Crypto Trader Says NFT Altcoin Primed To Surge More Than 15%, Outlines Path Forward for XRP and Sei

A popular crypto analyst thinks chart patterns suggest one non-fungible token (NFT)-related altcoin is primed to surge in price.

The digital asset trader Ali Martinez tells his 161,200 X followers that PENGU , the native token of the Pudgy Penguins NFT collection, just broke out of a falling wedge pattern.

A falling wedge breakout is a technical analysis pattern that is used to identify potential bullish reversals in an asset’s price. The pattern is characterized by a series of lower highs and lower lows that form a wedge-shaped pattern on the chart. As the pattern progresses, the distance between the highs and lows decreases, which indicates that the selling pressure is weakening. When the price breaks out of the upper trend line of the wedge, it’s traditionally considered bullish.

Martinez says PENGU could surge to $0.026. With the asset trading at $0.0224 at time of writing, that would represent an increase of more than 16%.

The analyst also notes that “key support is holding” for the decentralized finance (DeFi) layer-1 blockchain Sei ( SEI ).

“If buyers step in, the next targets are $0.31 and $0.44.”

SEI is trading at $0.206 at time of writing.

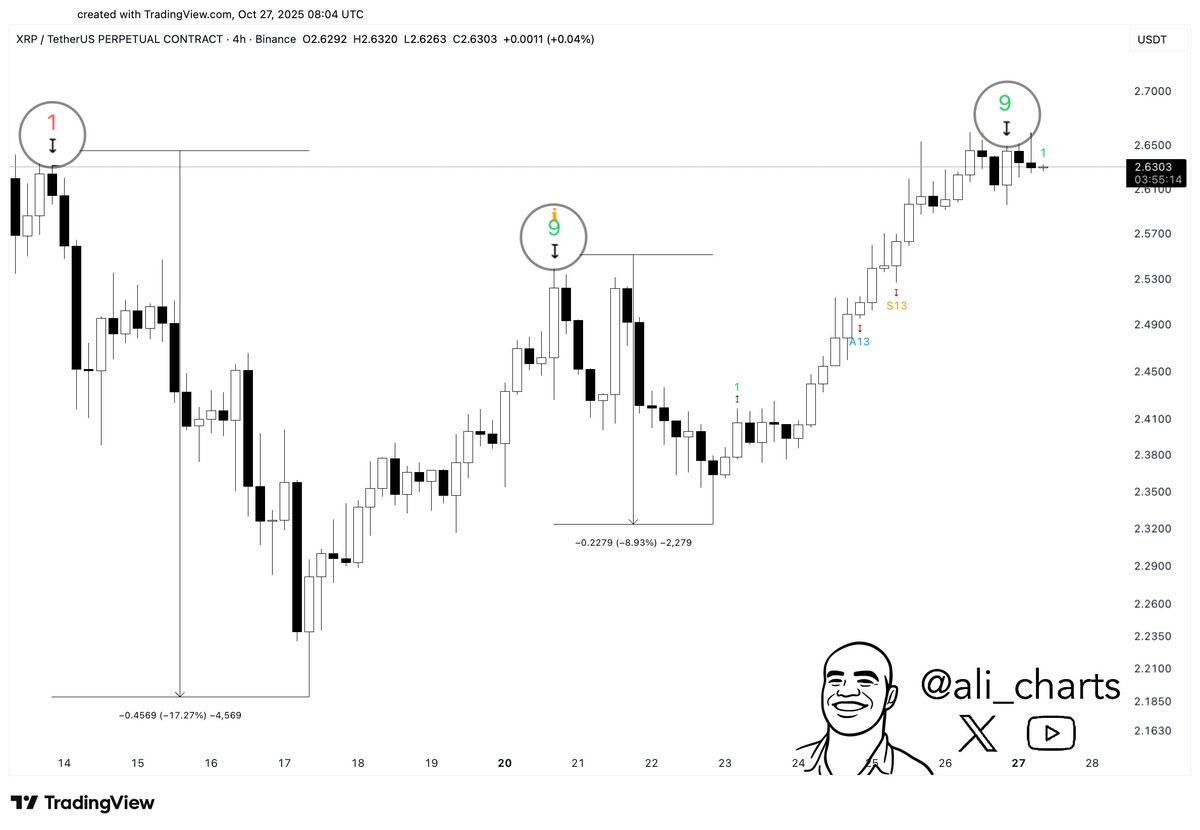

Conversely, Martinez notes that the TD Sequential Indicator, a tool that identifies potential trend exhaustion and price reversal points by counting a sequence of price bars, flashed a sell signal for the payments altcoin XRP .

XRP is trading at $2.68 at time of writing.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Despite $2.95 Billion in Crypto Liquidations, Blazpay's Presale and Chainlink Partnerships Stand Strong Against Market Volatility

- Crypto markets saw $2.95B in 24-hour liquidations, led by a $6.09M ETH-USD unwind on Hyperliquid, per Coinotag. - 140,507 traders faced margin calls, with short positions dominating losses amid Bitcoin/Ethereum price declines. - Blazpay's $925K presale and Chainlink's institutional partnerships offered rare stability during the sell-off. - $77.5M long liquidations and $15.3M short liquidations in 4 hours highlighted leveraged position fragility. - Analysts warn high-liquidity venues like Bybit/Hyperliqui

TRX News Today: Hybrid Safe Zones Arise: Crypto Holders Balance Risk and Practicality in 2025’s Varied Marketplace

- Crypto market in late 2025 highlights MoonBull ($MOBU), Chainlink ($LINK), and TRON ($TRX) as top assets with distinct growth drivers amid sector consolidation. - MoonBull's Stage 5 presale raised $500K, offering 9,256% projected returns via 95% APY staking and structured tokenomics, positioning it as a hybrid of meme-coin incentives and DeFi utility. - Chainlink ($17.91) stabilizes as a "blue-chip" oracle network, bridging blockchain and traditional finance through institutional-grade infrastructure and

Bitcoin Updates: Bitcoin Breaks Past $112,000 as Investors Turn to Digital Safe Haven

- Bitcoin surged past $112,000 following the U.S. Federal Reserve's policy decision, driven by geopolitical optimism, institutional interest, and strategic trading. - A seasoned trader, "0xc2a," secured $17 million in profits through Bitcoin and Ethereum long positions, highlighting whale influence on market sentiment. - Trump's planned meeting with Xi Jinping and a $400M influx into Bitcoin's DeFi protocols pushed prices to a 10-day high near $114,000. - Institutional adoption and $10B in Q3 M&A, alongsid

No Hidden Founder Here: How Antony Turner’s Visible Approach Puts BlockDAG in the Spotlight!