Author: Frank, PANews

Meteora, a major DeFi project in the Solana ecosystem, held its TGE and airdrop event on October 23. This was supposed to be a "redemption" for the protocol after early scandals. The team touted it as a revolutionary, community-first "fair distribution." However, this highly anticipated airdrop quickly turned into a storm of trust issues.

PANews analyzed over 70,000 on-chain claim activities related to Meteora's airdrop, unveiling the full picture of the event.

48% "High Liquidity" Experiment's Immediate Impact

Meteora's TGE plan was unique in its mechanism design, centering on "high liquidity" and a points-based distribution model.

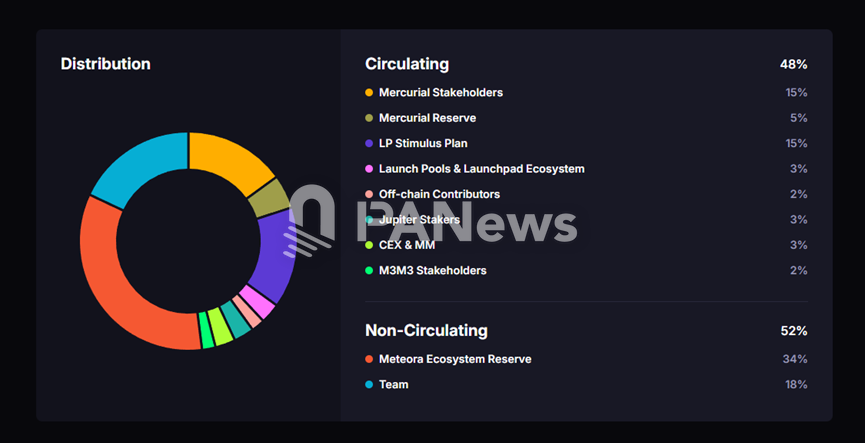

The total supply of MET tokens is 1 billion. On TGE day, 48% of the total supply (i.e., 480 million tokens) was fully unlocked and entered circulation at once. The team claimed this move was "intentional," aiming to eliminate "artificial scarcity" and achieve "true market price discovery."

This airdrop was based on an activity snapshot taken on June 30, 2025, with claims opening on October 23. The eligibility criteria adopted a points system, rewarding liquidity providers (LPs), Jupiter (JUP) stakers, and the previously controversial M3M3 Memecoin stakers.

This aggressive model almost immediately triggered a market "shock therapy." The massive 48% supply caused "overwhelming immediate selling pressure." After TGE launched, the MET price quickly dropped from the opening price of about $0.90, hitting a low of $0.51 within hours. The market's "harsh" reaction marked the beginning of this storm.

Four Whales Claimed Over 28% of the Airdrop, 60,000 Retail Investors Only Claimed 7%

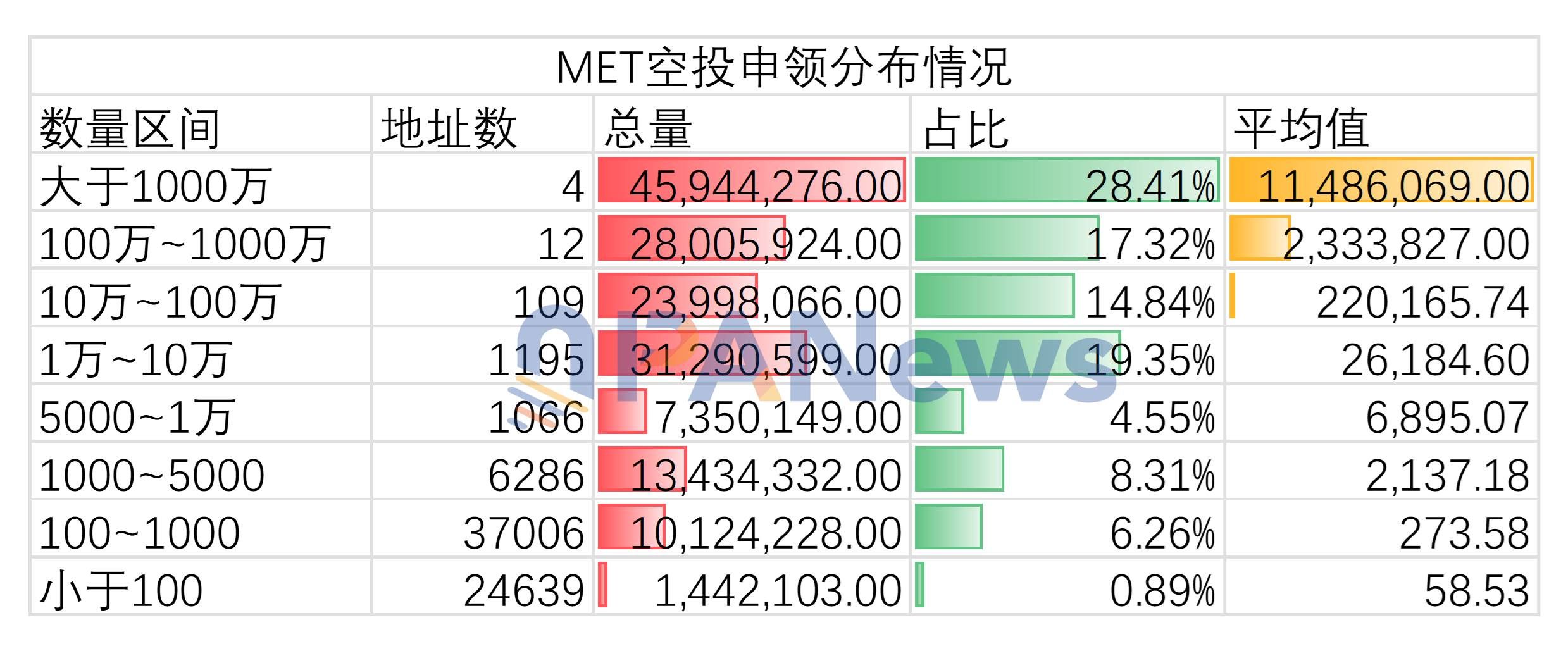

According to PANews statistics, as of October 24, about 161 million MET tokens had been distributed in the airdrop, with approximately 71,000 claim transactions. The average number of tokens claimed per transaction was 2,277.

In terms of scale, the currently claimed amount is about $83.7 million, with the average claim value per address around $1,180. On average, the MET airdrop seems like a decent reward, but a closer look at the data reveals a concentration among whales and a stark "wealth gap."

Among all claiming addresses, the address with the largest claim received 12.15 million tokens, worth about $6.31 million. There are four addresses that claimed more than 10 million tokens each; these four whales received about 45.94 million tokens, accounting for 28.5% of the total airdropped tokens claimed so far.

Among the remaining addresses, 12 addresses claimed more than 1 million tokens each, totaling over 28 million tokens (17.32%); 109 addresses claimed between 100,000 and 1 million tokens, totaling 23.99 million tokens (14.84%). There are 1,195 addresses that claimed between 10,000 and 100,000 tokens, with a total of about 31.29 million tokens (19.35%). The largest group is addresses claiming between 100 and 1,000 tokens, totaling 37,000 addresses and 10.12 million tokens (6.26%). Addresses claiming fewer than 100 tokens are also numerous, at 24,600 addresses, claiming a total of 1.44 million tokens (0.89%).

This data reveals a harsh reality: the MET airdrop was not a "sunshine for all" community reward, but rather an extremely uneven feast for the top holders.

The Four Whales Are All Unusual

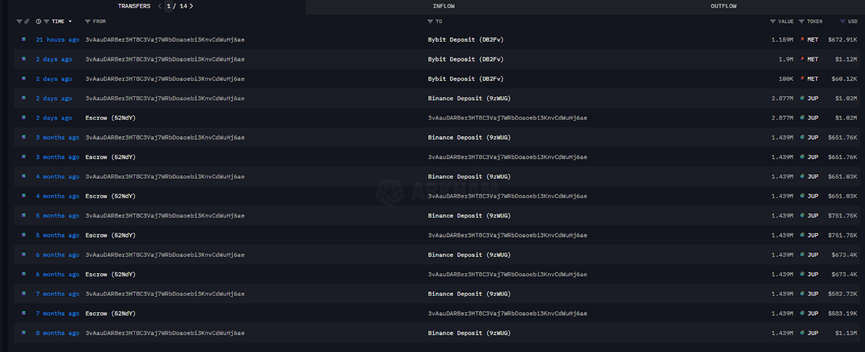

The address that claimed the most, 3vAauDAR8er3HT8C3Vaj7WRbDoaoebi3KnvCdWuHj6ae, received over 12.15 million tokens in one go, currently worth about $6.31 million. According to social media discussions, this address previously participated in the MER token (Meteora's predecessor MercurialFinance's token) airdrop and holds a large amount of JUP tokens, frequently transferring them to exchanges for selling. Some analysts believe this is an address associated with the Meteora team.

In the past eight months, this address has sold over 30 million JUP tokens.

Currently, this selling strategy has been used again for MET. As of October 25, this address has transferred over 3 million MET tokens to the Bybit exchange.

The addresses ranked second and third in claim amounts appear to be strongly related. Based on simple behavior, both are large JUP holders and are frequently active in adding liquidity to Jupiter pools. Coincidentally, the number of JUP tokens transferred by both addresses is often exactly the same—2,622,632.41—and their activity times often fall on the same day.

Judging from their activity patterns, these two addresses are likely controlled by the same group.

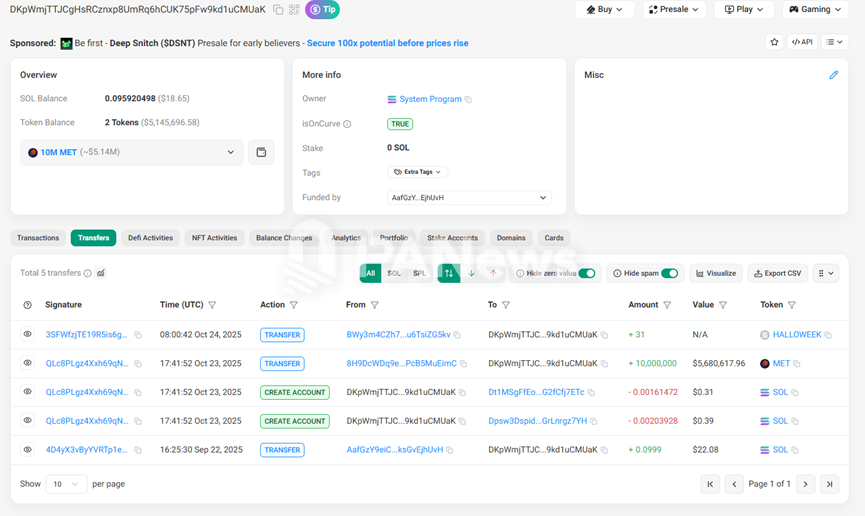

In addition, the fourth-ranked address, DKpWmjTTJCgHsRCznxp8UmRq6hCUK75pFw9kd1uCMUaK, is also unusual. This address claimed exactly 10 million tokens, a number that does not seem to correspond to normal points-based claims. The address was created only a month ago, which should have missed Meteora's snapshot time, and it has never engaged in any liquidity provision or JUP staking activities related to airdrop eligibility. As of now, the tokens in this address have not been moved. The eligibility and ownership of this address remain unknown.

"Insider Trading" Addresses Received Millions in Airdrops, Team Faces Class Action Crisis

Aside from the unusual large holders, there are many other controversial aspects in the MET airdrop.

For example, Arkm pointed out that three insider addresses related to the TRUMP token received a total of $4.2 million worth of MET airdrops. After receiving the airdrop, these addresses immediately deposited all MET into the OKX exchange.

In addition, Hayden Davis, the central figure in the LIBRA scandal, also received about $1.5 million worth of tokens in the MET airdrop.

These airdrop actions have sparked strong criticism from the community. One user commented on social media: "Why did Hayden Davis get the MET airdrop? You must be joking... Thanks to Meteora for giving Hayden Davis another $1.5 million."

In fact, this is not the first time Meteora has faced a trust crisis. In December last year, Meteora launched the M3M3 platform and its namesake token, claiming to change the dynamics of meme coins. However, the project quickly collapsed, with the token's value plummeting 98% from its peak, leading to subsequent class action lawsuits. After the LIBRA scandal in February this year, the Meteora team was again accused of insider trading.

In summary, Meteora's high-profile TGE and airdrop event not only failed to become the "community redemption" it claimed to be, but instead turned into a disaster that deepened the trust gap. From the aggressive 48% high liquidity model causing a price crash, to the "insider trading" related to the TRUMP token and the LIBRA scandal's central figure receiving millions in airdrops, every step taken by Meteora seems to have strayed further from its "community-first" ideals.

This event, which was supposed to be "redemption," has only added new wounds to the old scars left by the M3M3 and LIBRA scandals, plunging the team into a new round of trust storms and class action crises. For Meteora, the road to regaining community trust is clearly much more difficult than anticipated.