CLAIM: Is the Bitcoin Price Following the Gold Chart 188 Days Behind? So, When It Catches Up to Gold, How Much Will the BTC...

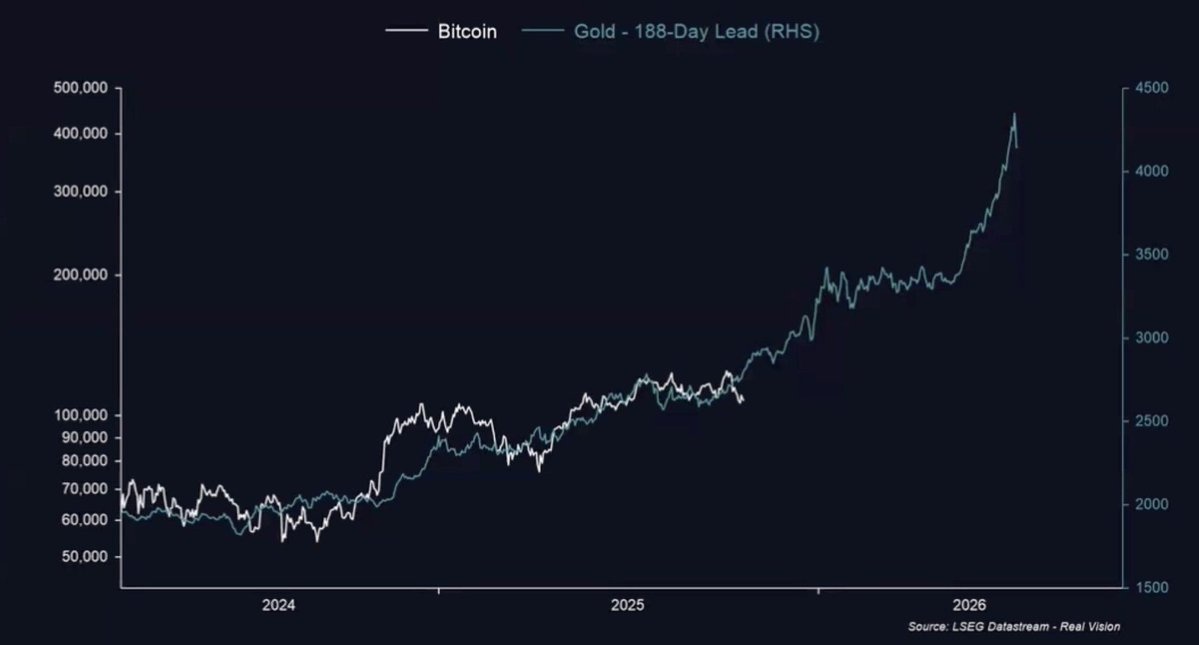

A recently shared chart claims that Bitcoin lags gold price movements by approximately 188 days.

According to analysts, this situation is considered a bullish signal for the cryptocurrency market.

The chart, based on LSEG Datastream and Real Vision data, compares Bitcoin and gold rates over the 2024–2026 period. Despite the time difference, Bitcoin's line is above gold's adjusted curve.

Amidst ongoing economic uncertainty, gold has risen 45% since the beginning of 2025, while Bitcoin has gained approximately 20% during the same period. However, analysts argue that the 188-day gap indicates an imminent acceleration in Bitcoin's price action.

This trend is also thought to be linked to the rise in institutional investment in Bitcoin ETFs. Analysts like Real Vision founder Raoul Pal frequently cite such historical correlations.

On the other hand, the correlation between Bitcoin and gold is only 0.09, indicating that Bitcoin still has a similar movement structure to technology stocks.

Considering the image shared by Real Vision, it is claimed that the BTC price may exceed $400,000 in 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Investing in People: Maximizing Returns from Higher Education in a Tech-Focused Economy

- Higher education ROI is shifting as tech-driven economies prioritize vocational training for faster, lower-cost career pathways. - Certificate programs show short-term financial gains over bachelor's degrees, but long-term returns favor traditional degrees according to Utah Foundation data. - Corporations now treat human capital as a strategic asset, investing in AI-driven training to bridge skill gaps in emerging fields like cybersecurity. - Macroeconomic growth relies on aligning education with tech de

Evaluating the Expansion Opportunities for EdTech within STEM and Technical Disciplines

- Global EdTech market grows to $907.7B by 2034 as STEM workforce gaps drive demand for AI, cybersecurity, and engineering skills. - Traditional academic programs struggle with declining enrollments and outdated curricula, while private-sector EdTech fills gaps through AI/VR training tools. - Investors target ETFs like EDUT/VGT and startups like Protege, leveraging federal grants and industry-academia partnerships to address 3.5M cybersecurity job shortages. - Underfunded academic programs and policy shift

Hyperliquid (HYPE) Price Rally: Unpacking the Institutional Liquidity Transformation in DeFi

- Hyperliquid (HYPE) drove 2025 DeFi institutional adoption via HIP-3 upgrades, slashing fees 90% and boosting TVL to $2.15B. - Strategic partnerships with Anchorage Digital and USDH stablecoin integrations enhanced institutional confidence in HYPE's compliance and liquidity. - Deflationary tokenomics (97% fee buybacks) and $340M buyback programs stabilized HYPE amid November 2025 price drops to $27.43. - Macroeconomic risks and token unlocks challenge HYPE's momentum, but USDH auctions and $1B public offe

PEPE Holds Tight Range Near $0.054 as Support and Resistance Limit Price Movement