Dogecoin News Today: Dogecoin's Foray into Football Seeks to Drive Practical Use Despite Ongoing Price Challenges

- Dogecoin (DOGE) faces bearish pressure near $0.20 resistance, with sellers dominating amid failed breakouts and macroeconomic headwinds. - Technical indicators signal oversold conditions, while $0.194–$0.196 support zone could trigger rebounds or deeper corrections. - House of Doge's acquisition of Italian football club Triestina aims to boost real-world adoption via DOGE payments for tickets and merchandise. - Market remains divided: $0.20 retest could reignite bullish momentum, while breakdown below $0

Dogecoin Bears Strengthen Hold, But This Support Area Suggests Possible Turnaround

Dogecoin (DOGE) has entered a period of downward consolidation, with sellers maintaining control near the $0.20 resistance after several unsuccessful breakout attempts, as highlighted by

Technical signals continue to indicate a bearish trend, with the Relative Strength Index (RSI) and momentum indicators approaching oversold levels. The price has been restricted to the $0.204–$0.197 range between October 20 and 21, characterized by significant afternoon trading and algorithm-driven liquidations below $0.20, as reported by Coindesk. Should the price fall below $0.194, it could test major support at $0.187, the previous month's base, while a decisive move above $0.201 with strong volume could point to a short-term recovery, according to

Increased volatility across the crypto sector has intensified DOGE’s challenges. Bitcoin’s recent climb to $112,000, as mentioned in

Despite the negative market environment, a recent initiative by the

Opinions remain divided regarding DOGE’s short-term prospects. Some experts warn of a potential “death cross” on the daily chart, according to CoinMarketCap, while others emphasize the importance of the $0.195 support as a pivotal level. A sustained move above $0.20 could revive buying momentum, with targets of $0.25–$0.30 if macro conditions improve, as Coinpedia suggests. On the other hand, a drop below $0.16 may lead to a retest of the $0.13 lows, based on

With

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

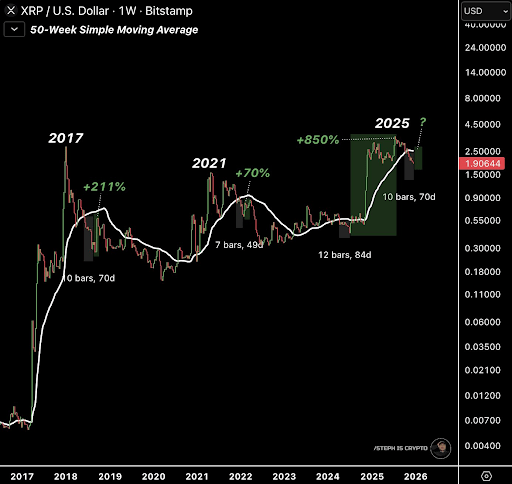

XRP Enters Historical Window That Has Previously Led To Triple-Digit Rallies

Which Cryptocurrency Has the Most Active Wallets? The List is Out, and Bitcoin Isn’t Number One

Leading Solana treasury Forward Industries tokenized FWDI stock via Superstate

Forward Industries brings FWDI shares to Solana: a revolution for decentralized finance