- Bitcoin options open interest reaches $63 billion

- Surge driven by bets on higher strike prices

- Bullish sentiment dominates the derivatives market

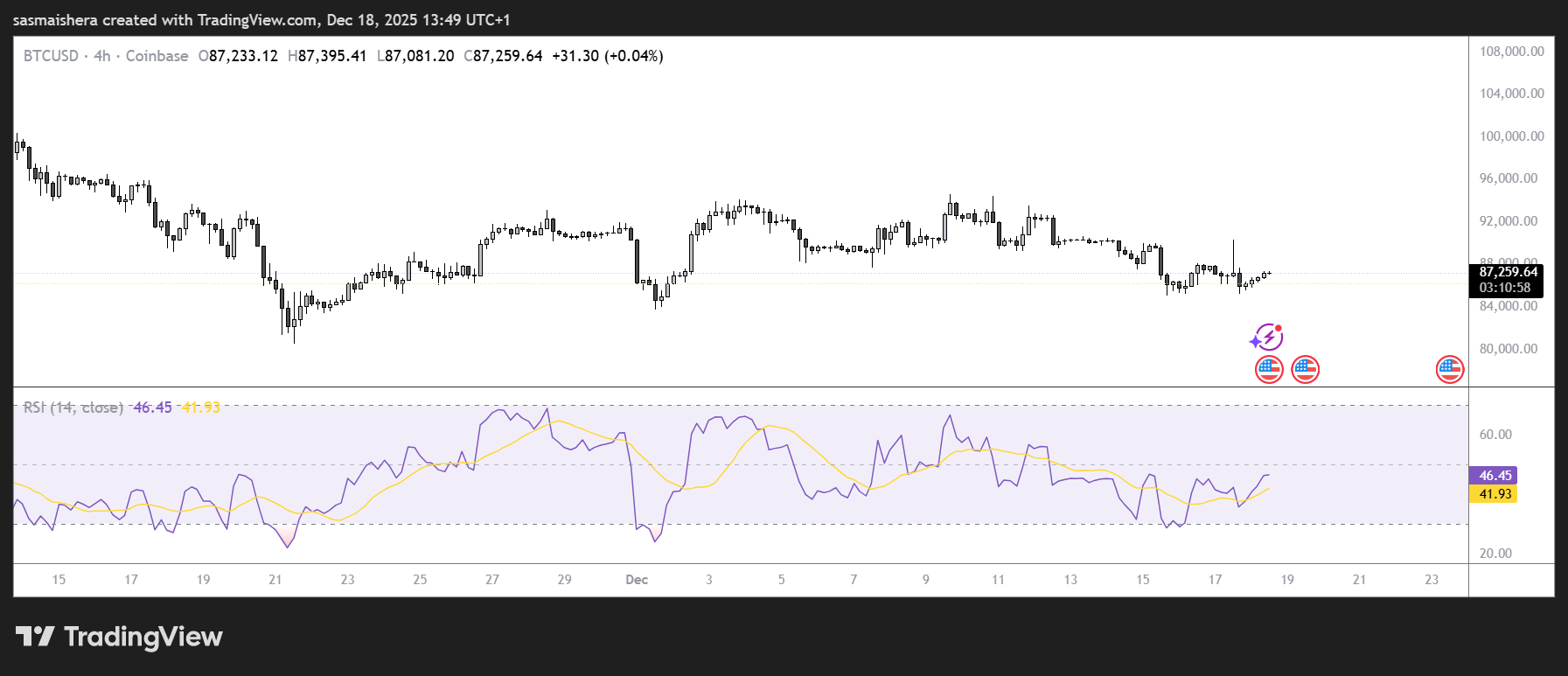

Bitcoin options open interest has hit an all-time high of $63 billion, according to the latest data from CoinGlass. This record surge highlights growing bullish sentiment in the crypto market , as traders are placing bets on higher strike prices for the leading cryptocurrency.

Options open interest refers to the total number of outstanding options contracts that haven’t been settled. A high open interest typically signals increased trading activity and strong investor confidence. What’s notable in this case is that most of the open interest is focused on call options with higher strike prices — indicating that traders are expecting Bitcoin to rise significantly in the coming weeks or months.

What Does This Mean for the Market?

The dominance of higher strike price options suggests that institutional and retail investors alike are anticipating another leg up in Bitcoin’s price. This bullish momentum comes amid growing optimism in the broader crypto market , fueled by macroeconomic factors, increasing institutional involvement, and potential regulatory clarity.

Analysts note that when open interest rises along with price, it typically supports the trend — and in this case, the trend appears upward. However, it’s also important to remember that options markets can be volatile, and sudden shifts in sentiment can lead to rapid changes in price dynamics.

A Sign of Strength in Crypto Derivatives

The record-setting Bitcoin options open interest also reflects the maturing of the crypto derivatives market. With more sophisticated trading instruments and increasing participation from traditional finance players, Bitcoin is no longer viewed solely as a speculative asset. Instead, it’s becoming an integral part of diversified investment strategies.

While risks remain, this spike in open interest suggests that many believe the Bitcoin rally isn’t over yet — and are positioning themselves for potential gains ahead.