Bitcoin News Update: MoonBull's Tokenomics Shake Up the Market While BTC and SOL Continue to Lead

- MoonBull ($MOBU) presale hits $0.00006584, raising $450K with 1,500+ holders via 27.4% stage-based price growth. - Mobunomics framework allocates 5% per transaction to liquidity, rewards, and burns, creating scarcity and 95% APY staking incentives. - Project gains traction amid $587M crypto VC funding surge, contrasting with BTC/SOL's market dominance through meme-driven community governance. - 48-hour liquidity locks and Ethereum audits bolster stability, with analysts labeling it "best crypto to buy in

HONG KONG - MoonBull ($MOBU) has rapidly gained attention, amassing over $450,000 in funds and drawing in more than 1,500 investors. Thanks to its organized, community-focused strategy, the project has emerged as a strong competitor in the crypto space, where

The Mobunomics system behind the token—which combines liquidity, holder rewards, and deflationary burns—has sparked considerable interest. Each transaction sends 2% to liquidity, 2% as passive income for holders, and 1% is permanently removed from circulation, increasing scarcity. With a two-year liquidity lock and staking rewards offering 95% APY, MoonBull has become an attractive option for those seeking substantial returns, as noted in a

MoonBull’s ascent comes as crypto venture capital activity intensifies. Just this week, $587.92 million was invested across 22 different projects, including Coinbase’s $375 million purchase of the on-chain investment platform Echo and Pave Bank’s $39 million Series A, as reported by

While MoonBull draws speculative interest, Bitcoin and Solana continue to serve as foundational assets. BTC’s enduring strength and institutional uptake provide stability for the market, while Solana’s fast network and growing DeFi landscape enhance its attractiveness. Still, MoonBull’s distinctive mix of meme-inspired community involvement and practical tokenomics has set it apart. Experts point to its referral incentives and governance system—which lets holders vote on project matters—as key differentiators in a crowded field, according to a

After launch, MoonBull’s stability measures include a 48-hour liquidity lock, a 60-minute delay on claims to reduce volatility, and smart contract audits on Ethereum, as detailed by GlobeNewswire. The project’s governance protocol, where each token equals one vote, further empowers the community and aligns development with their interests, as outlined in a

As the project develops, investors are watching for the $0.00009033 mark. For now, MoonBull’s rapid ascent demonstrates the market’s appetite for new ideas, even as

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

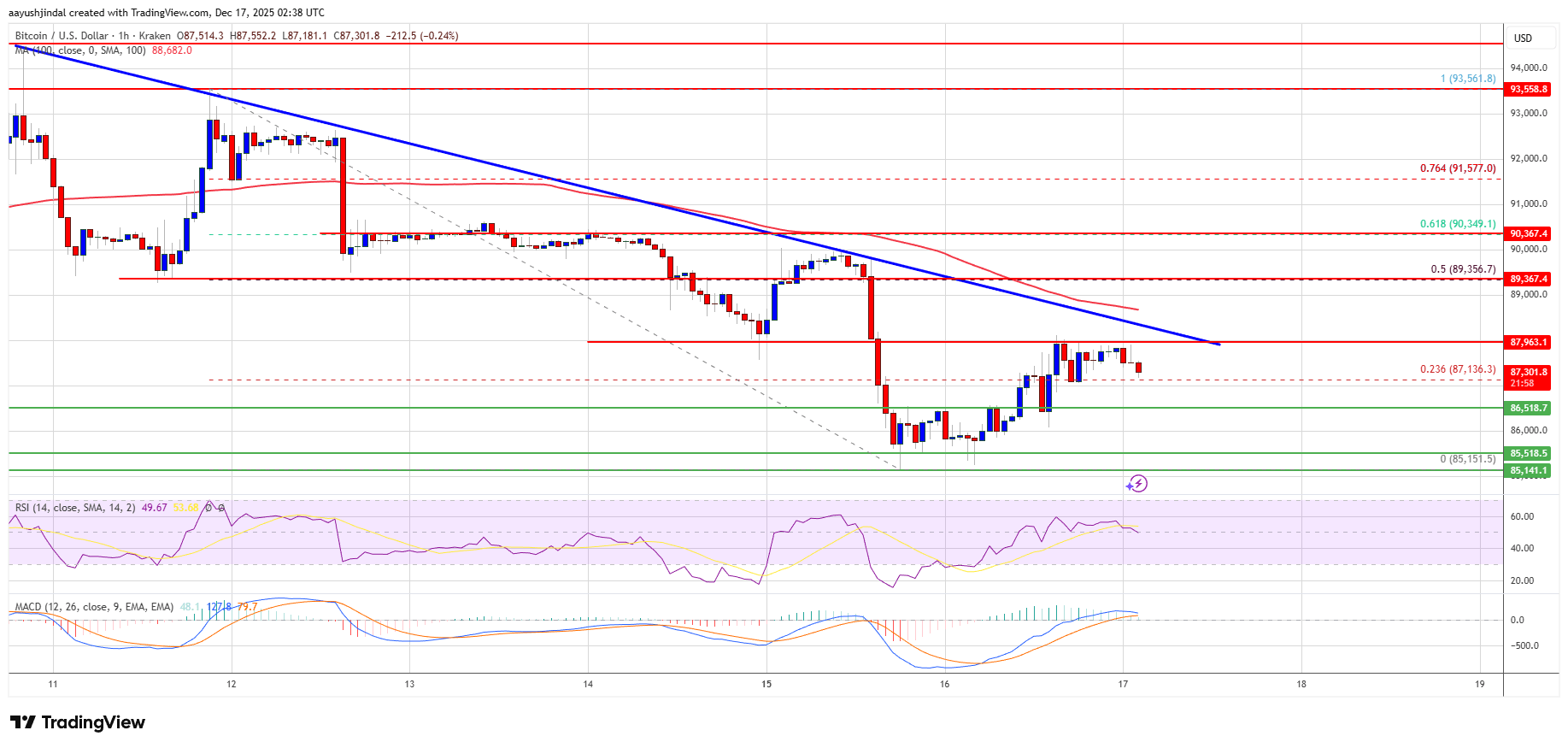

Bitcoin Price Regroups After Losses—Is Directional Break Near?

Bitcoin’s Quantum Leap: Saylor Says Upgrades Harden Security, Reduce Supply, and Freeze Lost Coins