PayAI surpasses PING! x402 ecosystem value anchor shifts

The "doer" PayAI breaks through.

The "pragmatist" PayAI breaks through.

Written by: KarenZ, Foresight News

In the ever-changing competition of the cryptocurrency market, a striking reversal has just occurred within the x402 ecosystem.

Last week, PING, once regarded as the "star token" of the x402 protocol, has been surpassed in market cap by the payment infrastructure of the x402 protocol. According to the latest data, PayAI’s market cap surpassed $50 million this morning, increasing more than 10 times in just 4 days. Meanwhile, after an initial surge, PING has undergone a correction and now has a market cap of $34 million.

This is not just a competition between two projects, but a pivotal moment for the entire x402 ecosystem and even the decentralized payment infrastructure sector, marking a shift from hype to utility.

PING's Highlight Moment and Predicament

PING, as the first token issued on Base via the x402 protocol, experienced its "highlight moment" last week, surging more than 20 times in just two days from October 23 to 24, with its market cap once exceeding $80 million.

This exponential growth attracted a large number of industry investors and brought unprecedented market attention to the x402 protocol itself, successfully opening a traffic gateway for this emerging sector.

However, hype without value support is ultimately unsustainable. In essence, PING is a pure Memecoin, with neither practical application utility nor real use cases, and has even been likened by some community users to "inscription"-type assets — its price increase is driven more by market speculation than by value creation, making it a typical traffic dividend frenzy rather than long-term growth based on value.

PayAI Breaks Through: The "Pragmatist" of x402 Infrastructure

In sharp contrast to PING’s speculative nature, PayAI, as an x402 protocol Facilitator, has broken through with a clear infrastructure positioning and practical value, becoming the core target as ecosystem value shifts.

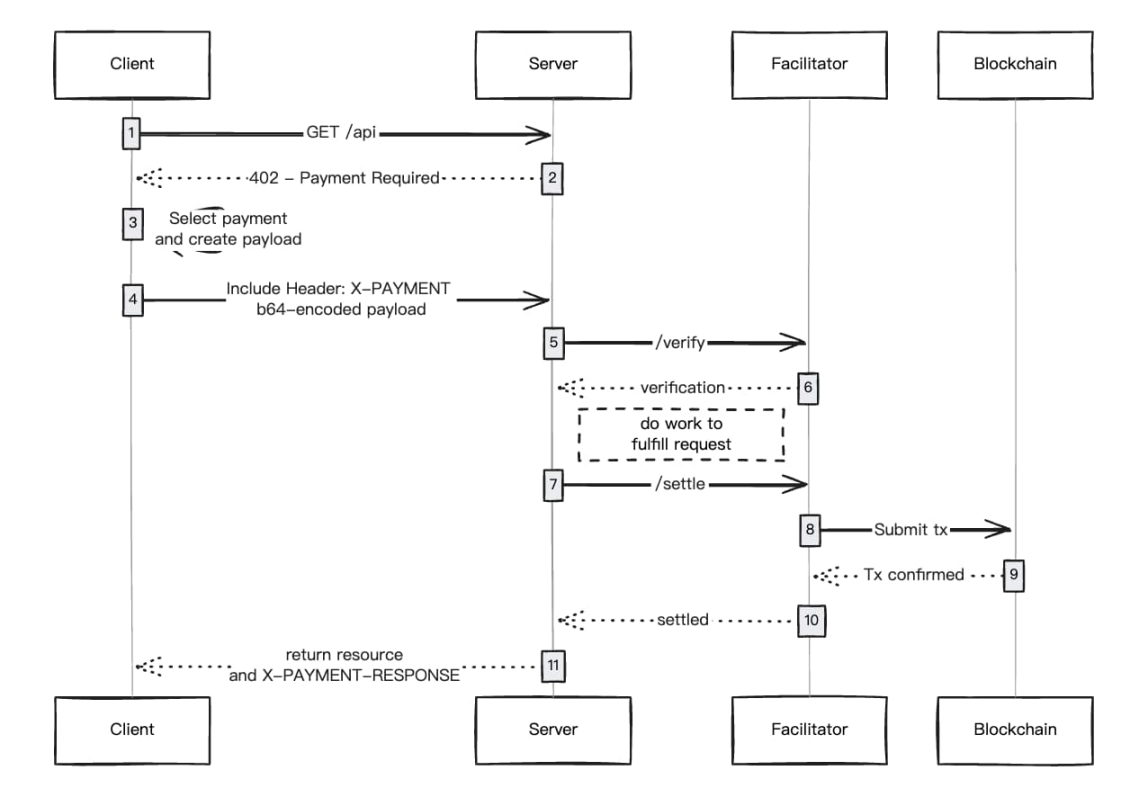

What is an x402 Facilitator? x402 Facilitators are service providers that support processing x402 payments on Solana and EVM networks, offering unified endpoint access to verify and settle on-chain payments for HTTP resources under the x402 protocol.

These Facilitators form the core infrastructure layer of the x402 payment ecosystem, responsible for using the x402 protocol to verify and settle on-chain payments for HTTP resources:

- Support for different blockchain networks (such as Solana, Base, etc.).

- Facilitators are responsible for network fees and handling verification/settlement.

- No API key required. Plug and play.

- Designed for both human and agent use cases, from pay-per-use APIs to AI agents, enabling payment settlement within one second after blockchain confirmation.

From the x402 payment process logic, the client calls the protected resource and constructs a payment payload; the Resource Server publishes payment requirements, verifies/settles payments, and fulfills requests; the Facilitator server verifies the payment payload and executes settlement via standard endpoints; finally, the blockchain network executes and confirms the payment.

Eating into Coinbase's Share, Becoming the Second Largest Facilitator in the x402 Ecosystem

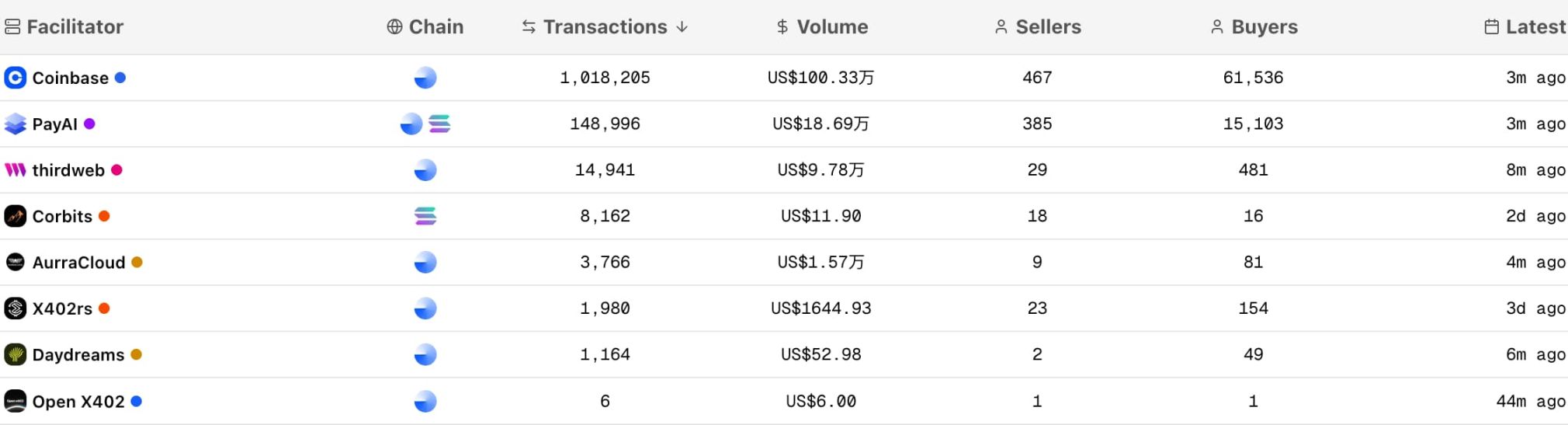

This role makes Facilitators the most valuable participants in the x402 ecosystem. Among these x402 Facilitators, PayAI is gradually eroding Coinbase’s dominance. According to x402scan data, PayAI has now processed over 14% of x402 transaction volume, making it the largest Facilitator after Coinbase. In contrast, Coinbase’s market share has dropped from its early absolute dominance to about 77%.

Chart source: x402scan

From the perspective of ecosystem participants, the number of PayAI sellers has reached over 82% of Coinbase’s, and the gap continues to narrow.

In the x402 ecosystem, sellers are the service providers who monetize APIs or content. The x402 protocol provides them with a "frictionless micropayment monetization" solution — enabling them to receive income directly from customers through programmable payments, without mandatory subscriptions or advertising.

The scale of sellers directly determines the market potential of the x402 ecosystem: more quality sellers mean buyers have richer choices, which attracts more traffic, forming a positive cycle of "more sellers → more buyers → ecosystem prosperity." PayAI’s rapid penetration on the seller side is laying a solid foundation for its ecosystem status.

PayAI Tokenomics and Utility

Regarding PayAI tokenomics, the total token supply is 1 billion, with all tokens in circulation at launch.

The PayAI team will purchase 20% of the token supply at launch and transfer it to the project treasury. These funds will be used for operations, marketing, and future token releases, such as community rewards and partnerships. Specifically, half of the treasury tokens will provide liquidity to generate fees, while the other half will vest linearly over one year.

So what is the utility of the PAYAI token? According to the official documentation, the expected uses of PAYAI include:

- Reducing platform fees when executing service contracts between AI agents.

- Increasing the visibility of buyer or seller agent listings.

- Participating in future platform governance (e.g., voting on feature proposals, agent ratings).

- Paying arbitration fees in dispute resolution (to be launched in the future).

In-depth Reflection

The ebb and flow of PING and PayAI’s momentum actually reflects an important issue: the x402 ecosystem is moving from concept to reality, from hype to utility.

The first issued token, PING, enjoyed a "dividend premium," which is a common market psychology. But as the market cools, investors begin to ask: What exactly am I investing in? If PING is just an inscription-style minting game, then its value foundation is very weak.

In contrast, PayAI, as a payment infrastructure x402 Facilitator, anchors itself to the two core values of "transaction flow" and "ecosystem rigid demand," demonstrating the project’s fundamental value with actual market share and application scenarios, and thus naturally gaining continuous capital recognition.

In this process, we have seen further maturity in the x402 field—market participants are beginning to determine project status based on actual transaction flow and fundamental value, rather than blind hype. This is undoubtedly a positive signal for the entire x402 ecosystem and the open payment ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?