Ethereum Updates Today: Institutions Accumulate as Market Uncertainty Looms—Ethereum’s $4K Recovery Faces a Pivotal Moment

- Ethereum faces critical juncture amid Hong Kong's first ETF approval injecting $141.66M and institutional buying of 63,539 ETH ($251M) by BitMine. - Analysts project $10K-12K 2025 target as Tom Lee's firm accumulates 2.73% supply, while technical indicators highlight $3,947-4,075 EMAs as key resistance. - Market remains divided: $4,075 breakout could trigger $4,476 rally, but breakdown risks testing $3,400 support amid $44B futures open interest and $97.6M October exchange outflows. - Institutional accum

Ethereum (ETH) is at a crucial crossroads as investors assess the impact of Hong Kong’s recent approval of its first spot

Hong Kong’s approval of the Ethereum ETF on October 21 brought $141.66 million in new capital, with major inflows from Fidelity’s FETH, BlackRock’s ETHA, and Grayscale. Still, this positive trend was offset by a wider sell-off, as TradingView also reported that Ethereum ETFs worldwide saw $145.6 million in outflows on October 20. Meanwhile, institutional investors such as BitMine took advantage of the price drop, purchasing 63,539 ETH (valued at $251 million) from platforms like Kraken and BitGo, according to a

Technical analysis shows Ethereum consolidating near important exponential moving averages (EMAs), with the 20-EMA at $3,947 and the 100-EMA at $4,075 serving as significant resistance, according to a

Despite recent swings, Ethereum has gained 18.35% so far this year, demonstrating resilience even as it remains 20.12% below its record high of $4,955.23, based on

Experts remain split on Ethereum’s near-term direction. A move above $4,075 could spark a rally toward $4,476 or higher, while a drop below $3,750 may lead to a test of support at $3,400–$3,450, as noted by CoinEdition. With

As these factors play out, Ethereum’s ability to maintain levels above $3,850 will be key. A sustained recovery could revive bullish sentiment, supported by broader economic trends and growing institutional involvement.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How iRobot Strayed from Its Original Path

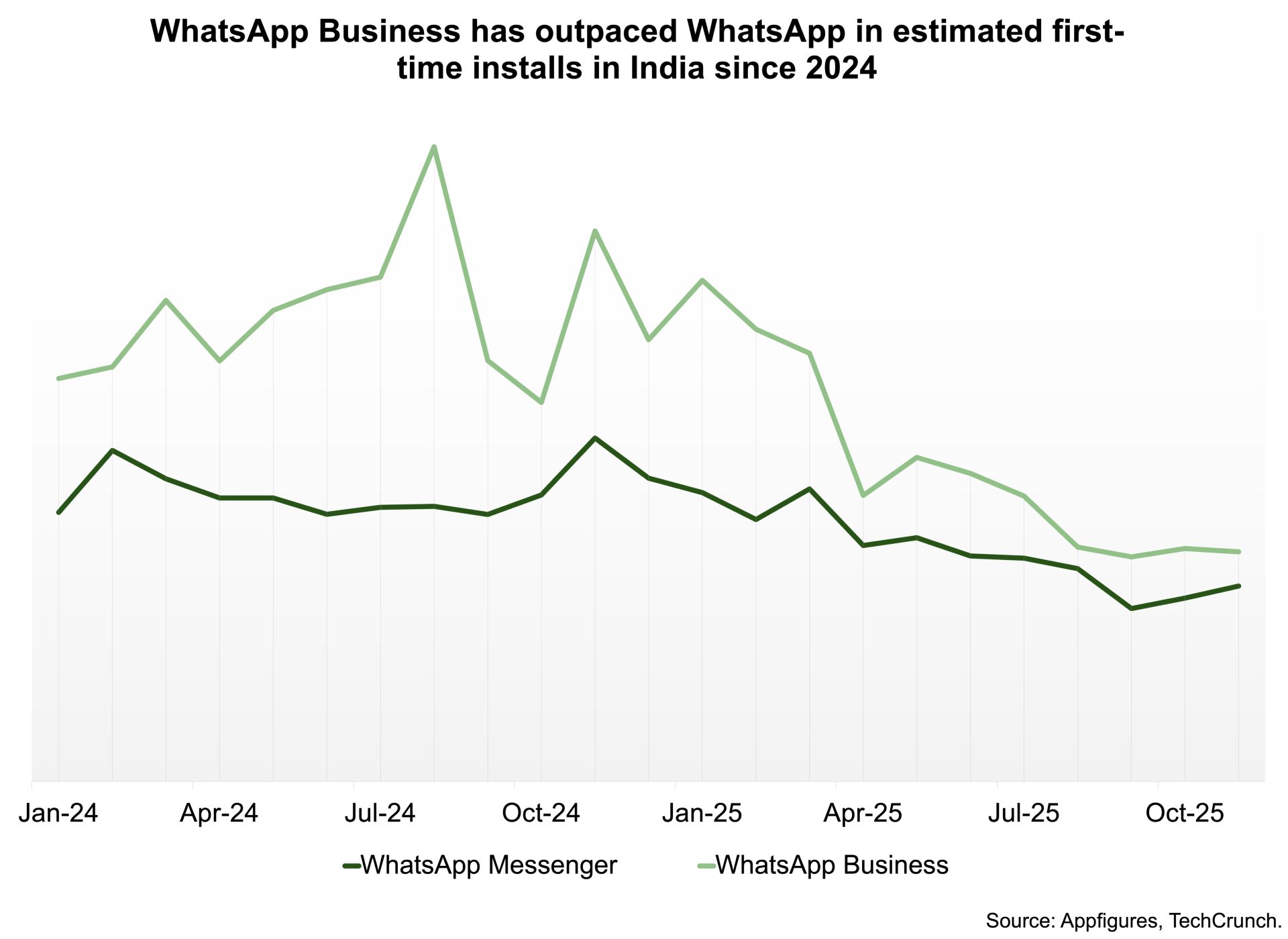

WhatsApp’s largest user base is now presenting its greatest challenge

Assessing Bitcoin’s Price Movement in Light of Macroeconomic Changes and Positive ETF Sentiment in November 2025

- Bitcoin faces macroeconomic headwinds in 2025, with Fed tightening causing a 15% crypto market cap drop, but ETF approvals drove 45% growth in institutional Bitcoin ETF AUM to $103B. - Institutional investors navigate $81k-$91k Bitcoin consolidation, balancing Fed policy risks against 68% adoption rates and regulatory clarity from EU MiCA and U.S. GENIUS Act. - Strategic entry strategies include core positions at $85k-$87k support, hedging with stablecoins/altcoins, and timing Fed rate cut expectations t

Moonbirds to launch BIRB token in early Q1 2026