COAI Surge Driven by Exchange Listings and Trading Leverage

- COAI price increase linked to new exchange listings.

- Intense trading brought a 16-25% price surge.

- No official statements from COAI leadership yet.

ChainOpera AI (COAI) witnessed a notable surge with a 42% increase today, trading in the range of $15–16.2 on Bitget and Gate.io, driving significant market attention.

The surge in COAI’s price highlights potential volatility in the cryptocurrency market, triggered primarily by recent exchange listings and leverage options, affecting trade dynamics and investor strategies.

The price of ChainOpera AI (COAI) has surged significantly due to various market factors. Recent exchange listings and increased trading options have played a crucial role in this development.

Various actions and trading strategies have been employed by investors, leading to this dramatic price surge. Key exchanges like Bitget and Gate.io have witnessed increased activity.

The immediate market impact of COAI’s price surge is notable, causing significant market attention. Trading volumes have reached exceptional levels, highlighting investor interest.

Financial implications include a sharp rise in trading volumes. This suggests renewed investor confidence and could potentially affect future trading strategies or market behaviors.

Despite the surge, no official comments have been released from COAI’s leadership. As volatility persists, traders remain watchful of future market movements and regulatory implications.

Historically, such surges result from key exchange expansions. Future implications include regulatory reviews and potential price corrections if market hype wanes. Trend analysis supports these expectations based on past rebounds.

As of the latest analysis, it seems there are no direct quotes or statements from any key players, executives, or market analysts regarding the price surge of ChainOpera AI (COAI), according to the available primary sources.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How iRobot Strayed from Its Original Path

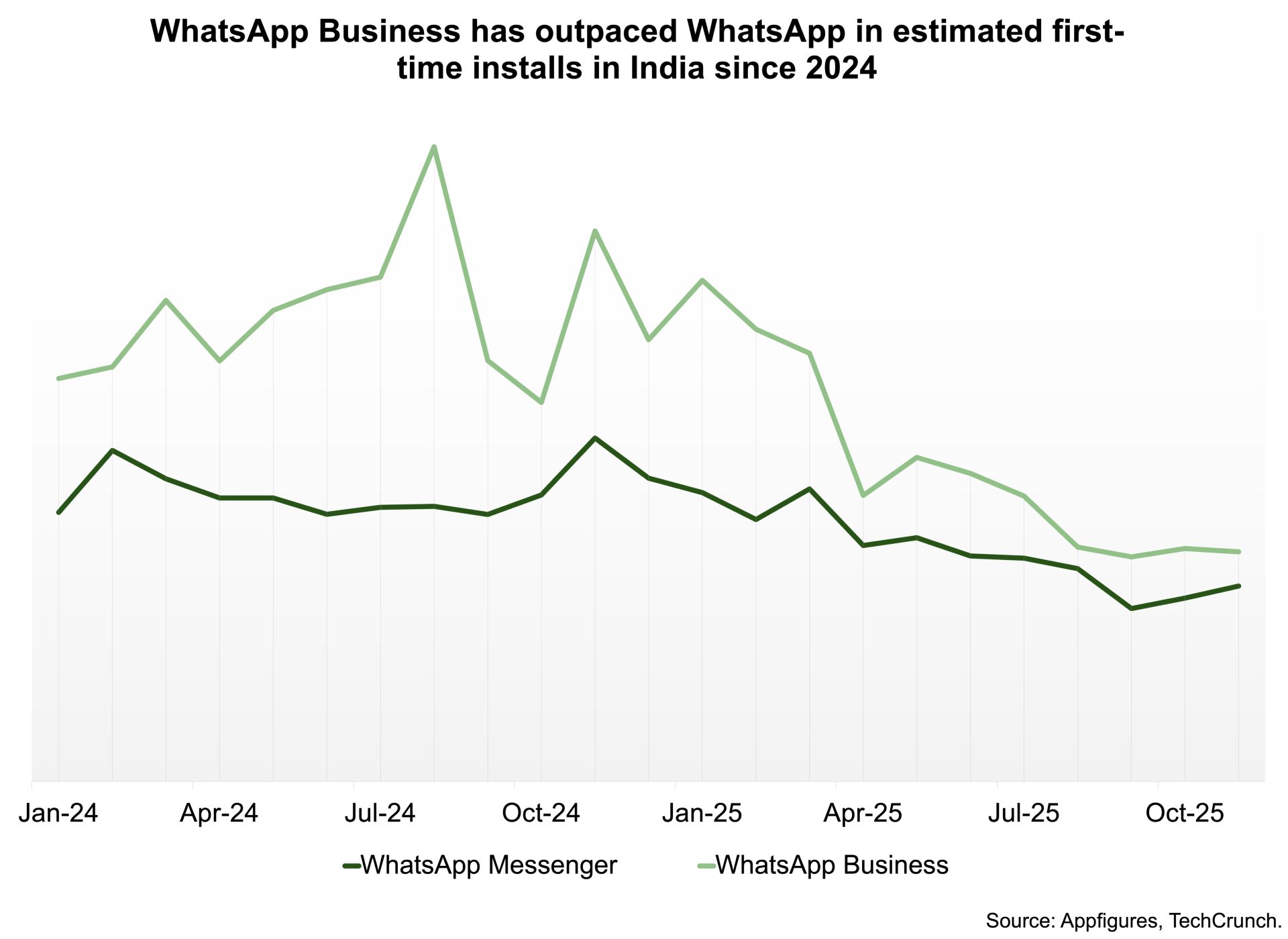

WhatsApp’s largest user base is now presenting its greatest challenge

Assessing Bitcoin’s Price Movement in Light of Macroeconomic Changes and Positive ETF Sentiment in November 2025

- Bitcoin faces macroeconomic headwinds in 2025, with Fed tightening causing a 15% crypto market cap drop, but ETF approvals drove 45% growth in institutional Bitcoin ETF AUM to $103B. - Institutional investors navigate $81k-$91k Bitcoin consolidation, balancing Fed policy risks against 68% adoption rates and regulatory clarity from EU MiCA and U.S. GENIUS Act. - Strategic entry strategies include core positions at $85k-$87k support, hedging with stablecoins/altcoins, and timing Fed rate cut expectations t

Moonbirds to launch BIRB token in early Q1 2026