Analysts warn the relaxed stance may embolden speculative issuers. Regulators from the UK to Singapore are also weighing whether such tokens fall under consumer-protection law instead of financial regulation.

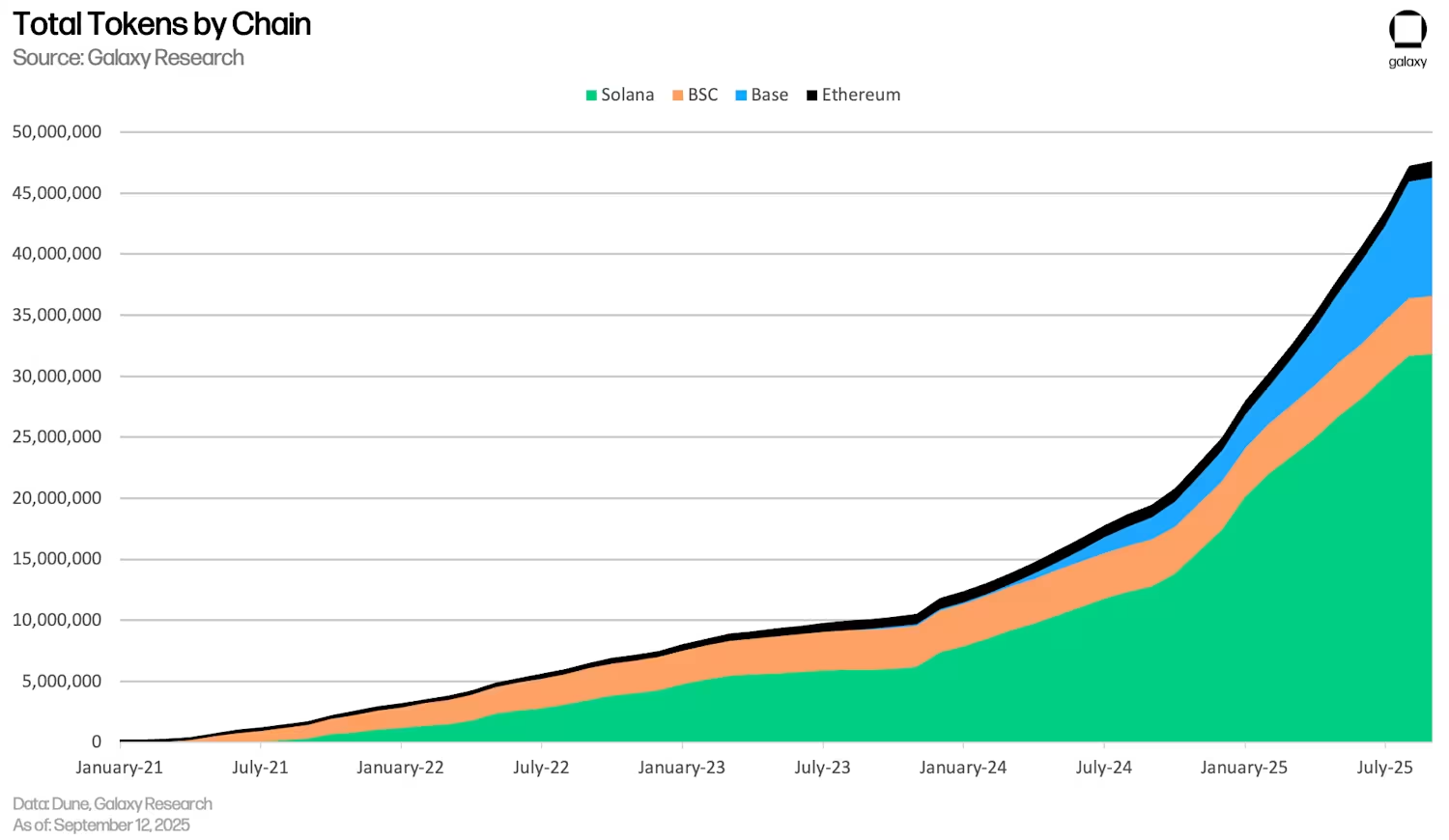

Total Meme Coins By Chain. Source:

Total Meme Coins By Chain. Source:

According to Galaxy Research, more than 32 million meme coins now trade on Solana, which holds 30% of decentralized-exchange volume. Most traders lose money within seconds, while infrastructure operators capture most profits—reflecting a casino-like system that rewards deployers over participants.

An a16z Crypto report found that over 13 million meme coins launched last year, but activity fell 56 percent as bipartisan legislation advanced toward clearer oversight. Analysts said the slowdown shows early saturation and investor fatigue with celebrity-driven tokens.

Although no charges target Trump or Milei, the complaint underscores a growing clash between crypto populism and regulatory inertia. As meme coins evolve from jokes into global liquidity events, courts and voters must now decide where free-market innovation ends and financial misconduct begins.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Espresso co-founder’s decade in crypto: I wanted to disrupt Wall Street’s flaws, but witnessed a transformation into a casino instead

Everything you've been hoping for may have already arrived; it just looks different from what you expected.

Solana Foundation Steps In as Kamino and Jupiter Lend Dispute Intensifies

Bitcoin Firms Confront the Boomerang Effect of Excessive Leverage

Ethereum Burns $18B, Yet Its Supply Keeps Growing