Fed and ETF Boost Cryptocurrency Market! Institutional Investors Sell Ethereum (ETH), Rush to Bitcoin and These Two Altcoins!

This week, Bitcoin and altcoins are focused on the Fed's October interest rate decision and the meeting between US President Donald Trump and Chinese President Xi Jinping.

At this point, while it is almost certain that the FED will cut interest rates by 25 basis points, BTC and the market started the critical week with an increase.

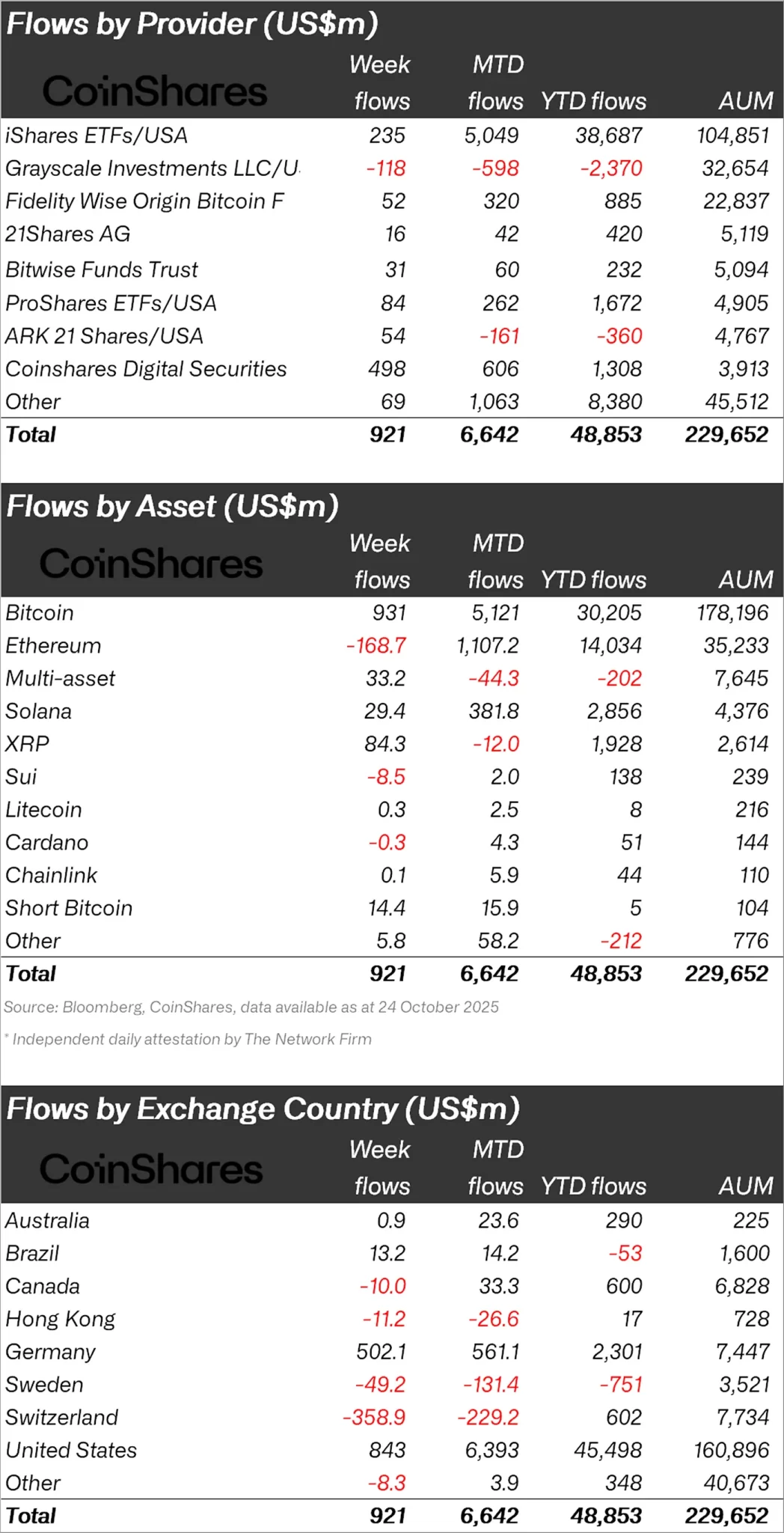

As investors continue to closely monitor market developments with the recovery, CoinShares released its weekly cryptocurrency report and stated that $921 million in inflows occurred last week.

“Following lower-than-expected US Consumer Price Index (CPI) data, investor confidence increased, resulting in an inflow of $921 million into cryptocurrency investment products.”

Bitcoin Enters, Ethereum Exits!

When looking at individual crypto funds, it was seen that the majority of inflows were in Bitcoin.

While Bitcoin experienced an inflow of $931 million, Ethereum (ETH) experienced an outflow of $168.7 million.

When we look at other altcoins, Solana (SOL) experienced an inflow of $29.4 million and XRP $84.3 million, while Sui (SUI) experienced an outflow of $8.5 million.

“A total of $931 million inflows have been made into Bitcoin, bringing cumulative inflows since the US Federal Reserve (Fed) began cutting interest rates to $9.4 billion.

Ethereum saw total outflows of $169 million for the first time in 5 weeks, and daily outflows remained stable throughout the week.

Solana and XRP saw outflows of $29.4 million and $84.3 million, respectively, ahead of their US ETF launches.

When looking at regional fund inflows and outflows, the USA ranked first with an inflow of $843 million.

Following the USA, Germany had an inflow of $502 million and Brazil $13.2 million.

In the face of these inflows, Switzerland experienced an outflow of $358.9 million and Sweden $49.2 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AI’s Rapid Expansion: The Drive for Innovation Amidst Financial and Practical Challenges

- Global investors are prioritizing AI-driven opportunities amid economic uncertainties, with South Africa's $57.76M inflation-linked bond auction signaling confidence in its fiscal resilience despite high debt-to-GDP ratios. - Coca-Cola HBC's $3.4B Africa acquisition highlights the continent's growing appeal, though labor concerns persist, while Innodata Inc. saw 79% YoY revenue growth in Q2 2025 from AI diagnostics and cloud services. - Mastercard and PayPal's AI-powered payment partnership aims to enhan

BNB News Update: River's Auction: Token Worth Determined by Market Forces, Not by Teams

- River launches 48-hour Dutch auction for River Pts, shifting to market-driven token valuation via time-declining pricing. - Auction builds on 5,300% DEX surge for River Pts and $10 all-time high for $RIVER, with 1M tokens valued at ~$34K. - Funds will boost liquidity, $RIVER buybacks, and DAO governance while avoiding dilution through team-reserved supply. - Strategy aligns with crypto trends like GIC's $1B+ private equity exit, emphasizing liquidity in illiquid assets. - BNB-based auction highlights evo

Bitcoin News Today: Bitcoin Faces $112k Test: Traders Prepare for Surge or Drop to $100k

- Bitcoin consolidates near $111,500 amid $2,025 range, with $112,000 resistance critical for 2025 rally potential. - U.S.-China trade tensions and Trump's tariffs amplify risk aversion, while technical indicators signal bearish divergence. - On-chain data shows short-position surges below $106,300, but ETF inflows and Coinbase Premium Index hint at support resilience. - Altcoins like ETH and XRP remain range-bound near 20-day EMAs, with market trajectory dependent on macroeconomic factors through 2026.

BNB News Update: Transforming Time into Worth: River's Auction Sets a New Standard in DeFi

- River launches 48-hour Dutch auction for River Pts, redefining value creation through time-encoded tokenomics. - Participants buy River Pts with BNB at decreasing prices, with final settlement and refunds extending Dynamic Airdrop Conversion system. - Auction includes referral bonuses (2-12%) and aims to strengthen liquidity, $RIVER buybacks, and community-governed River DAO. - River Pts surged 5,300% on DEXs while $RIVER hit $10, demonstrating traction in DeFi innovation through time-based token design.