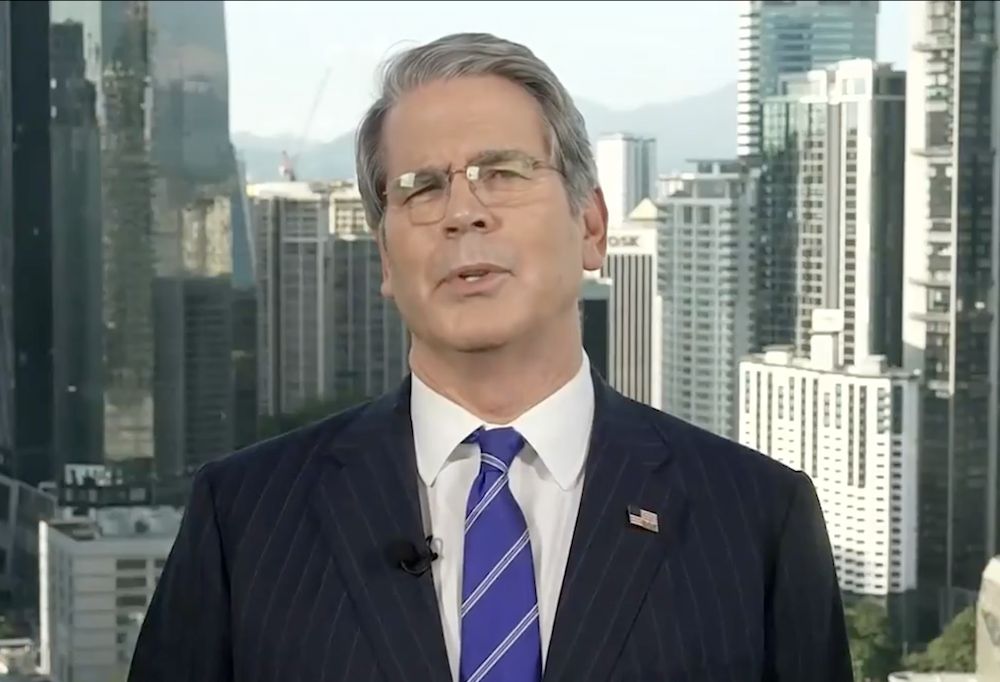

US Treasury chief Bessent says 'substantial' trade framework with China reached

United States Treasury secretary Scott Bessent said on Sunday that the US and China have made “substantial” progress on a trade deal framework, sparking investor hopes of reigniting the bull market.

The proposed trade framework will likely remove the need for the 100% additional tariffs announced by US President Donald Trump on October 10, Bessent said. He added:

"President Trump gave me a great deal of negotiating leverage with the threat of 100% tariffs on November 1, and I believe we have reached a very substantial framework that will avoid that and allow us to discuss many other things with the Chinese."

Bessent’s comments follow weeks of easing trade tensions between the two countries, culminating in president Trump confirming the meeting with China’s President Xi Jinping at the Asia-Pacific Economic Cooperation (APEC) summit on October 31.

President Trump previously said there was “no reason” to meet with representatives from China, sparking investor fears of a new protracted trade war between the two countries.

Crypto investors, traders, and industry executives celebrated news of the trade framework and the increased likelihood of a deal between the US and China, as crypto markets experienced a modest rally on the positive trade deal news.

Related: Crypto traders blame Trump’s tariffs in search of ‘singular event’: Santiment

Crypto markets rally as traders and investors celebrate trade framework

Crypto markets are sensitive to trade war developments, rallying when news is positive and declining when trade tensions erupt or global trade is disrupted.

President Trump’s social media post on October 11, announcing additional 100% tariffs on China, ignited a crypto market meltdown that saw some crypto tokens lose up to 99% of their value in 24 hours.

Bitcoin (BTC) rallied by a modest 1.8%, Ether (ETH) pumped by 3.6%, and SOL (SOL) rose by 3.7% following Bessent’s announcement on Sunday.

Jeff Park, an advisor at investment company Bitwise, said the positive trade deal news will send BTC and gold to new all-time highs.

“Asset prices will get crazy this week if the US-China trade deal is announced and the Fed cuts interest rates. Buckle up,” investor and analyst Anthony Pompliano also said.

Magazine: Hong Kong isn’t the loophole Chinese crypto firms think it is

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Give Nokia 1 billion, Jensen Huang wants to earn 200 billions

Jensen Huang unveiled some major announcements at the 2025 GTC.

When AI Agents Learn to Make Autonomous Payments: PolyFlow and x402 Are Redefining the Flow of Value on the Internet

x402 has opened the channel, while PolyFlow extends this channel to the real business and AI Agent world.

PolyFlow integrates x402 protocol to drive the next-generation AI Agent payment revolution

PolyFlow's mission is to seamlessly connect traditional systems with the intelligent world through blockchain technology, gradually reshaping everyday payments and financial activities to make every transaction more efficient and trustworthy—making every payment more meaningful.

BNB Price Chart Targets $10,000 as Macro Bull Run Strengthens in 2025