Bitcoin Updates: JPMorgan's Decision: Using Bitcoin as Collateral Marks a Change in Traditional Finance

- Bitcoin's $108,200 price consolidates post-$125,000 peak, with technical indicators like golden crosses signaling potential $130,000 surges. - JPMorgan's 2025 policy shift allows Bitcoin/Ethereum as loan collateral, bridging TradFi and crypto by treating digital assets as legitimate balance-sheet instruments. - 70% of institutional investors now view crypto as viable asset class, with Standard Chartered's $200,000 price prediction and ETF inflows reinforcing bullish macroeconomic trends. - Bitcoin outper

Bitcoin Demonstrates Strength Amid Market Swings

Despite ongoing macroeconomic uncertainty, Bitcoin has maintained impressive stability, with both technical signals and institutional moves contributing to a cautiously positive outlook. As of October 22, 2025,

Institutional trust in Bitcoin is on the rise, highlighted by

Recent market activity further highlights Bitcoin's robustness. Even after a record $19 billion in liquidations late in October, which drove prices to a four-month low of $104,000, Standard Chartered's Geoff Kendrick remains optimistic. He forecasts that Bitcoin could climb to $200,000 by year-end, fueled by ETF inflows and macroeconomic developments, according to

Bitcoin has also outperformed gold in recent weeks. While gold struggled due to concerns about overcrowded trades—evidenced by long queues for physical gold in Sydney—Bitcoin posted its strongest gain since April, according to

Technical analysis continues to support the case for Bitcoin's resilience. The cryptocurrency has bounced back from key support zones, such as the 200-day moving average and the lower boundary of a three-month trading range, according to

The intersection of positive technical signals, growing institutional participation, and favorable macroeconomic conditions suggests a maturing market. As JPMorgan's collateral program and ETF inflows gather pace, Bitcoin's place in institutional portfolios is shifting from speculative bets to strategic holdings. With volatility still a defining feature of the sector, the coming weeks will reveal whether the current consolidation leads to a sustained rally or a deeper correction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

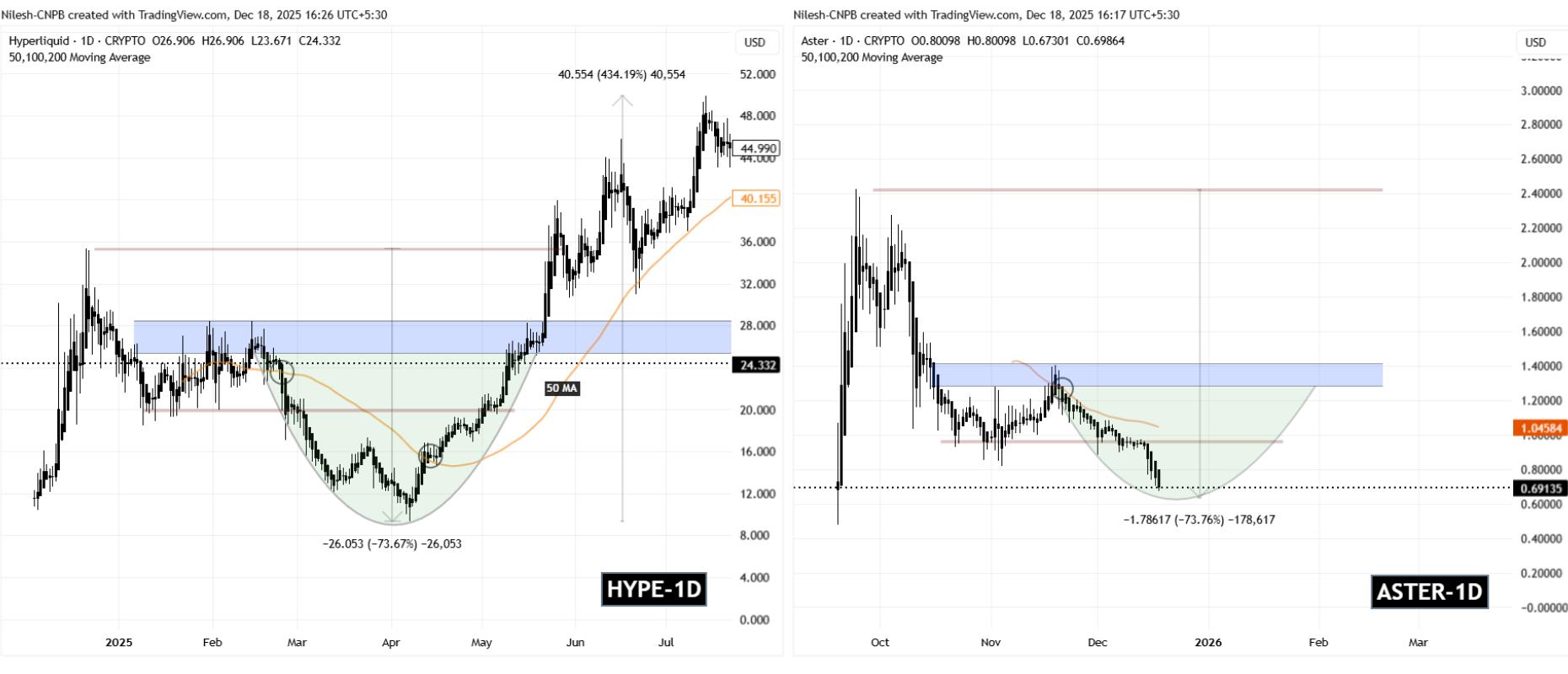

Is Aster ($ASTER) Nearing a Potential Bottom? A Key Emerging Fractal Suggests So!

XRP Algorithmic Trading Hits US Retirement Accounts with Digital Wealth Partners

Indian MP Proposes Bill for Asset Tokenization via Blockchain

Ethereum’s Future Gas Limit Increase: Rumors and Realities