Uncovering Crypto Insider Trading: How Flipside AI Turns Vague News into Verifiable Insights

In the fast-paced world of crypto, news articles often drop bombshells, like allegations of massive insider trading tied to political events; but they leave out the juicy details.

Take this recent piece from crypto.news on the "crypto bloodbath" triggered by Trump's tariff announcement on October 9, 2025. It mentions a mysterious wallet funded an account on Hyperliquid and received an inflow ranging between $80 million and $160 million in USD Coin (USDC) through the Arbitrum network during this time. Vague, right? No addresses, no timestamps, no transaction hashes. Just enough to spark curiosity and suspicion.

But what if you could verify that claim in minutes, trace the money trail, and uncover a web of suspicious activity? Enter FlipsideAI , the powerful blockchain intelligence platform from Flipside Crypto that lets you query on-chain data with simple natural language prompts, without writing a single line of SQL yourself.

In this post, I'll walk you through how we used FlipsideAI to sleuth out the details behind this story, turning a fuzzy headline into a deep dive. By the end, you'll see how easy it is to do your own research and why this is a game-changer for both technical and non-technical users in crypto.

The Setup: A Crypto “Bloodbath” Raises Questions

On October 10th, the markets went into what some called a “crypto bloodbath.” Bitcoin and Ethereum prices tumbled within minutes of President Trump’s tariff announcement of 100% tariff on Chinese tech exports.

A crypto.news article cited an X post showing that 30 minutes before the announcement, an anonymous account transferred around $80 million USDC from Arbitrum to Hyperliquid. The account then opened a series of short positions across Bitcoin and Ethereum worth an estimated $1.1 billion in total notional value — a move so fast and precise that it immediately sparked suspicions of insider trading.

"The wallet was created between Oct. 9 and 10 and received an inflow ranging between $80 million and $160 million in USDC through the Arbitrum network."

But what does it actually mean? Which wallet? How did those funds move?

The Initial Sleuth: Pinpointing the Transfer

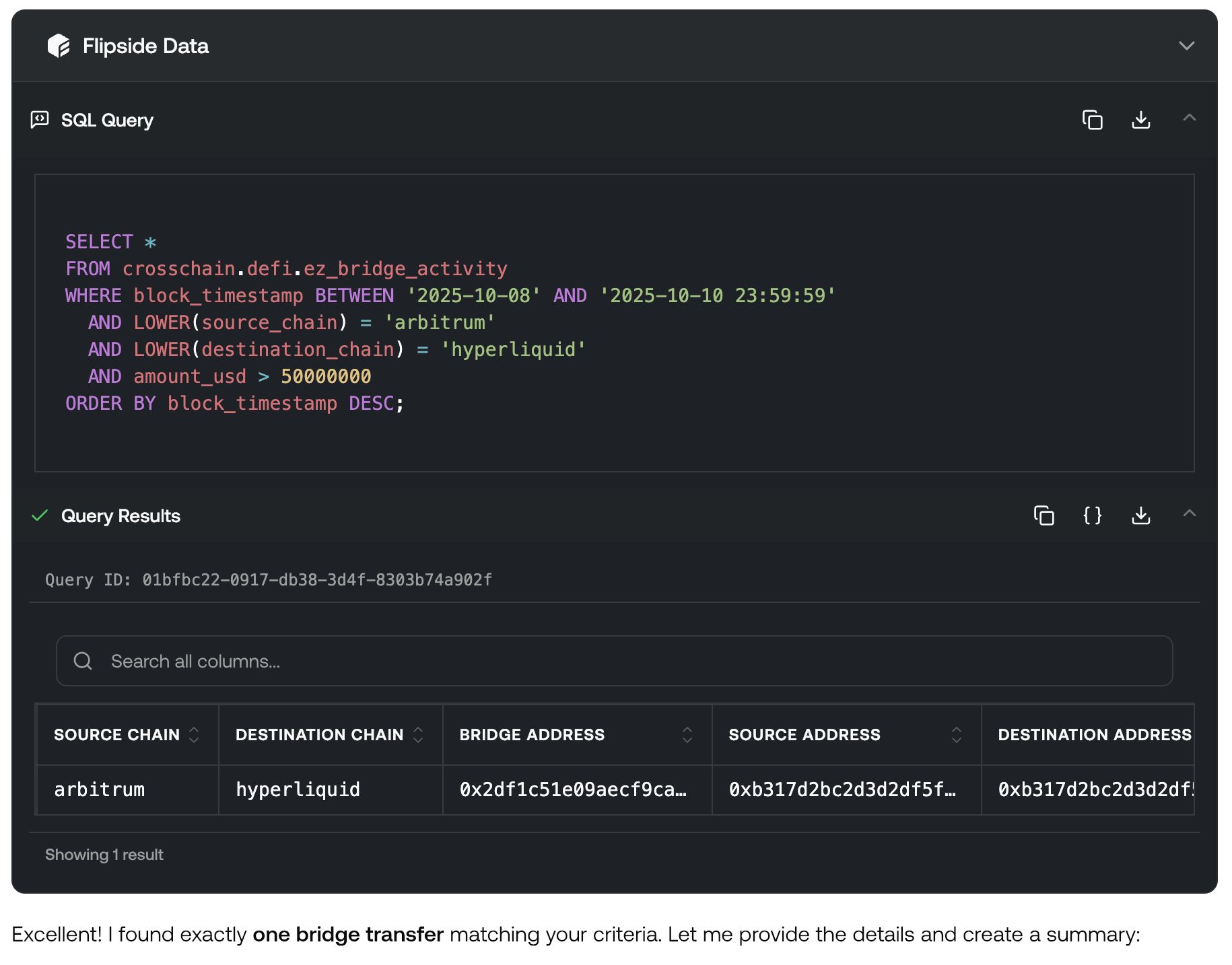

Our goal was to validate the news' claim and find the exact whale wallet that was being funded. A powerful feature of FlipsideAI is its ability to interpret natural language queries into complex blockchain data queries. So, I fired up FlipsideAI's chat interface and asked a straightforward question.

💡 Prompt: Can you find any bridge transfers from Arbitrum to Hyperliquid worth over $50MM, between 2025-10-08 and 2025-10-10, including the 10th?

FlipsideAI crunched the data across 30+ supported blockchains, pinpointed the two protocols and timeframe mentioned in the prompt, and returned an immediate, highly specific result. It instantly validated the details from the article and provided the exact address and transaction hash on Arbitrum. Here's the output, including the intermediate step where FlipsideAI executed the SQL query to find the transaction:

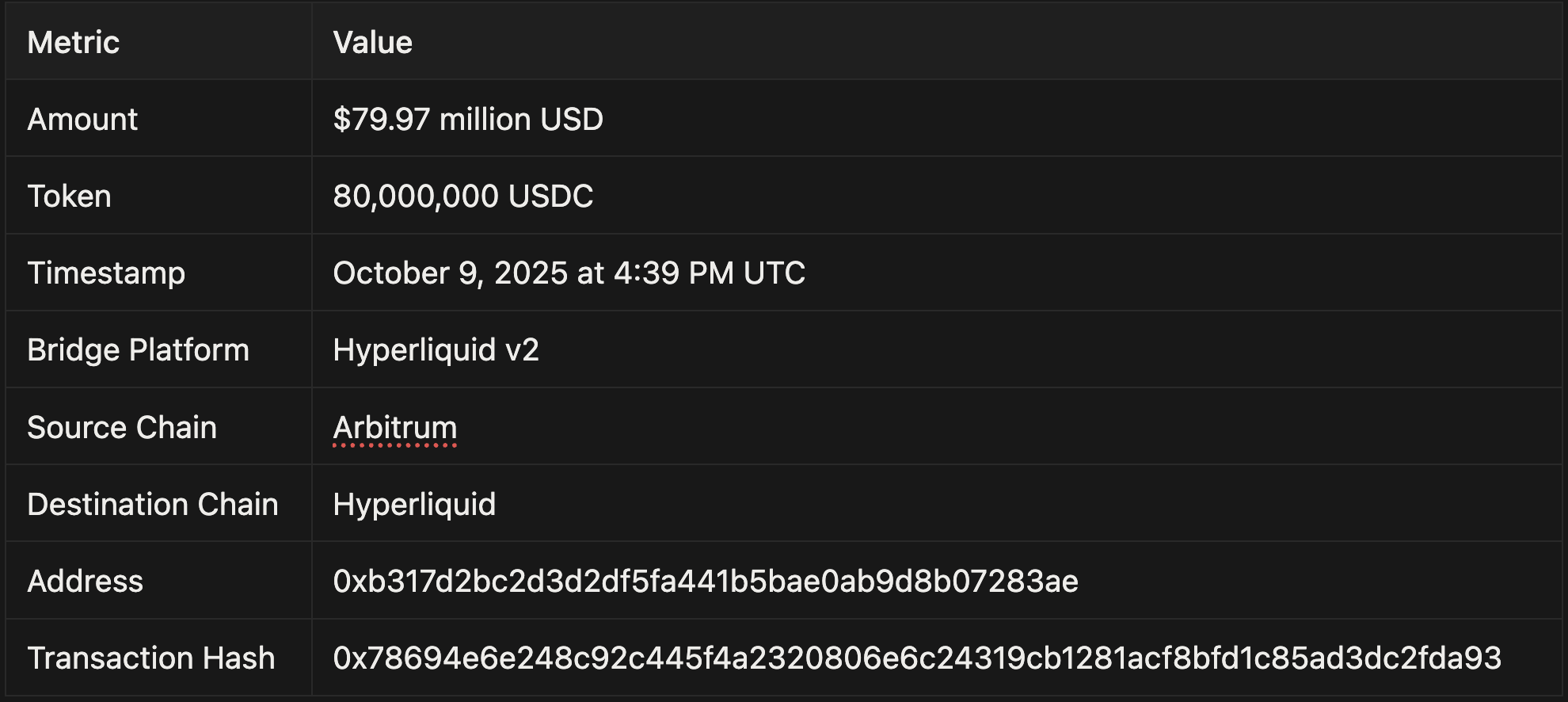

Bridge Transfer Found: Arbitrum → Hyperliquid ($50MM+)

I found 1 large bridge transfer from Arbitrum to Hyperliquid during October 8-10, 2025:

Transfer Details

By entering the transaction hash into Arbitrum's block explorer, you can verify the exact details FlipsideAI returned. This matches the article's timeline and amount range perfectly. No more vagueness — we've turned a fuzzy claim into verifiable on-chain evidence.

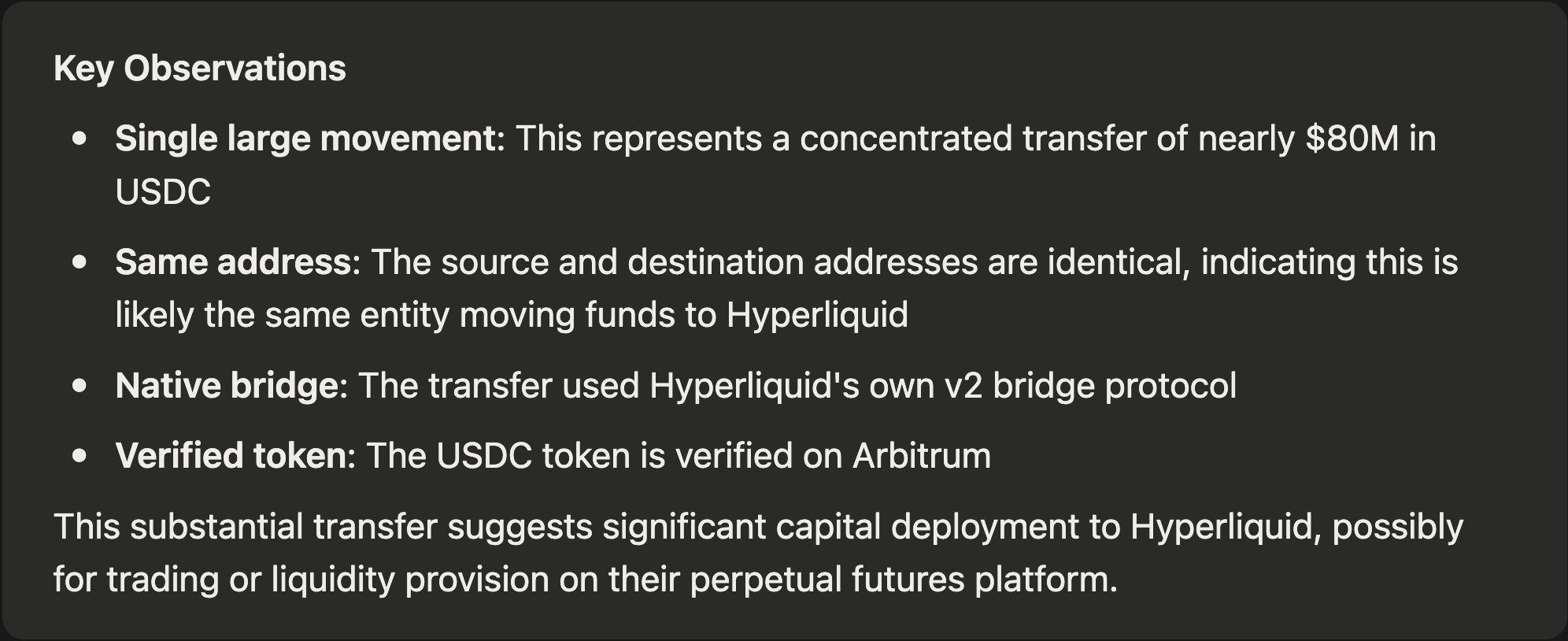

FlipsideAI's analysis also suggested this was a liquidity deployment or trading setup, summarizing the key observations below:

This substantial transfer suggests significant capital deployment to Hyperliquid, possibly for trading or liquidity provision on their perpetual futures platform.

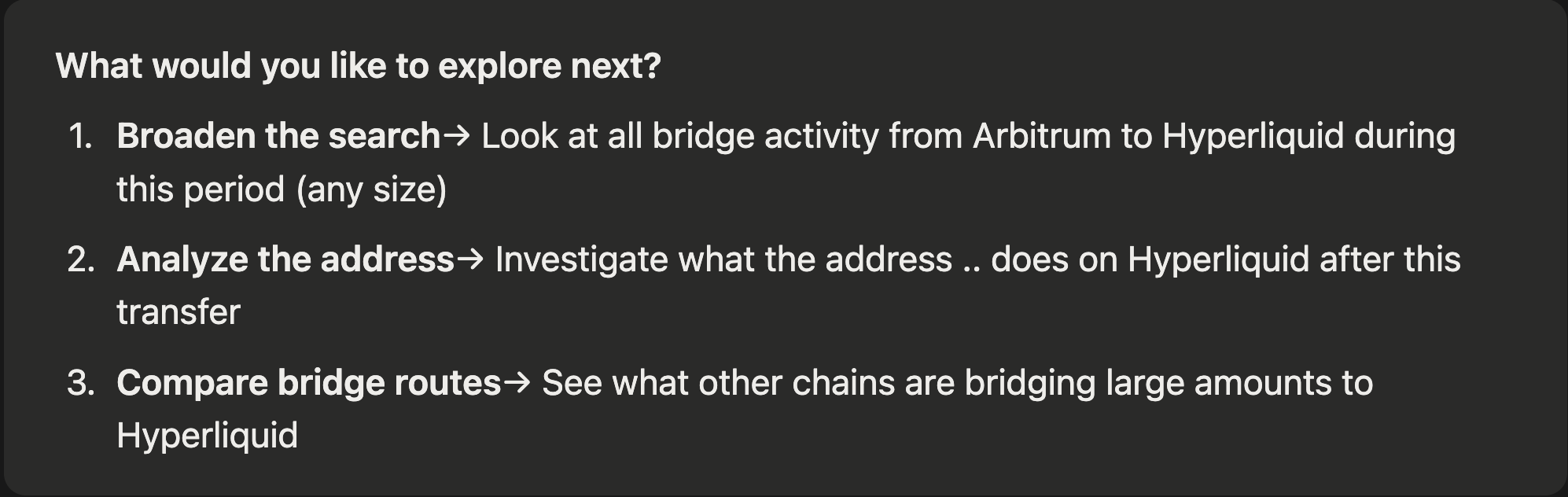

At the end of the analysis, FlipsideAI suggested possible next steps to dig deeper.

Digging Deeper: Tracing the Funding Trail

The initial finding confirmed the primary transaction, but a deep dive insider trading analysis requires understanding the ****money flow.

Our next prompt was more complex, it asked FlipsideAI to analyze all fund flows involving that main address (0xb317...) across the critical four-day period (Oct 8–11, 2025). We also included the article URL to give the AI more context.

💡 Prompt: Read this article for context and build a table of addresses that might have funded that address, how much was sent from Arbitrum to Hyperliquid during the time frame Oct 8-11 2025. Keep timestamps, transaction id's etc.

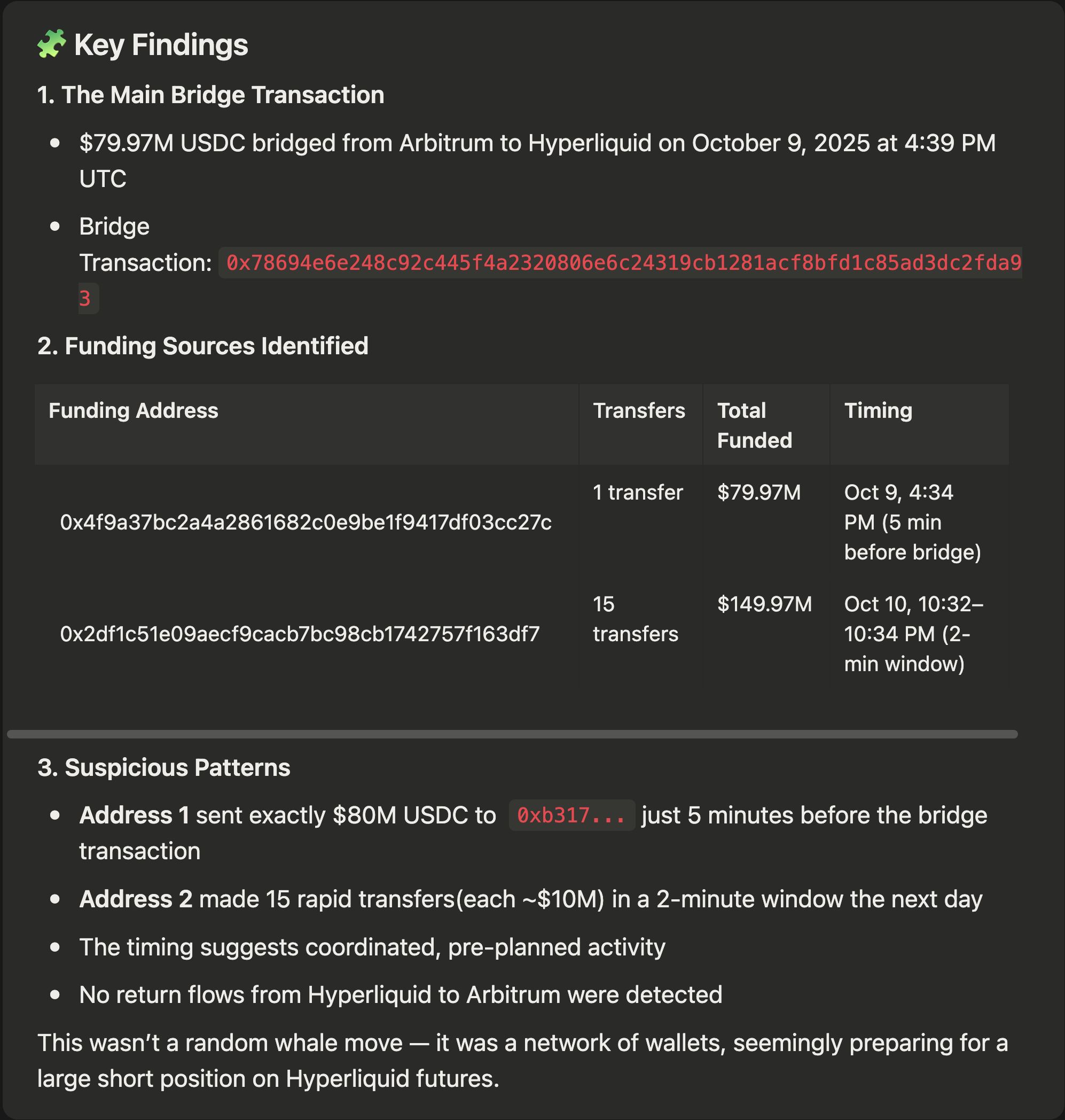

From that, FlipsideAI built a detailed transaction tree:

This wasn’t a random whale move — it was a network of wallets, seemingly preparing for a large short position on Hyperliquid futures.

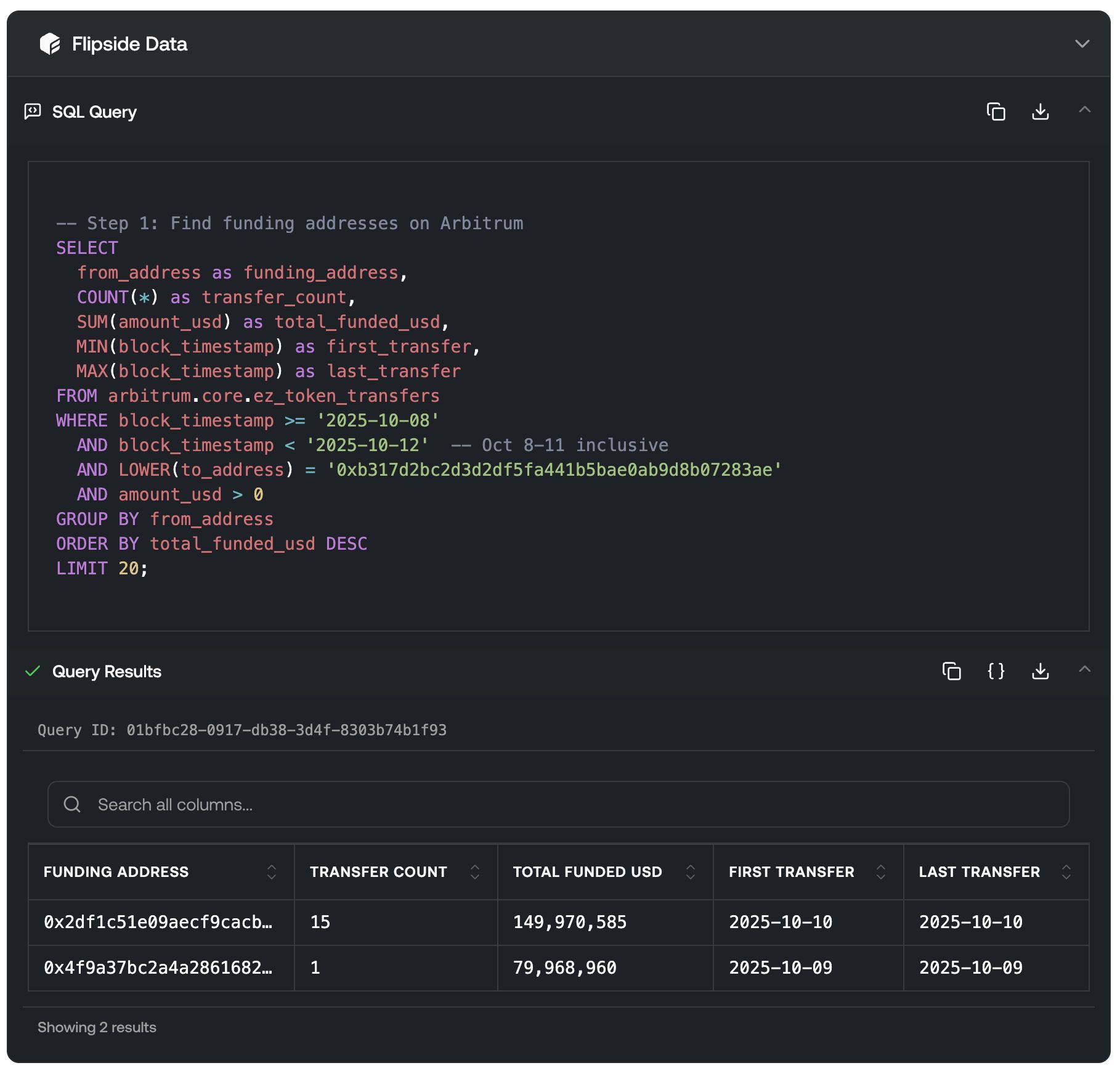

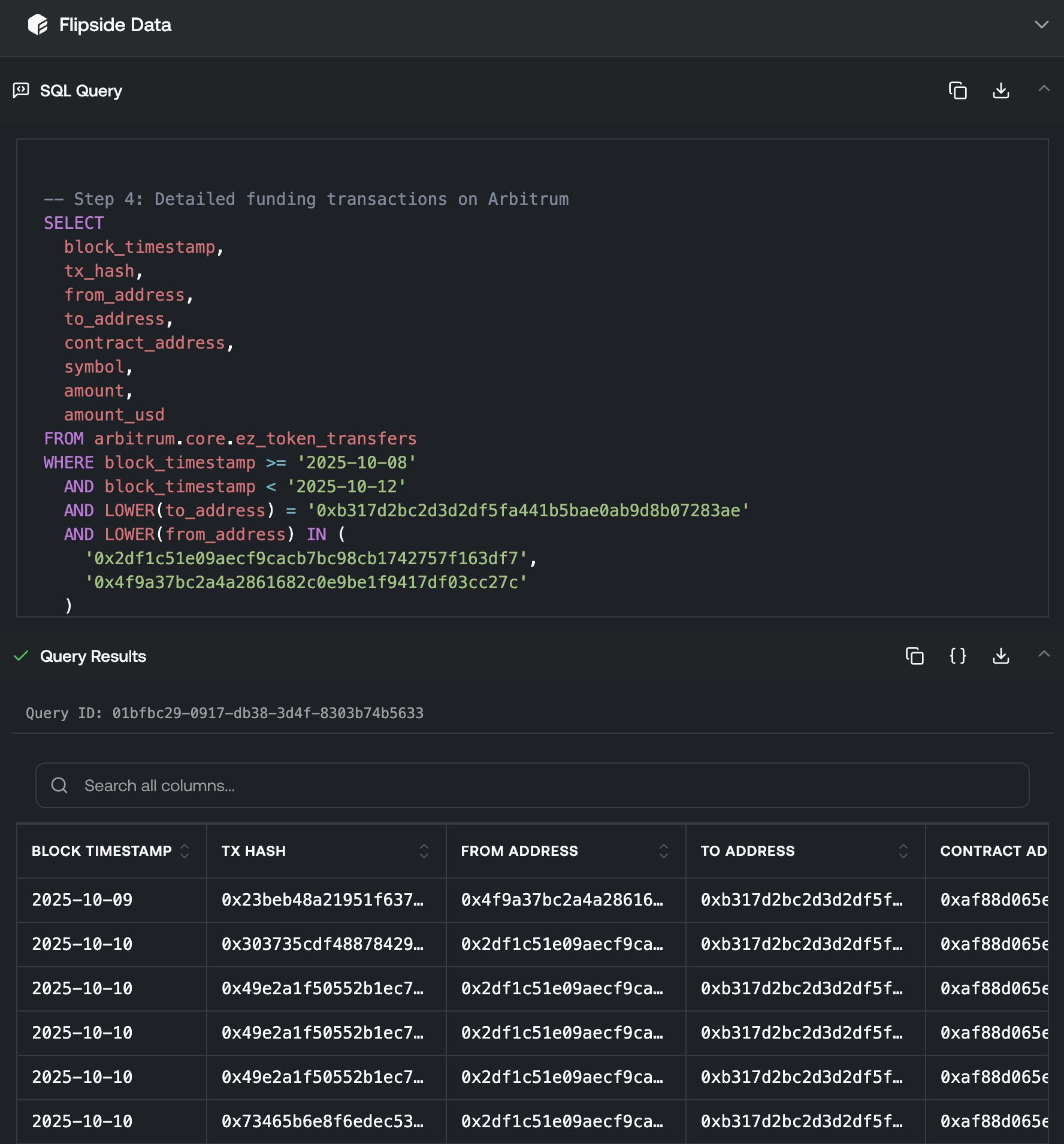

For those who are interested in the SQL details of how FlipsideAI managed to find the funding sources, here are the intermediate outputs from the chat:

By checking the first address’s history on Arbitrum's block explorer based on the exact timing given by FlipsideAI, the transaction hash that funded the $80M in 0xb317... can be easily verified.

The second funding address0x2df1... is Hyperliquid’s bridging deposit address. You can also easily verify the 15 transfers through checking the intermediate outputs from the chat to get the exact transaction hash of those 15 transactions:

The Deeper Layers: CEX Connection and Network Mapping

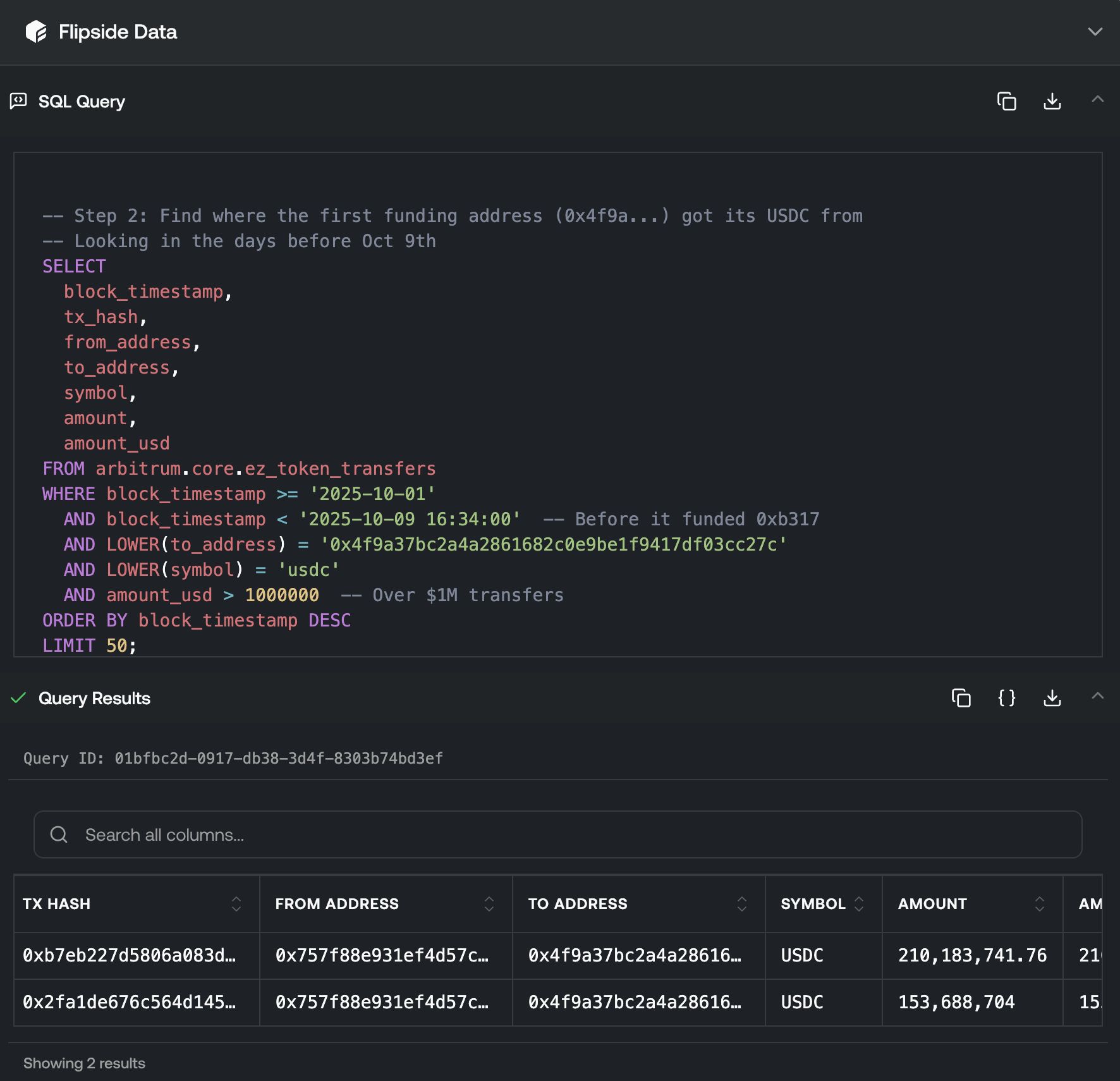

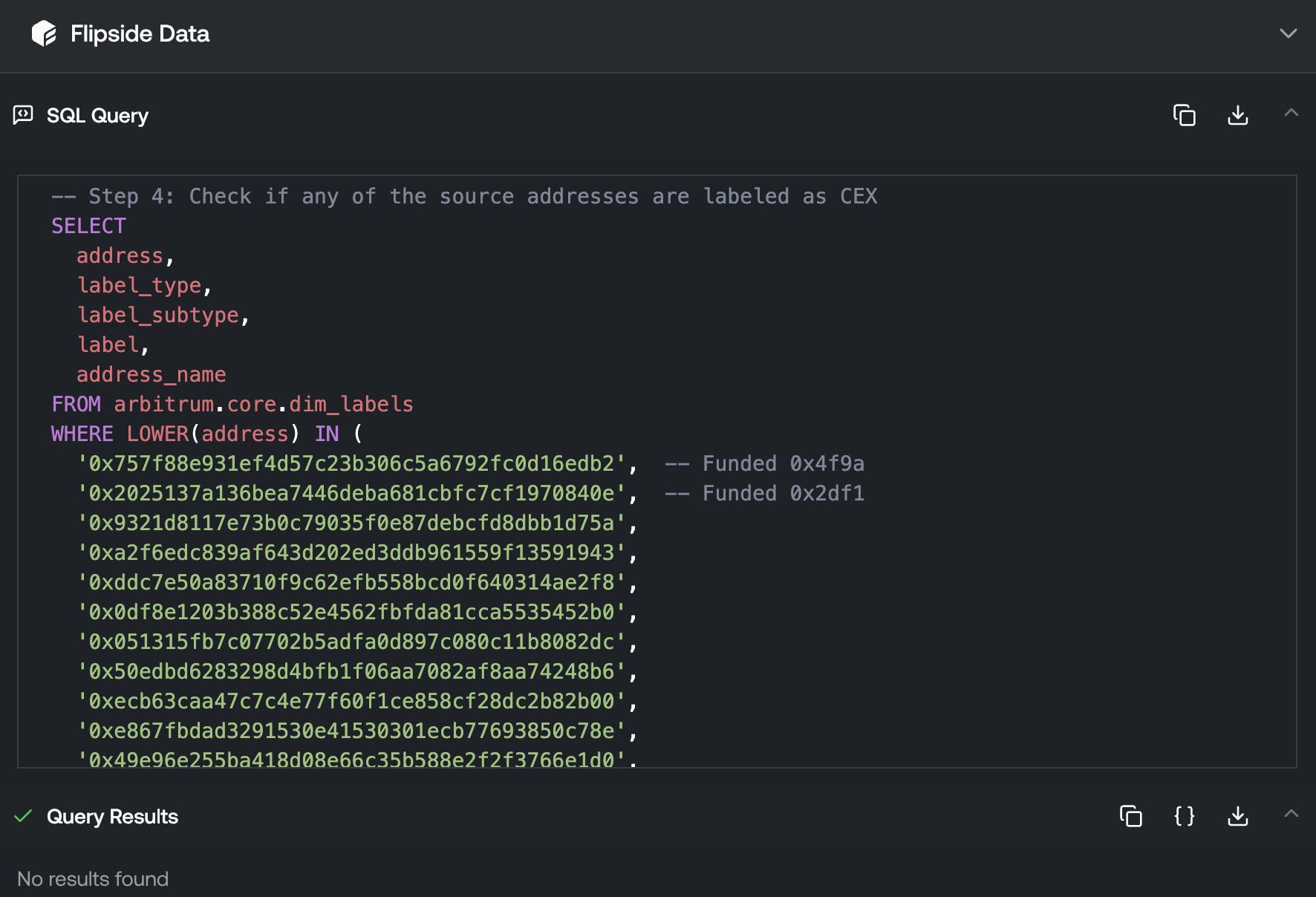

Now digging even deeper, we’d like to know if there’s any centralized exchange (CEX) accounts funding the 0x4f9a... address that subsequently funded the 0xb317... address that bridged the $80M to Hyperliquid. So we asked FlipsideAI again to help us!

💡 Prompt: Can you track the funding addresses and check the cex connections?

FlipsideAI quickly built up the logical flow of first checking who funded 0x4f9a... - the results show a major funding address 0x757f... .

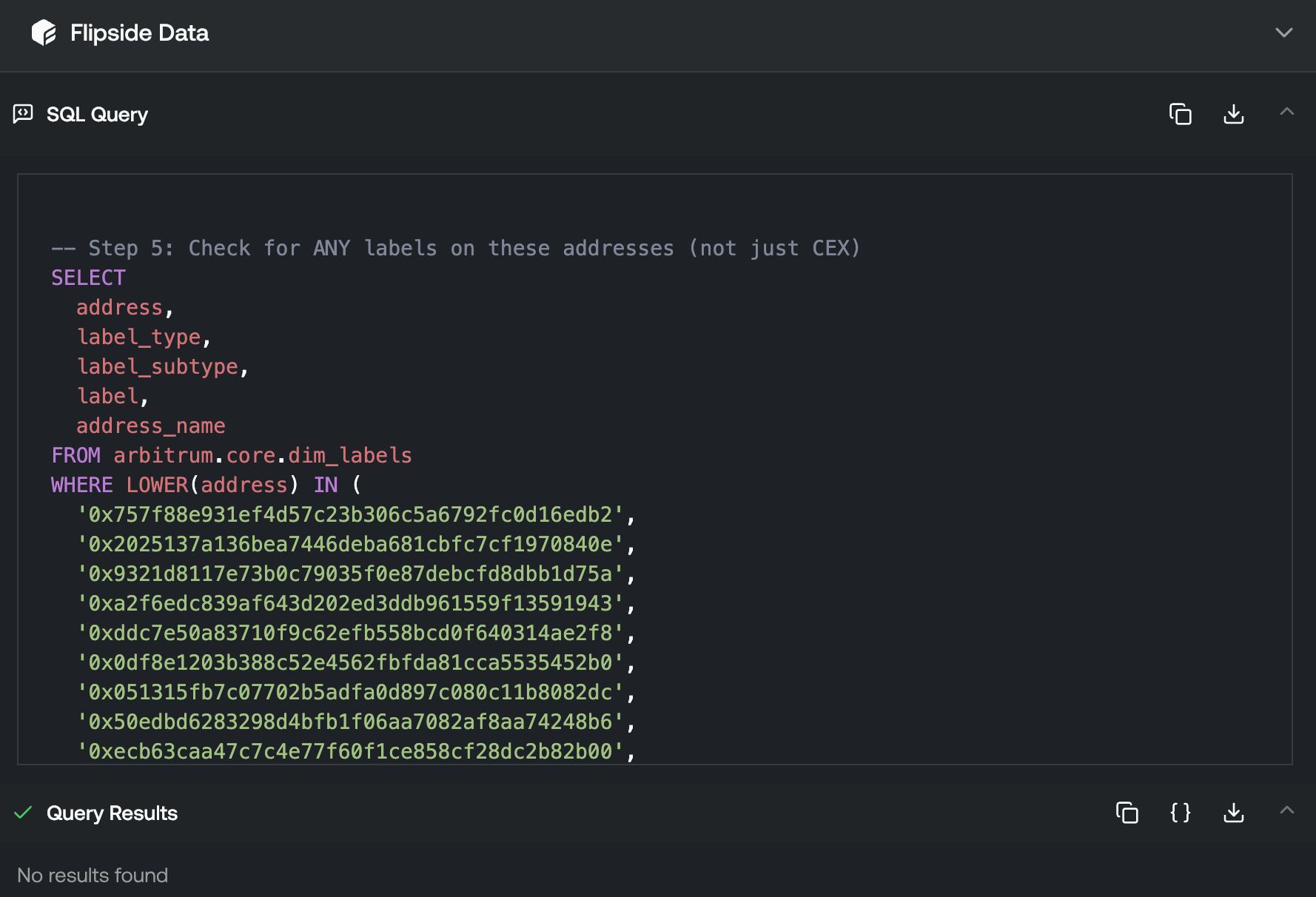

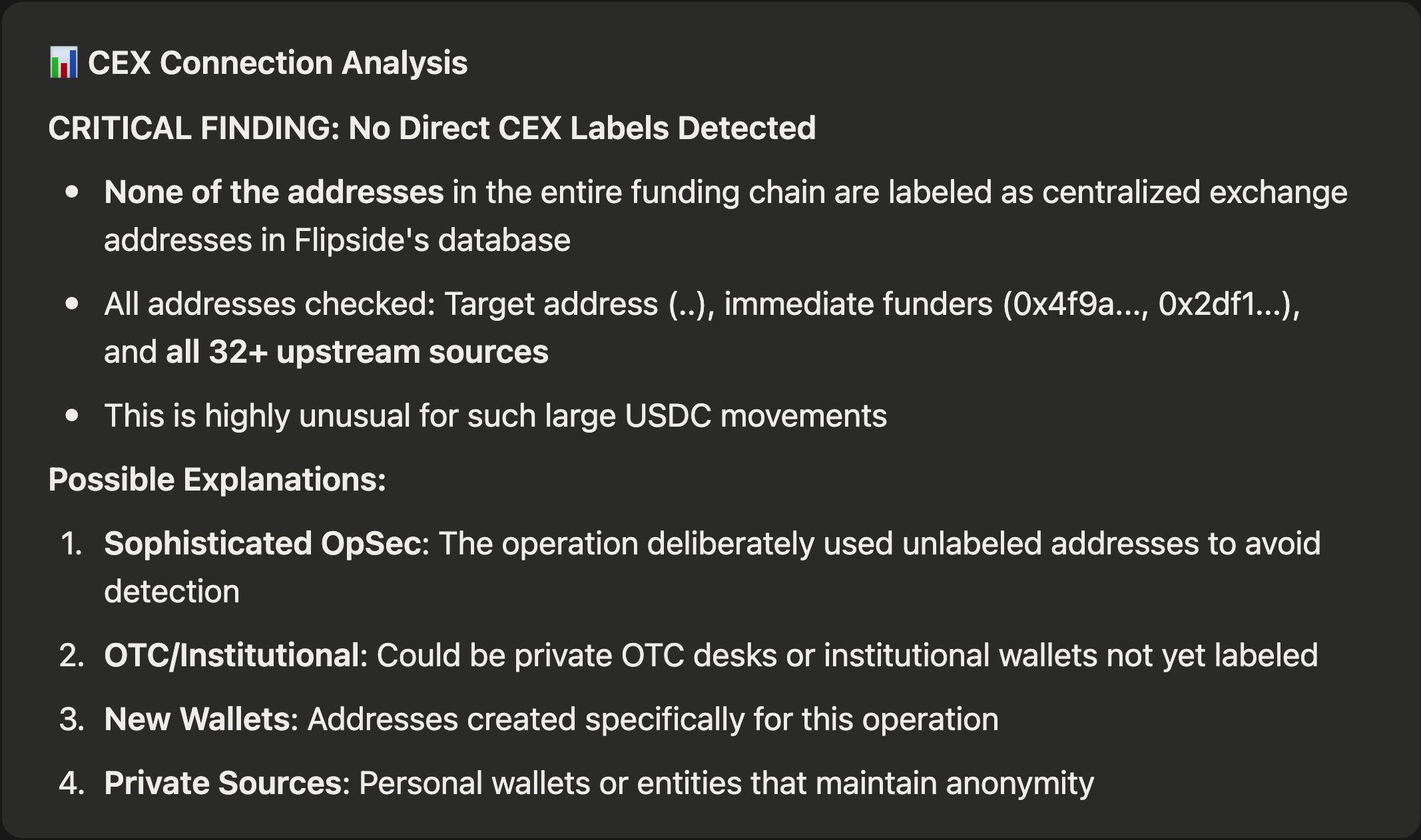

Then it checks if this address, along with a sample of other addresses who also sent to the Hyperliquid’s bridging deposit address 0x2df1... , are labelled in Flipside’s database as CEX. As shown below, none of the addresses can be mapped to a CEX label.

To be thorough, FlipsideAI checked if any labels could be mapped to these addresses, but still found none.

Based on the above logical deduction and checking, FlipsideAI has summarized the CEX connection analysis below:

As you can see, FlipsideAI checks thoroughly through its own logical reasoning to ensure nothing is missed. And when nothing is found, it doesn't hallucinate; it honestly summarizes the conclusion that no CEX connections were detected.

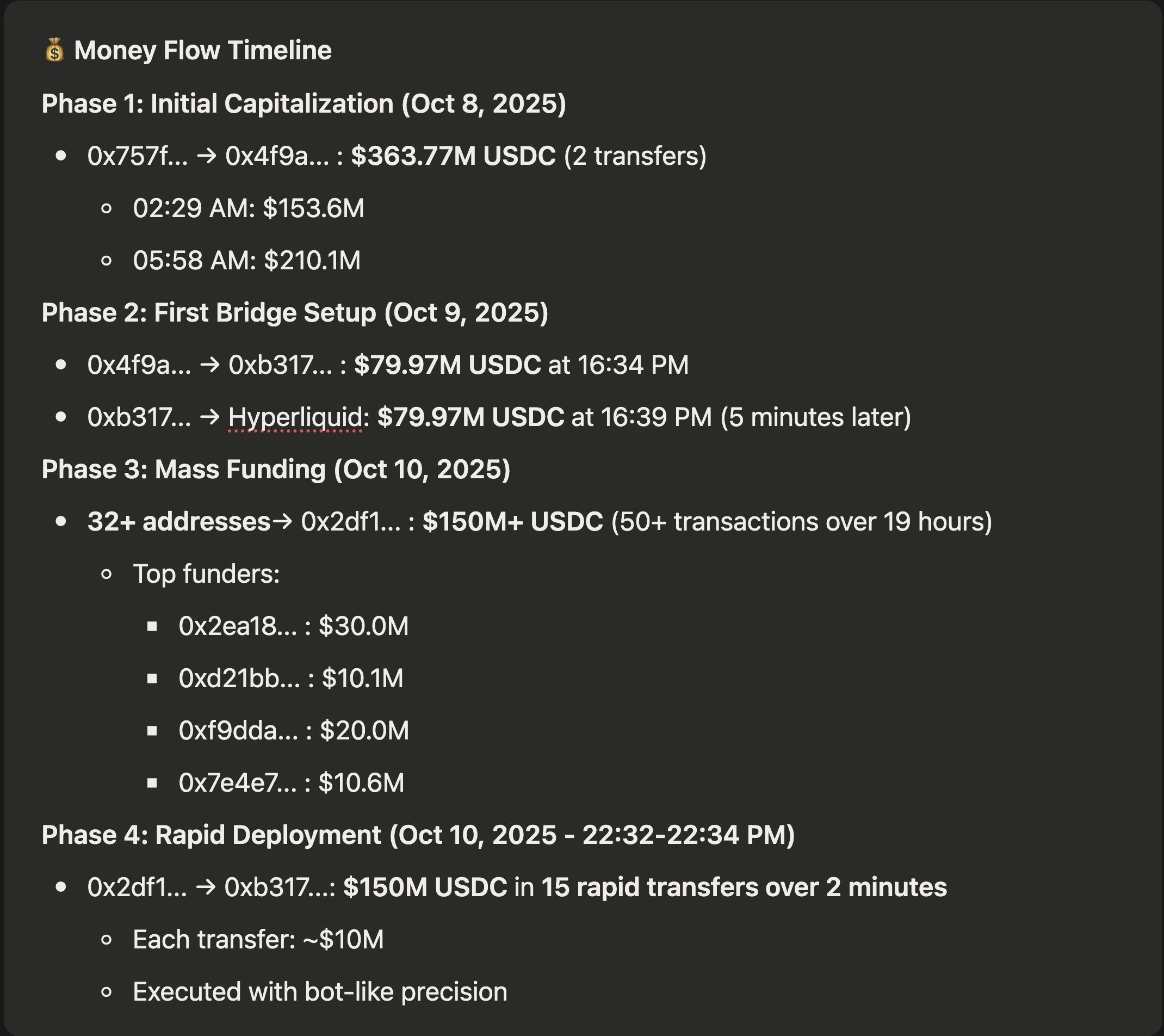

Connecting All Dots

FlipsideAI then compiled a comprehensive summary of the entire multi-step analysis, complete with a detailed money flow timeline to help users visualize the sequence of events that unfolded during this period.

This timeline traced the flow of funds from the earliest funding sources through intermediary wallets, culminating in the massive bridge transaction to Hyperliquid, providing a clear, chronological picture of the suspicious activity that supports the insider trading hypothesis.

By organizing all the data and findings into an easy-to-follow narrative with precise timestamps, transaction hashes and transaction amount in USD, FlipsideAI transforms vague news into actionable intelligence that anyone can understand and verify.

Your Turn: Start Your Own Research

Want to replicate this? FlipsideAI makes blockchain sleuthing accessible to everyone. No coding, no PhD in data science, just chat like you're talking to a savvy analyst. Here's how to get started:

- Sign Up (It's Free and Easy): Head to Flipside Crypto's homepage . Click "FLIPSIDEAI". You'll get instant access to 30+ blockchains, queries written for you and AI-powered insights with detailed analysis and dashboards. (Pro tip: Click on one of the chain’s logos, as shown in the screenshot below, to auto-generate a prompt for DeFi, NFTs, wallets, and more on that chain)

- Jump into the Chat: Once logged in, go straight to the AI Chat . Paste in a prompt like the ones above, or get inspired by their examples by clicking the “Explore all” button (stablecoin yields, token holder analytics, network metrics). Flipside handles the heavy lifting, querying terabytes of on-chain data and spits out tables, visuals, and next-step suggestions.

- Level Up Your Research:

- Explore pre-built dashboards for trends and reports.

- Chain prompts like we did: Start broad, then zoom in.

- Use @ in the chat to find datasets and workflows

- Export data for your own analysis (CSV, visuals, even SQL if you're feeling fancy).

- Ask FlipsideAI to make a dashboard from the analysis and publish it.

- Check out FlipsideAI's docs and tutorials for more pro tips.

Final Thoughts: Empowering the Crypto DYOR in You

In under 10 minutes, we went from "hmm, interesting article" to a full funding map of this Trump tariff insider trading saga. With FlipsideAI, you're not just reading the news, you're investigating it and doing your own research. Next time a headline piques your interest, skip the speculation: prompt, analyze, uncover.

The FlipsideAI platform democratizes on-chain intelligence, letting you verify claims, spot patterns, and stay ahead of the curve. What topics are you interested in researching? Let's DYOR together.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Prize pool of 60,000 USDT, “TRON ECO Holiday Odyssey” annual ecological exploration event is about to begin

TRON ECO is launching a major ecosystem collaboration event during Christmas and New Year, offering multiple luxurious benefits across the entire ecosystem experience!

Interpretation of the CoinShares 2026 Report: Bidding Farewell to Speculative Narratives and Embracing the First Year of Utility

2026 is expected to be the "year of utility wins," when digital assets will no longer attempt to replace the traditional financial system, but rather enhance and modernize existing systems.

Crypto Market Plummets as Fed’s Hawkish Stance Stuns Traders

In Brief Crypto market lost 3%, market cap fell to $3.1 trillion. Fed's hawkish rate cut intensified market pressure and volatility. Interest rate rise in Japan further destabilized crypto prices globally.